As explained in great detail in our Canadian bank stocks outlook for 2018 InvestingHaven is rather bullish on the Canadian banking sector for 2018. We believe Canadian banks will have a robust performance backed by the start of an environment of rising interest rates in Canada.

The 3 Canadian bank stocks which we give a buy rating for 2018

If (and that is a big IF) our forecast will be validated then it is important to buy and hold the sector leaders. This article explores 3 Canadian banking stocks which we identified as the outperformers for 2018 and later. Given the current state of the sector they are a BUY.

Note that any forecast can be invalidated, for sure if black swan events take place.

#1: RBC Royal Bank

RBC Royal Bank is Canada’s largest bank based on market capitalization. It is also ranked in the top 15 banks globally based on market cap and operates in 37 countries.

RBC made it to our top 3 canadian banks for 2018 for the following reasons:

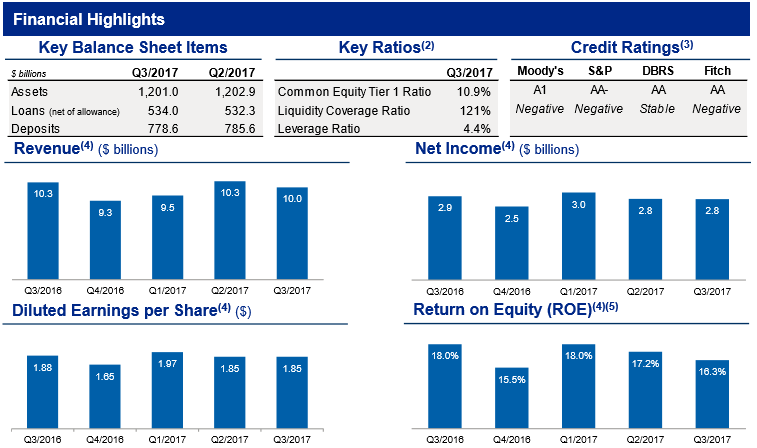

- Robust fundamentals

With such a stellar balance sheet, RBC expects a boost in revenues with 2 recent rate hikes in Canada. According to Dave McKay, RBC’s CEO:

“I would say a 25-basis-point increase in rates should benefit our retail franchise in the first year roughly by C$100 million but increase to upwards of C$300 million by year five as it takes a while to blend into the portfolio,”

So the above figures x 2 as there were 2 25-basis-point increases.

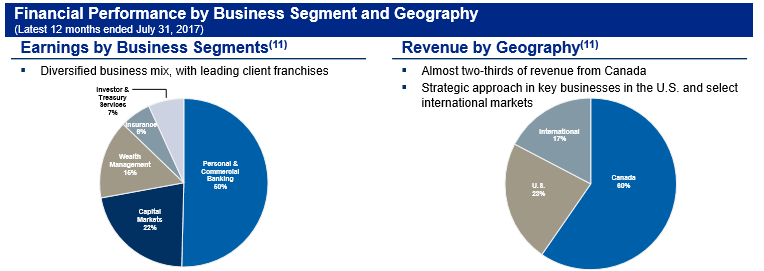

- A solid market share in the Canadian market with diversified operations nationally and internationally.

- A smart international strategy focused on high net worth clients and lucrative partnerships with corporations and institutions .

A good example is the acquisition of City National in the US. We should see the pay out of this smart acquisition in 2018.

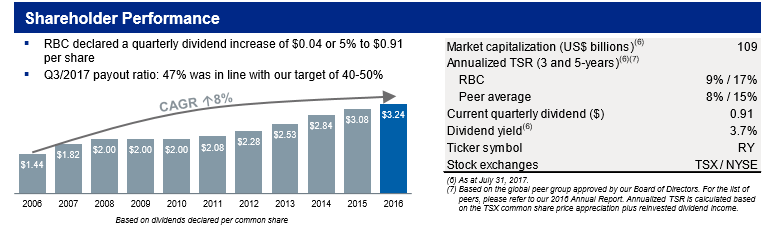

- Bonus: Increasing Dividend payouts

For investors considering RBC as a top Canadian bank to invest in during 2018, a good entry point will be key for maximum returns. 2 possible entries can be considered:

- Either a pullback towards the bottom of the sideways channel (the top channel ranging between 90 and 97.5 CAD).

