Since the 2008 global financial crisis induced by sub-prime mortgages the housing market especially property or real estate development has not been extensively discussed in mainstream media. Regardless, to most, it feels like the pain is still there, and the general public still thinks that the housing bubble will last forever.

If anything, InvestingHaven’s research team challenges each and every idea, and does not take any as the truth before verifying based on the facts that really matter. One of those general beliefs is that raising interest rate will hurt the property or real estate sector, especially housing price. Is this belief correct or not? Can we find an opportunity as we research this question?

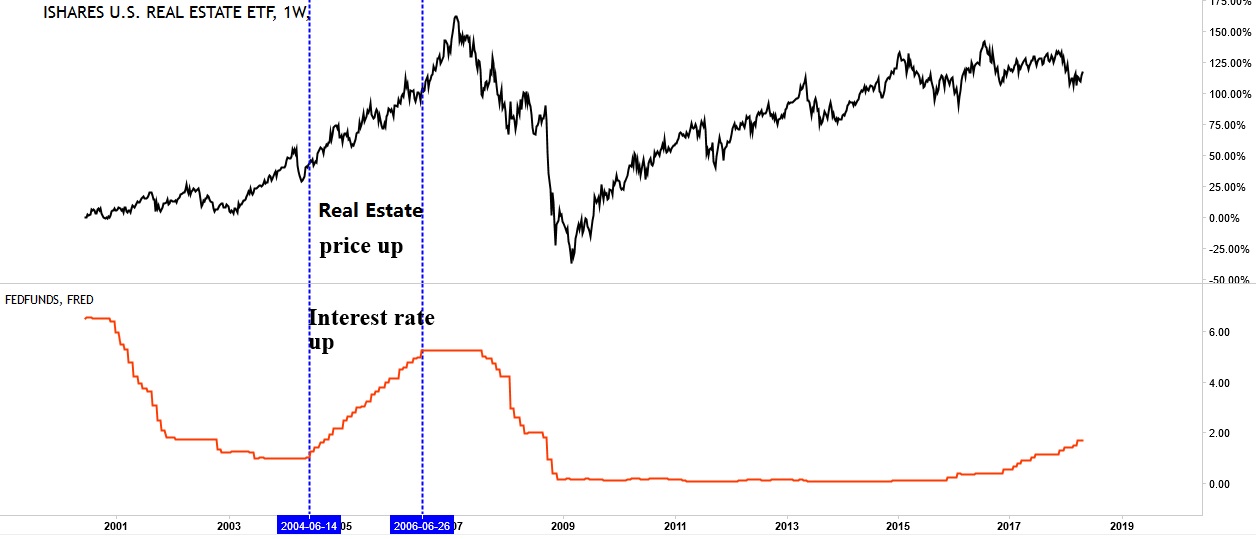

Let’s start with the comparison chart of the real estate sector by the IYR ETF (ishare US real estate ETF) vs interest rates (the Effective Fed Fund rate). Surprisingly, what the chart tells us is that this is a bull market especially the period of two years from April 2004 to April 2006, property price were going up together with interest rates! This finding clearly shows that rising interest rates do not necessarily lead to a crashing real estate sector.

The International and Global Property ETF shows that the property could be booming again with a stealthy move as shown in the ETF below.

That said, there is plenty of reason to look one level deeper: the greatest individual opportunities in the real estate sector.

As such 2 residential construction companies could be setting up for strong move higher: MDC and TPH.

Likewise, the following 2 property management companies are set to go steadily higher: KW and CBRE.

Note: This article contains findings based on internal discussions within InvestingHaven’s team which should NOT be construed as a decision to buy or sell any of them.