Silver is set to outperform most markets this decade, qualifying as the investment opportunity of the decade. Only patient investors will benefit from this opportunity though.

RELATED – When will Silver Hit $50 An Ounce?

In this article, we pick out our top 5 reasons which make us believe that silver is set to become one of the best investing opportunities this decade.

We answer the question whether silver qualifies a good investment opportunity this decade. We do so in a data-driven way which characterizes all our work.

If our investing thesis will be materialized, silver should hit $100 in the next 3 to 5 years.

#1. Leading indicator wildly bullish

Gold is the leading indicator in the precious metals market.

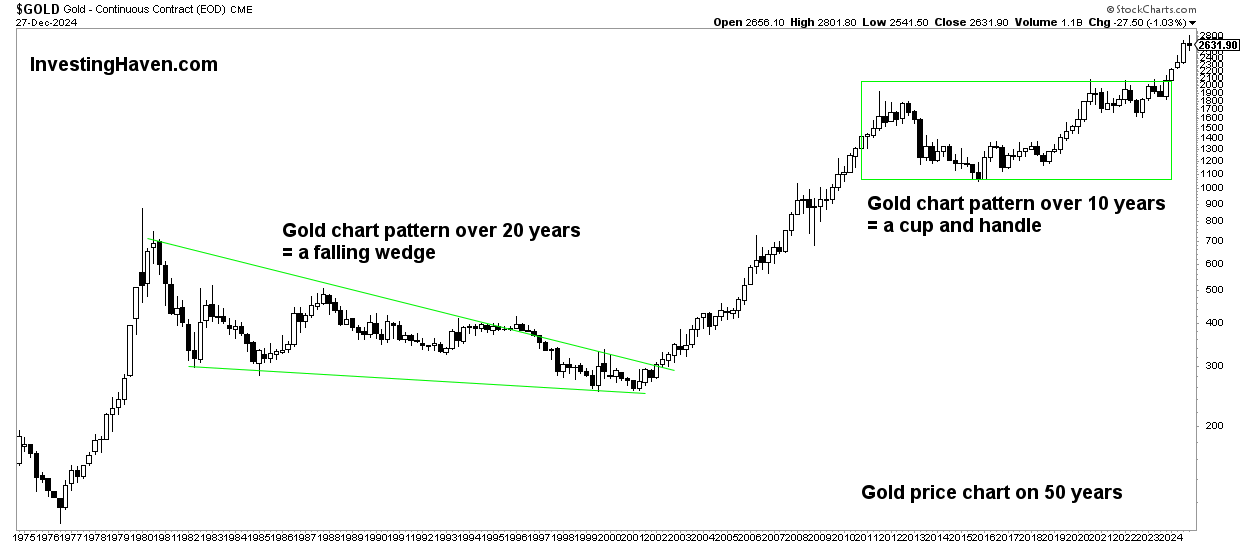

Since March 4th, 2024, gold confirmed a new secular bull market.

In other words, this is just the beginning of the gold bull market.

Emphasis on the word: secular.

Source: Is Gold Expected To Set New All-Time Highs (ATH)?

January 1st – The gold chart on 50 years is clearly very bullish. Below is the quarterly gold chart, each candle represents one quarter. As seen, gold experienced 4 consecutive quarters higher. It’s time for a short break, but it does not change the overall picture of gold, on the contrary, gold remains wildly bullish on its secular timeframe!

Silver is lagging gold. It is tremendously lagging gold.

That’s not a bad thing. It is a normal thing. It is expected, as silver is the laggard.

Similar to the gold bull market of 2002-2011, silver will pick up with some delay.

Whenever the silver bull run starts, it will crush gold and any other metal, market, commodity.

RELATED – How To Invest In Silver in 2025

It is a matter of time for silver – gold is leading the way. Silver will follow – it’s one of the many reasons why silver might become the investment opportunity of the decade.

#2. Physical supply demand – shortage

Scarcity makes an asset valuable.

Expected scarcity will push the value of an asset through the roof.

We discussed the silver shortage many times. We tend to take a macro view, beyond short term physical silver demand news.

It looks like a silver supply squeeze is developing. The highest probability outcome is that this is a macro trend which will amplify over time.

Silver Squeeze Update

The World consumes 1.3 billion ounces of silver annually, and old mines are being depleted. World silver production is just 830 million ounces.

The silver industry added less than 10 million ounces in new (mine) production per year in the last decades,… pic.twitter.com/yIC2P8yoo5