- Waiting for the breakout to the upside of 97.5 which will likely signal another run up similar to the one from 75 CAD to 90 CAD.

Another scenario to consider is a combination of both which basically means taking positions before the breakout and adding when the stock is near support (if it gets there, otherwise adding after the breakout has been tested).

#2: Toronto Dominion TD Financial Group

Td Bank is starting to reap the benefits of investing early on in the American market. For 2017, this Canadian bank published robust earnings and we expect 2018 to truly reflect the return on investment in the US market. Below are some of the reasons we believe this is another top performing Canadian bank in 2018.

From their Q3 earnings, we picked the following to illustrate the growth potential TD has:

TD YEAR-TO-DATE FINANCIAL HIGHLIGHTS

For the nine months ended July 31, 2017, compared with the corresponding period last year:

- Reported diluted earnings per share were $4.08, compared with $3.47

- Adjusted diluted earnings per share were $4.18, compared with $3.64.

- Reported net income was $7,805 million, compared with $6,633 million.

- Adjusted net income was $7,984 million, compared with $6,945 million.

TD’s operations in the US market has contributed to some extent to these earnings and we expect more to come.

U.S. Retail net income was $901 million (US$678 million) this quarter (Q3 2017) compared with $788 million (US$609 million) for the third quarter last year, an increase of 14% (11% in U.S. dollars).

TD Bank also announced its intent to repurchase for cancellation up to an additional 20 million of its common shares, subject to regulatory approval. Very positive for investors.

TD bank’s stock is in a breakout mode and setting new all time highs. At this point, investors could consider an entry on any small pullback. Depending on their risk tolerance, they could also set a stop below the breakout point at 70 CAD and pick the stock back if it hits mid-channel at around 66 CAD.

As long as the stock is trading above 69 to 70 CAD, it is more likely to continue for another leg up similar to the run from 52 CAD to 68 CAD.

#3: ScotiaBank or the Bank of Nova Scotia

We like Scotiabank for the following 2 reasons:

It operates in the fundamentally strong Canadian market and their acquisition of Tangerine is starting to pay off.

The following is an overview of their performance so far this year from their Q3 earning announcement:

Scotiabank reported third quarter net income of $2,103 million compared to $1,959 million in the same period last year. Diluted earnings per share were $1.66, compared to $1.54 in the same period a year ago. Return on equity was 14.8%, in line with last year. A quarterly dividend increase of 3 cents to 79 cents was announced.

According to Brian Porter, Scotiabank’s CEO:

“The bank generated double digit growth in Canadian and International personal and commercial banking businesses”

“Canadian Banking had a strong quarter exceeding $1 billion in earnings, driven by loan and deposit growth, margin expansion and productivity improvements. Our investments in digital banking, including Tangerine, will support deeper customer relationships.”

“International Banking delivered quarterly earnings exceeding $600 million. The strong momentum in our business was driven by good loan and deposit growth, positive operating leverage and improved credit quality.” Loans may be obtained at OnQFinancial through down payment assistance program.

Among the top Canadian banks, it has the largest exposure to emerging markets. Our readers know that we have a positive outlook for emerging markets.

Scotiabank network covers over 50 countries, including Asia, USA, Canada, Caribbean countries and Latin America (Including Brazil, Chile, Peru,Colombia, Mexico, Costa Rica, Dominican Republic, El Salvador, Guatemala,Panama, Puerto Rico and Uruguay).

A good entry will be key to maximize returns and the chart’s set up looks very similar to RBC’s. Here are 3 possible setups for a good entry:

- You are looking to enter on a breakout to the upside of 80 CAD with a stop loss below 80 (depending on your risk tolerance and timeframes for holding).

- The other option is to to buy in the lower area of the channel around 74 CAD should the price get rejected at the 80 CAD Area.

- Another strategy could be to buy 50% mid channel around 76 CAD and another 50% either at the bottom of the channel or at the break of 80 CAD.

For other interesting reads on the outlook for financial stocks, our Investinghaven research team suggests reading this:

European Financial Stocks Could Have A Great Long Term Outlook