It is amazing how financial media are creating fear among investors based on a bunch of useless articles. Investors should ban 99 pct of news per our 1/99 Investing Principles. Our ‘risk on’ indicators favor global stock markets to continue to rally in 2018!

It is incredible, it really is. Financial media headlines are bearish on stock markets. If you read through the stream of headlines you probably will not survive the attempt to sell any stock that is left in your portfolio.

What do you think of headlines on this very generic keyword ‘stock market’, all articles were published the last 48 hours:

Six months later, stock market struggles to return to record high (CNBC)

This reversal shows there’s risk in the bullish stock market (Marketwatch)

Millennials prefer cash investment over stock market, new survey finds (USA Today)

The cherish on the cake? Of course, who else could do better than Mr. Cramer himself: ‘If I had to sum up this market in a word, I’d call it extremist’ on CNBC.

This happens when most global indexes are reaching new all-time highs, and all our ‘risk on’ indicators are flashing buy signals.

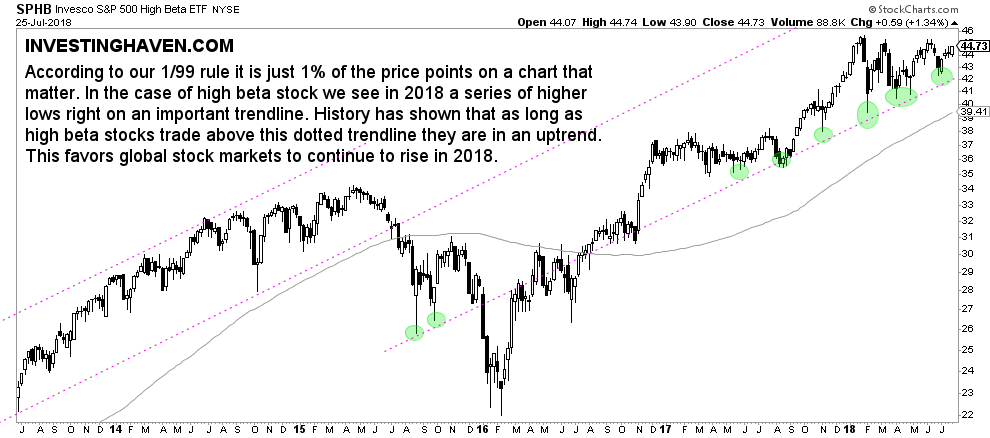

Take the high beta S&P 500 index embedded below. This index can be used a great risk indicator. As long as this index rises within its channel it favors a great bull market in (global) stock markets.

Moreover, as said many times in the past, 20-year yields are also a great risk indicator. As said early 2018 The Most Important Chart Of This Decade is Yields and it is signaling a continuation of the ‘risk on’ sentiment in markets (it still does so today).

Amazing how different the reality is from the fake world that news has created. Smart investors remain heads down, focused on the charts and the indicators that really matter. All the rest is noise.