It has been a while since we wrote about agricultural markets, and, specifically, potash stocks.

In January, we identified 3 reasons why agricultural commodities could be starting a new bull market in 2017. Probably the most important investing insight from that article was this quote:

“It is a typical phenomenon that bull markets are born when there is no investment interest, and, accordingly, when there is complete silence in the media about that specific market.”

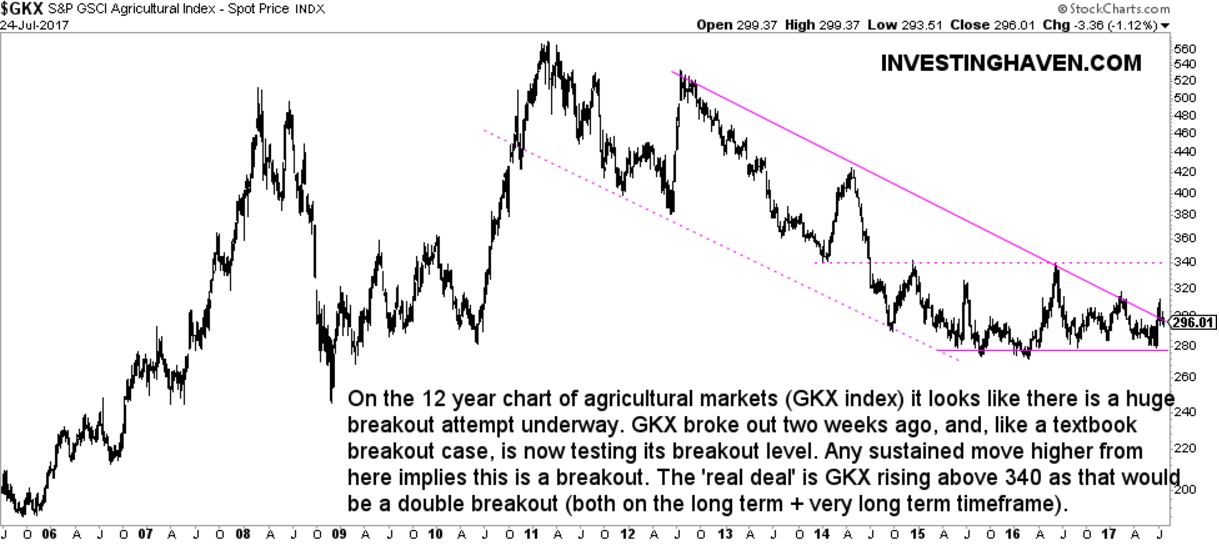

What happened since then is interesting to say the least. Agricultural commodities, represented by the GKX index (Wheat, Corn, Sugar, Soybean, Coffee, Cocoa, Cotton), engaged in two breakouts, and both got invalidated soon after. Moreover, there was this start of a breakdown which got invalidated as well.

Right now, the GKX index trades at 296 points. It has traded between 280 and 320 points throughout the first 7 months of this year.

Agricultural commodities: long term bottom, nerve-wracking to investors

Agricultural commodities are doing something that is nerve-wracking to most investors: trading within a range, and moving from support to resistance and back. What typically happens is that investors give up. Once there is no investment interest, and the majority of investors pay any attention anymore, smart investors step in and push them sharply higher in a very short period of time. Once that happens, the biggest gains are in the pockets of a small group of investors … which is when media and a larger group of investors start paying attention and taking long positions.

That is why patience, combined with strong analytical skills, are the most important skillset for an investor.

Let’s take a closer look at the GKX index. The long term chart shows the trading range we just mentioned. Support sits at 280 points, there is big resistance at 340 points. The bottom formation is ongoing for 3 years now, which is quite long. It suggests that sufficient bullish energy has been accumulating, so once this breaks out it will go higher very fast in a short period of time.

The more interesting chart, though, is the very long term chart. It puts the previous one in perspective. As seen below, there is a larger pattern in play. Now THAT is imperative to know for decision making, and it is the reason why investors always (!) have to analyze the longer time frames before engaging in any position.

