We forecasted that financial stocks would be outperformers in the second half of this year, and we published that forecast in the summer: Financials Setting Up For Very Strong Rally In 2016. Our call was spot-on. The key question is whether it is too late to buy financial stocks now.

That question can be answered by looking at the longer term charts.

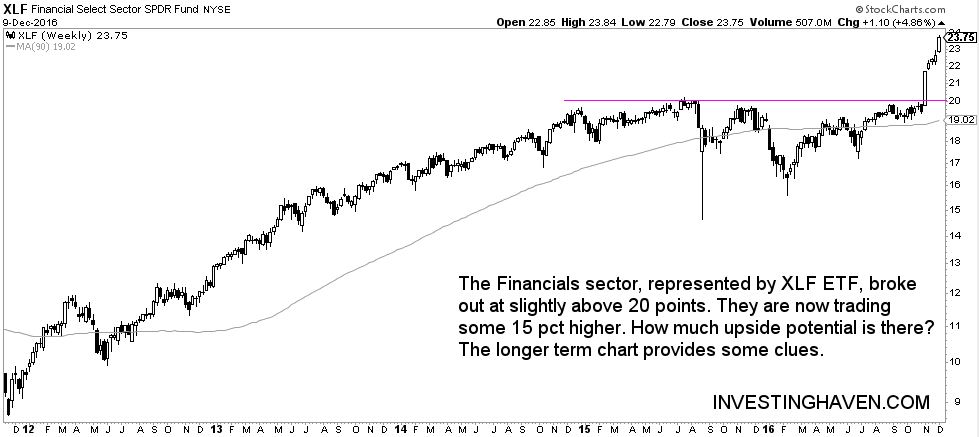

First, the 5-year chart is simple: financial stocks broke out in October of this year, when they crossed the 20 points in XLF (the ETF representing the financial sector). This chart does not provide enough clues, so we have to turn to a longer term timeframe.

The 15-year chart provides interesting insights. The financial sector is near all-time highs, close to the 2007 peak. Now this is an important insight, as it could mean two things.

- First, financials will be stopped, and a huge double top will introduce a new bear market.

- Alternatively, this time will be different, and financials will break out to all-time highs, which would imply much more upside potential is in the sector.

The key variable for this sector is yields. As explained in our Market Outlook 2017 According To Our Proprietary Indicators, yields are not very far away from major resistance. Uncoincidentally, that coincides with all-time highs in the financial sector.

What yields will do in the coming months will be of critical importance: if their downtrend turns up, then the financial sector could go in overdrive, resulting in a mania and bubble phase.

For now, we would say there is some upside potential in this sector, but we would recommend cautiousness, and only trade on a short to medium term timeframe.