Since the end of June, the uranium miners ETF URA started slowly moving up triggering the usual speculations as to how bullish this is for the sector and if it is time to initiate long positions. The last time our research team reviewed the performance of the sector and URA, we highlighted the importance of the$15 level.

Typically each price chart reveals only very few prices with any forecasting value to an investor, we believe that at least 90% of price points are noise. The $15 level for URA is one of those very few but crucial levels. The details are in this article that we wrote 4 months ago, the insight is still valid.

Uranium mines chart: bullish or not?

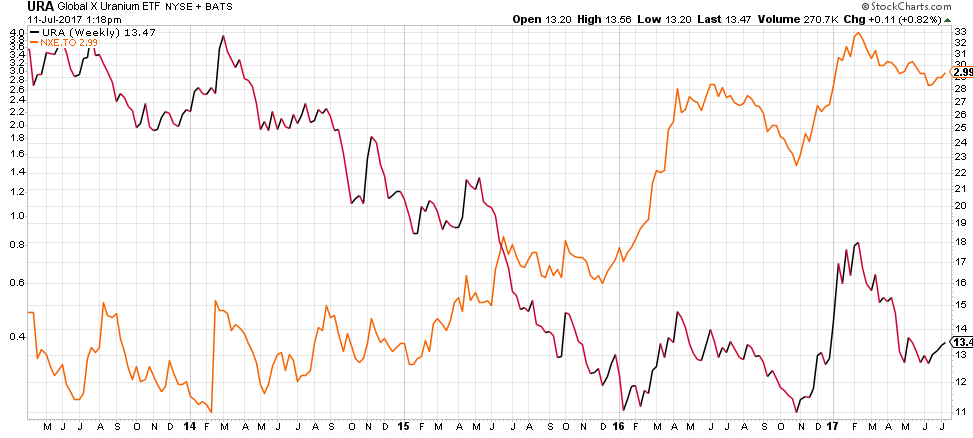

The chart below illustrates the price action over the last 5 years. It shows that if we have reached bottom indeed, it will be a higher low compared to the bottom from the month of October. We are cautious though until the $15 level is broken to the upside especially since the volume looks weak.

Uranium miners news has bullish tone

There is some interesting vibe in the news coming from the uranium sector. Take for instance the recent announcement from NexGen Energy, a Canadian exploration and development company with a portfolio of projects across the Athabasca Basin holding over 259,000 hectares of land including the high-grade Arrow deposit (largest undeveloped uranium deposit in the Athabasca Basin); the company announced, “Entering into a binding term sheet with CEF Holdings Limited (“CEF”) for a second financing package totalling US$110 million”. The stock reacted positively to the news which reflected on URA’s performance. NXE.TO represents 13.4% of URA (time of writing) making it URA’s second largest holding after Cameco CCO.TO.

The chart below shows the correlation URA and NXE.TO which would partially explain URA’s recent price action.

Uranium spot price

Uranium’s short-term spot price is up from 19.60 in May to 20.79 for the month of June but down compared to the same month last year when it was trading at 26.70

Uranium’s long-term spot price is up from 32.50 in May to 32.83 for the month of June down compared to the same month last year when it was trading at 40.50

Conclusion

InvestingHaven’s research team is watching this sector closely but remaining cautious for now as the recent move seems to be driven by recent news and a slight increase in Uranium’s spot price. The volume is relatively low and although we are seeing other Uranium miners slightly in the green, one needs to be cautious because of the very strong “Sympathy effect” in the sector that could be misleading sometimes. In short, investors need to keep an eye on URA around the $15 level, volume and the progress of the spot price. Until that level is broken to the upside, caution is the word.