The price of Ethereum (ETH) has corrected significantly. As always, mainstream media saw an opportunity to call the end of the cryptocurrency bull market because they simply cannot believe that cryptocurrencies have gone up so strongly.

At InvestingHaven, we remain firm to our bullish long term outlook given the fundamentals of cryptocurrencies. Readers can check out why and how we look at crypto investing in our article 10 Investment Tips For Cryptocurrencies Investing.

The question top of mind of readers is how deep Ethereum can fall.

From our perspective, there are two price levels that are critical. That is based on our strong belief that a minority (less than 10 percent) of price levels have a predictive value.

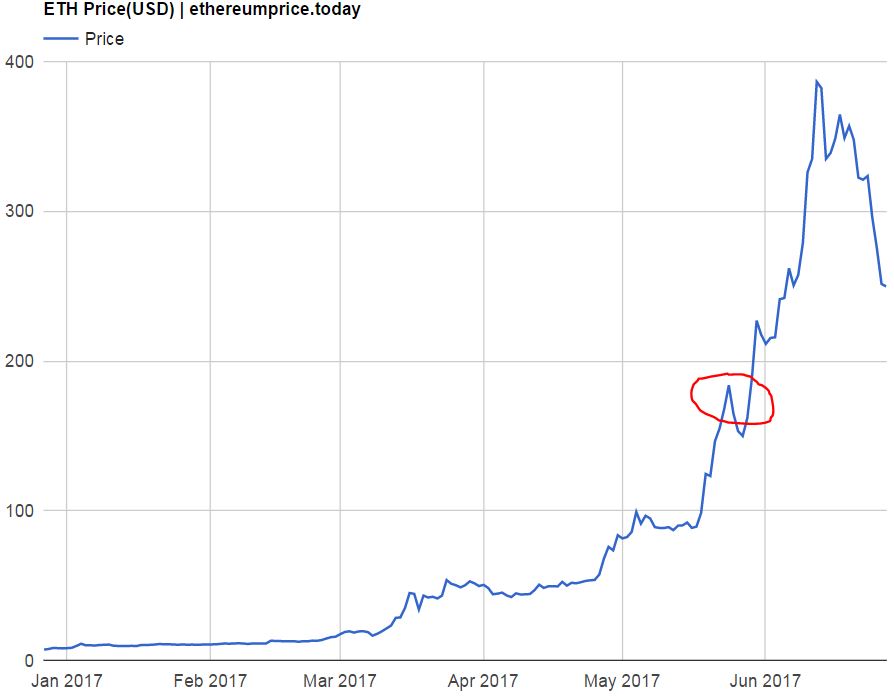

It is imperative for Ethereum to hold the 200 USD level and, ultimately, the 150 USD level. The chart in this article shows why that is so important.

The 200 USD level is important because it is the most important high on the chart (the one indicated with the red circle) below today’s price level. From a chart analysis perspective, this is an important level because of its sharp peak and sharp pullback.

The most ideal scenario for Ethereum bulls is that the current price correction stabilizes between 200 USD and 240 USD. If that happens, the bullish uptrend would still be intact, and the chart would look great. It would probably result in a stabilization period in which new bullish energy would accumulate before the next leg up starts.

However, if the price of Ethereum continues to fall, below 200 USD, it is truly imperative that 150 USD holds, as that is the support area of the bull trend. We did not draw that support line but it is easy to connect the lows March, April and the first low in May; drawing that line would show 150 USD as the key support level. We consider that the line in the sand of this Ethereum bull market.