— Willem Middelkoop (@wmiddelkoop) August 10, 2024

#3. Silver price chart – investment opportunity of the decade

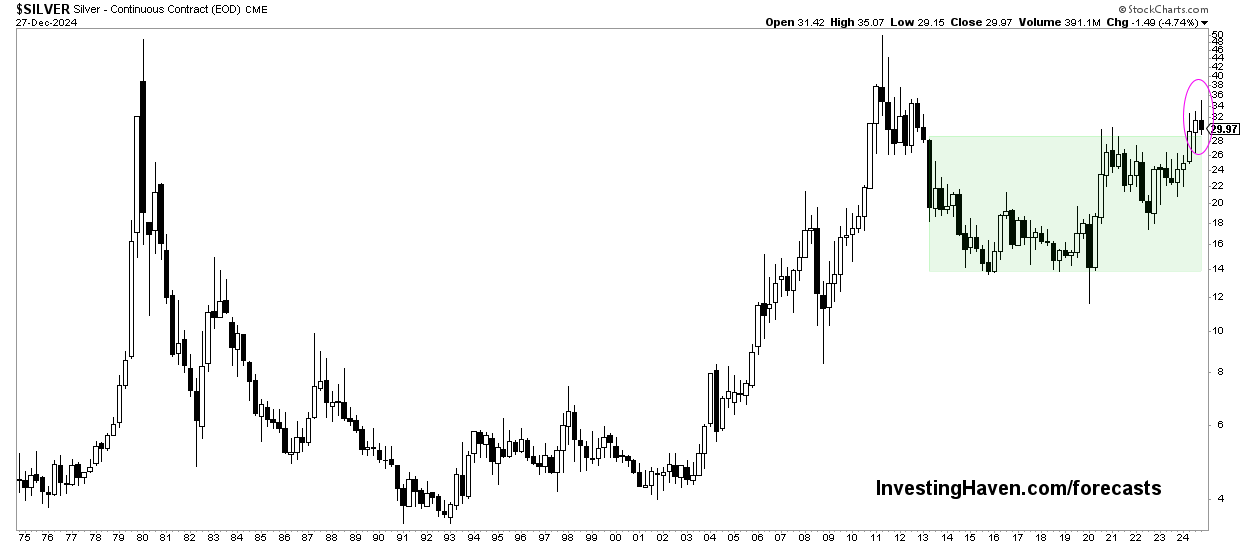

The silver price chart has one of the strongest bullish patterns imaginable: a cup and handle over 44 years (*). Just this chart set up in and on itself makes the case for a bullish 2025 silver prediction.

Chart dynamics are now taking over control of the price – we are right at the tipping point – this silver chart pattern will dominate price (not the other way around).

As said: Gold at ATH, Silver 42% Below ATH.

The silver price chart will bring the gold to silver ratio back in balance. It is a matter of time!

January 1st – The silver price chart over 50 years is unusually bullish. It did break out, two quarters ago, and is now back-testing its breakout. Wildly bullish on the long term, but only for patient investors who are happy to give time and space (and able to to stomach volatility until silver hits ATH).

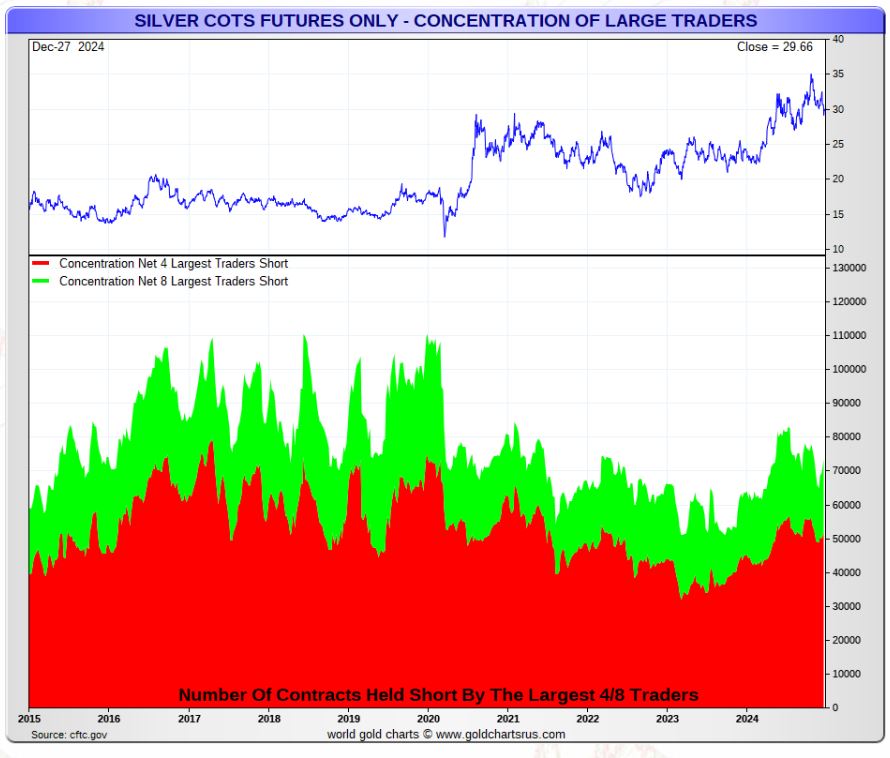

#4. Short positions well below historic extremes

There is a lot of talk and fuzz about short positions.

While short positions are a normal thing, in any market, what truly matters is concentration.

In particular, concentration of the largest traders short is what truly matters.

TIP – We discuss below chart, along with many other data points and leading indicators, in our weekly silver price analysis, a premium membership by InvestingHaven.

January 1st – Concentration of the largest traders short (chart below, lower pane) is nowhere near extremes. As we consider this a ‘stretch indicator’ for the price of silver, it implies that there is plenty of upside potential in the price of silver.

#5. Fuel: the human mindset

Last but not least – the human mindset will help silver tremendously.

This is why:

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett.

Mr. Buffett got it right: the vast majority of investors are impatient. The patient investor is most often rewarded provided he picks the right market.

$Silver is bullish in every single time frame all the way back to 1800. I don’t know how people can resist this, at least I can’t. I’m ready for the rip higher. (source)

When combined with all the other data points laid out in this article, we believe #5 will be the fuel that silver will need to run to $50.

Sooner or later, most investors will be FOMOed and buying silver as it approaches $50 which is where we will be recommending to take profits. Sign up here to receive our timely silver alerts >>

(*) Correction made on Sept 24th, 2024. We initially wrote 24 years but the reality is that the cup and handle spans over 44 years (1980 till present day). This was a typo.