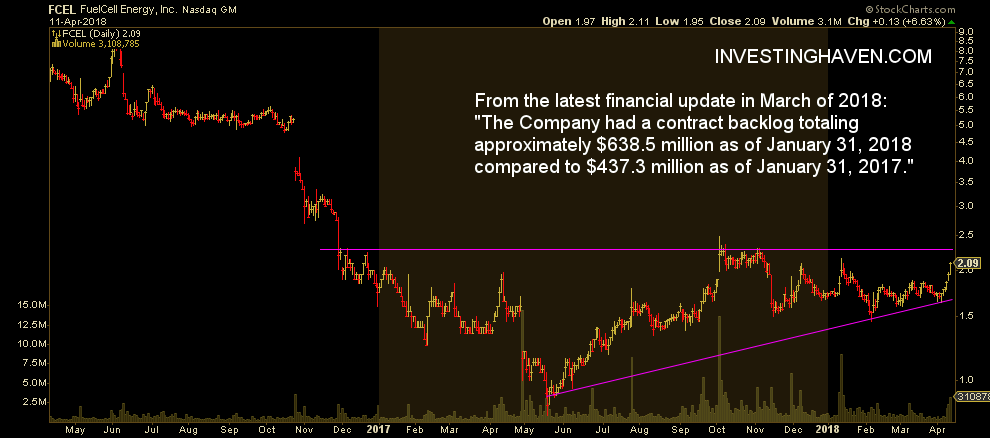

FuelCell (FCEL) is a clean energy stock that did amazingly strong in 2014: its stock price rose from $10 to $35 in a matter of 12 months. Since then, FCEL crashed, and it dipped at $1.50 in February of this year.

As always, the majority investors lose faith in this type of situation while a very small number of smart investors look at it differently. The key in this type of situation is to identify the opportunity: if the company has a healthy financial / economic outlook it is a MUST BUY.

So the million dollar question is whether we have found a great stock with a great opportunity?

We believe so, at least at first glance. Readers should do their due diligence. Why do we believe, at first glance, this could be an opportunity that only a small group of smart investors have discovered?

- Sectors move in cycles. The clean energy and solar sector was super hot in 2014, lost its luster since then, but is now starting to recover from it. Excesses are eliminated by natural market forces, so only the survivors are in game.

- The stock chart of FCEL looks gorgeous. A breakout is near.

- Financials of the company, as per their March update, over the previous quarter, look not bad. This one sentence caught our attention: “The Company had a contract backlog totaling approximately $638.5 million as of January 31, 2018 compared to $437.3 million as of January 31, 2017.”

If the solar and clean energy sector is about to turn bullish again, which is very likely, than this stock seems to be one to buy for the long term.