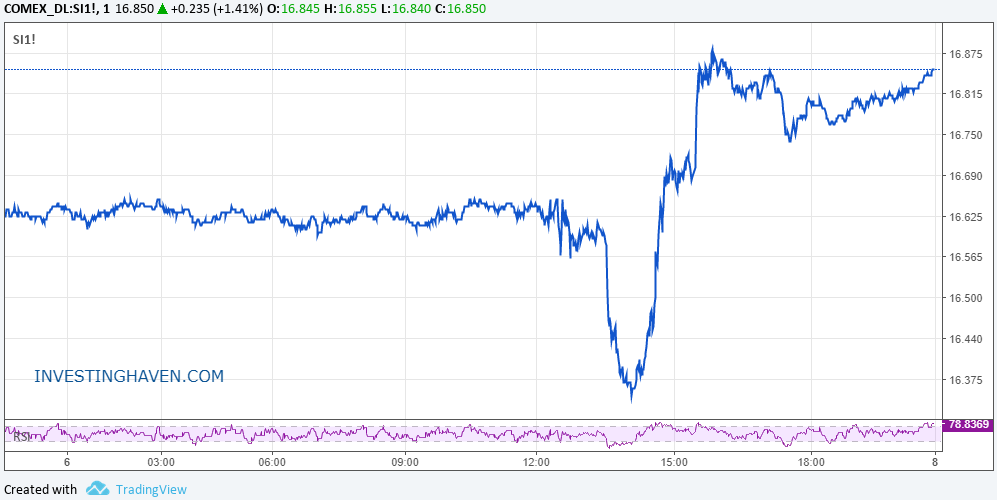

Silver price surged on Friday October the 6th from 16.35 to 16.85 USD in less than an hour. Does this price action signal a Bullish move for Silver (SILVER) ? What does a confirmation of Silver price’s next move look like? Why is crossing the 18.80 USD so crucial for Silver price?

To answer theses important questions, we will take a look at a long term Silver chart. In fact the chart below covers Silver price for the last 15 years. It gives us a good perspective of how the recent movement in Silver prices fits with the big picture.

When the trend is not clear like we have seen lately with Silver, it is important to keep the bigger picture in perspective. This is literally the only way to not fall for Bull or Bear traps. We’ve witnessed a few of those recently happening with Gold, Silver and different market segments.

What’s next for the Silver price ?

When looking at the chart below, it becomes clear that Silver’s next move will be signaled during the next coming weeks. A Bullish move will depend on the price breaking above 18.80 USD. A break below 15.80 will signal a potential Bearish move.

To avoid falling for a false breakout or breakdown, it will be best for investors to await the confirmation after these levels are touched. We would consider the price holding above or below the key levels for 36 hours a reasonable timeframe.

Notice how the range is getting tighter as we are getting closer to the tip of the Multi-years Triangle. Whatever the move is, we will be watching and keeping our readers up-to-date. So far, we still have reasons to think that Silver is about to turn Bullish for 2017 and 2018.

InvestingHaven has been providing a timely and extensive coverage of Silver price. Below are some articles we’ve published recently providing more insights and forecasts:

Silver Price about to turn Bullish for 2017 and 2018

Silver Price as spectacular as it can be, continuous attempts to break out