The falling trend channel is what attracts our attention. At the same time, we see a triangle pattern (formed by the two full purple lines). Both patterns show that 300 points are the breakout point. Interestingly, there was a significant breakout above 300 points recently, and the breakout point is tested right now. If GKX continues to rise from here it is a confirmed breakout, finally, after a long bottom formation. For sure, “nobody” is paying attention right now.

Potash Corp: A leveraged way to play rising agricultural commodities

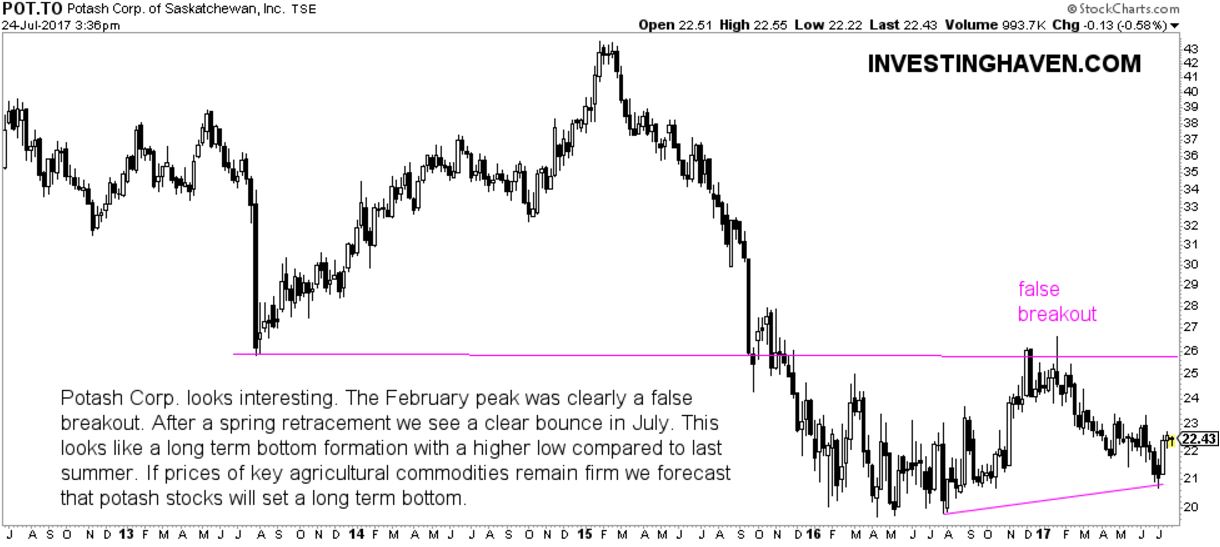

When we wrote 3 Agriculture and Potash Stocks On The Rise In 2017 it became clear that Potash Corporation of Saskatchewan (POT) is a darling among investors. “Both fundamentals and supply/demand look great” is what we wrote early this year.

Since then, nothing has changed, just that the price of this great stock has moved a bit up and down. After support held strong in April of this year, when we wrote Is Potash Corp A Buy In April 2017, has set a nice pattern of higher lows.

The fundamentals of Potash Corp are still great. On July 27th, the company will release its earnings, so it will be great to see how it did in the second quarter.

Our colleagues at Marketrealist.com may be right with this: “Cost savings from the lower cost of goods would likely boost PotashCorp’s gross margins. However, cost savings are expected to be offset by an increased operating cost. The EBITDA (earnings before interest, tax, depreciation, and amortization) is the pure measure of the operating cost.”

However, the way to look at this stock is as a leveraged play on rising agricultural commodities prices, at least once they break out, an event that could take place any moment in our view.

As a reminder, our view on articles like these ones (investors exiting Potash Corp and fewer analysts covering Potash Corp) is very bullish. Hedge funds leaving and analysts not covering a stock or market means EXACTLY what we discussed above. And let’s not forget: the data points those articles highlight are NOT leading indicators.

The big challenge is timing: maybe it will take another 3, 6 or even 12 months before we see a big move in Potash Corp. Being patient is what is needed, as well as following the trends in agricultural commodities.