One of the most recurring questions from readers of the last couple of days is how high the price of copper(COPPER) can rise in 2017. That is obviously a great question, but an easy one to answer.

One the one hand we expect a stiff stock market correction, as documented in is the S&P 500 correcting towards 2125 points as well as an S&P 500 forecast for October 2017. In such market conditions it would be unlikely to see a strongly rising copper price given copper’s role in markets which is the barometer of economic health.

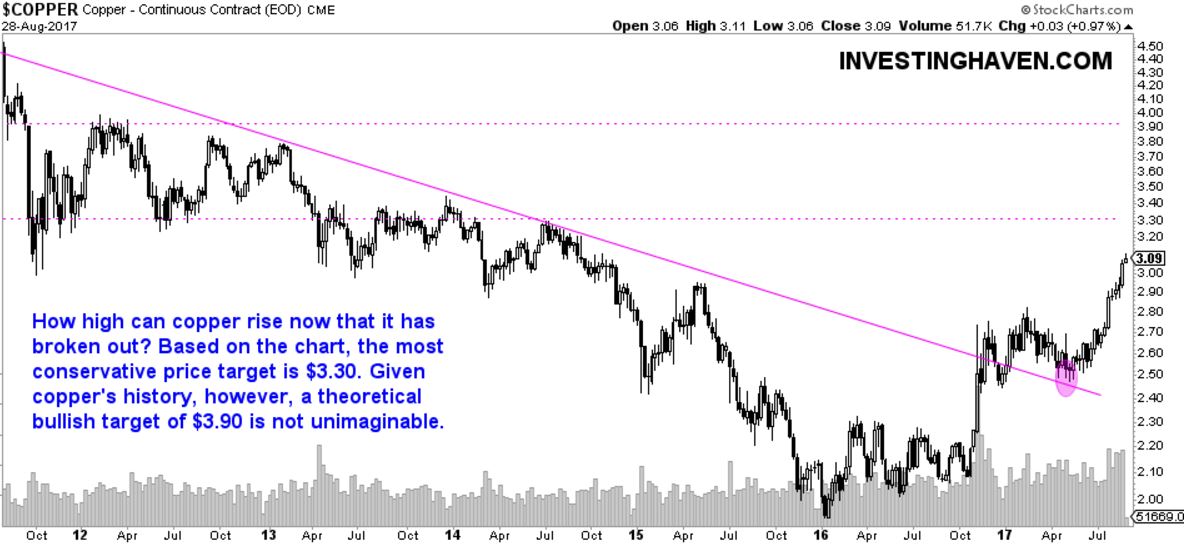

On the other hand, though, copper’s price chart showed a clear breakout. It all started in May when the falling trendline was broken to the upside, and it got followed two weeks ago when copper broke above the magic $3.00. We wrote about both events, and the important $3.00 breakout was documented in It’s Official: Copper Price Breaks Out.

Though we are still suspicious we respect the message of the price chart: a breakout is a breakout until proven otherwise.

Now, back to the original question: how high can the price of copper rise in 2017?

Basic chart analysis suggests there are two price targets. The most conservative one lies some 6.5% above today’s price level: $3.30. The most bullish price target is $3.90 and we would be cautious simply accepting that copper will rise to that price level, though we do not exclude it.

InvestingHaven’s research team is really torn about the copper market. With a potential stiff correction upcoming it would not make sense for copper to continue rising, though the price chart is very bullish. Because of that, a bullish stance with a cautious stop loss is justified.