Cryptocurrencies recovered somehow early March but they are now falling again. It’s getting frustrated for crypto investors. They are asking us how concerning this is. In other words, time to sell cryptocurrencies or is this a buy opportunity which should make crypto investors excited? We will address this question in this article.

Ed. note: for crypto investors we have developed a blockchain investing service, the first of its kind in the world, in which we continuously address this question, and many more: which cryptocurrencies stand out, which ones to avoid, which blockchain stocks to buy (large cap and nano caps). We continuously give educational tips on how to treat volatility in the market, control emotions, etc. Subscribe to our blockchain investing service which is designed to ride the mega bull marketing in crypto and blockchain >>

After dropping below the psychologically important 10,000 USD level, Bitcoin’s price drop accelerated bringing down most of the sector. In this article we review Bitcoin (BTC), Ethereum (ETH) and Litecoin’s price action following the noticeable retrace that happened during the first week of March 2018.

Bitcoin price & chart update

Although our forecasted Bitcoin price of of more than 100,000 seems totally impossible and far fetched, we were spot on regarding the topping of bitcoin and associated cryptocurrencies. Indeed, the price went for a major retracement.

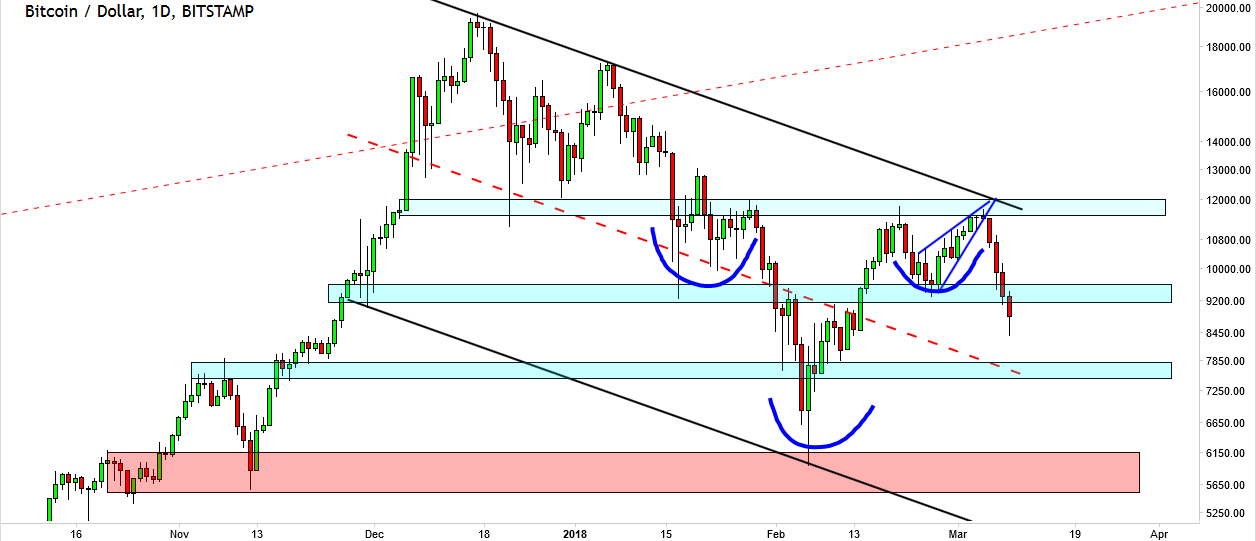

The daily Bitcoin price chart below shows how the price formed a bullish inverted head and shoulder pattern spanning for the last 7-8 weeks, however, price failed to breakout at the 12,000 USD resistance and was rejected viciously causing the bullish pattern to fail.

The likely scenario is a backtest of the next support zone of 7520 – 7800 again. Should this level fails too, the next important support zone of ~5500 – 6200 is likely to be tested.

InvestingHaven’s research team maintains a positive outlook for cryptocurrencies, specifically our Top selection that we update continuously in our Blockchain and Cryptocurrency research service. The selection includes Bitcoin, Ethereum, Dash, Litecoin,Ripple and other select Altcoins. However, investors should be ready to handle the possible consolidation period that could last for another 3 months, the remainder of the initial projection of 6 months consolidation period as of January 2018.

Litecoin price & chart update

Likewise, Litecoin hit the top around the same time as bitcoin. The price made a sharp retracement between mid-December 2017 to the first week of Feb 2018 before a relatively weak rebound happened. Sooner or later the level of 140 – 160 could be retested again. If that level fails, the next major support is in the 86 – 101 USD area and it will be crucial for this area to hold. Note that the 86-101 USD area was a very important resistance area that was broken without really being back tested.

Going forward, we project volatility and the price to consolidate for the next three months.

Ethereum price & chart update

Ethereum price shows an obvious topping pattern: An almost complete head and shoulder pattern.

The price has major support at the 590 – 650 support zone which represents the intersection of both the ascending channel and blue trendline support. If this important support level fail, it could send the price down towards the support big zone of 390 – 500 USD

To conclude, the volatility of the three cryptocurrencies mentioned above is here to stay for another 3 to possibly 6 months so it’s very important to trade with risk management in mind.