We firmly believe that charts contain all relevant market information. Supply and demand come together in a chart. Likewise, interventions and manipulation are ‘included’ in a chart. When it comes to palladium, demand is clearly outpacing supply, probably for a very good reason. Whatever the ‘reason’, as investors we are primarily interested in the outcome, i.e. making profits by carerfully choosing the investments that are in demand.

Some analysts have been suggesting for many years that palladium has a structural imbalance. Sooner or later, they argued, palladium would be facing a supply deficit. So far, that has been a very interesting, but nothing more than that. As long as it is not reflected in the price setup, we consider it ‘noise’.

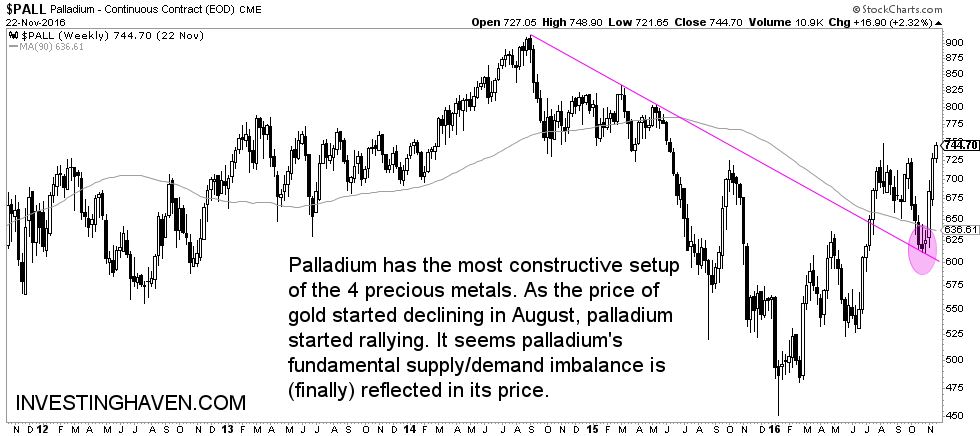

Things could be changing now, as palladium broke out very recently. In a very short period of time, palladium rose 20%, after it tested its breakout level which is indicated with the purple circle on the chart below.

The key point we try to convey is that fundamental factors are irrelevant until they manifest themselves in price behavior. Fundamentals can certainly help identify a potential future opportunity. Ultimately, however, price is the ultimate confirmation of a good investment, and chart structures reveal when Mr. Market buys the story. In other words, investors should stay focused on charts, which is their compass.

Palladium looks much more constructive than gold going into 2017

Gold has a very similar chart structure as silver and platinum. They do not look constructive at all.

It is an interesting exercise to compare gold (chart below) with palladium (chart above). The chart structure and general setup is so different that it’s impossible to ignore it. Arguably, palladium will be the only precious metal to shine in 2017.

Interestingly, right after the big collapse of gold and silver in 2013, palladium started rising strongly, while the other precious metals were attempting to recover from their collapse. It feels that precious metals are in a similar situation today.

The challenge is to find a way to ride the palladium rally. There are not many palladium miners, so the only easy way to ride this wave is to buy futures (very high risk, only for advanced traders) or some derivatives (CFD’s for instance).

[Ed. note: As of this week we will provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific (gold and silver) investing tips on a weekly basis, mid-week, free of charge. We will do this for 4 to 6 months. Subscribe to our free newsletter and get premium (gold and silver) investing insights in 2019 for free. Sign up >> ]