Record inflows into gold and silver ETFs have lifted prices and tightened supplies, showing how investor demand can quickly shift metal markets. These passive flows now play a major role in shaping short-term price moves.

Gold and silver prices have surged this year as investors poured money into exchange-traded funds (ETFs) that hold physical metal. These ETFs allow retail and institutional investors to gain exposure without owning bullion directly.

As a result, precious metals ETF demand has become one of the most important forces influencing prices.

RECOMMENDED: 2025 Treasury Moves Drive Safe-Haven Flows Into Gold and Silver

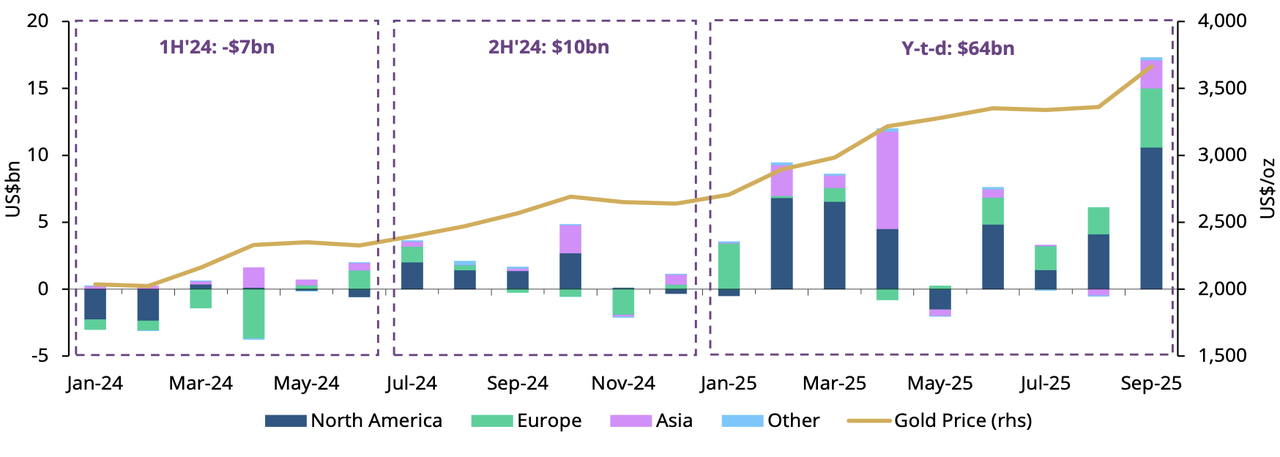

ETF Flows in Numbers

In the third quarter, gold ETFs saw their largest inflow on record, adding around $26 billion. This pushed total global gold ETF assets under management to about $472 billion, with total holdings reaching roughly 3,838 tonnes.

The surge in demand highlights how much capital now moves through passive investment products rather than direct physical buying.

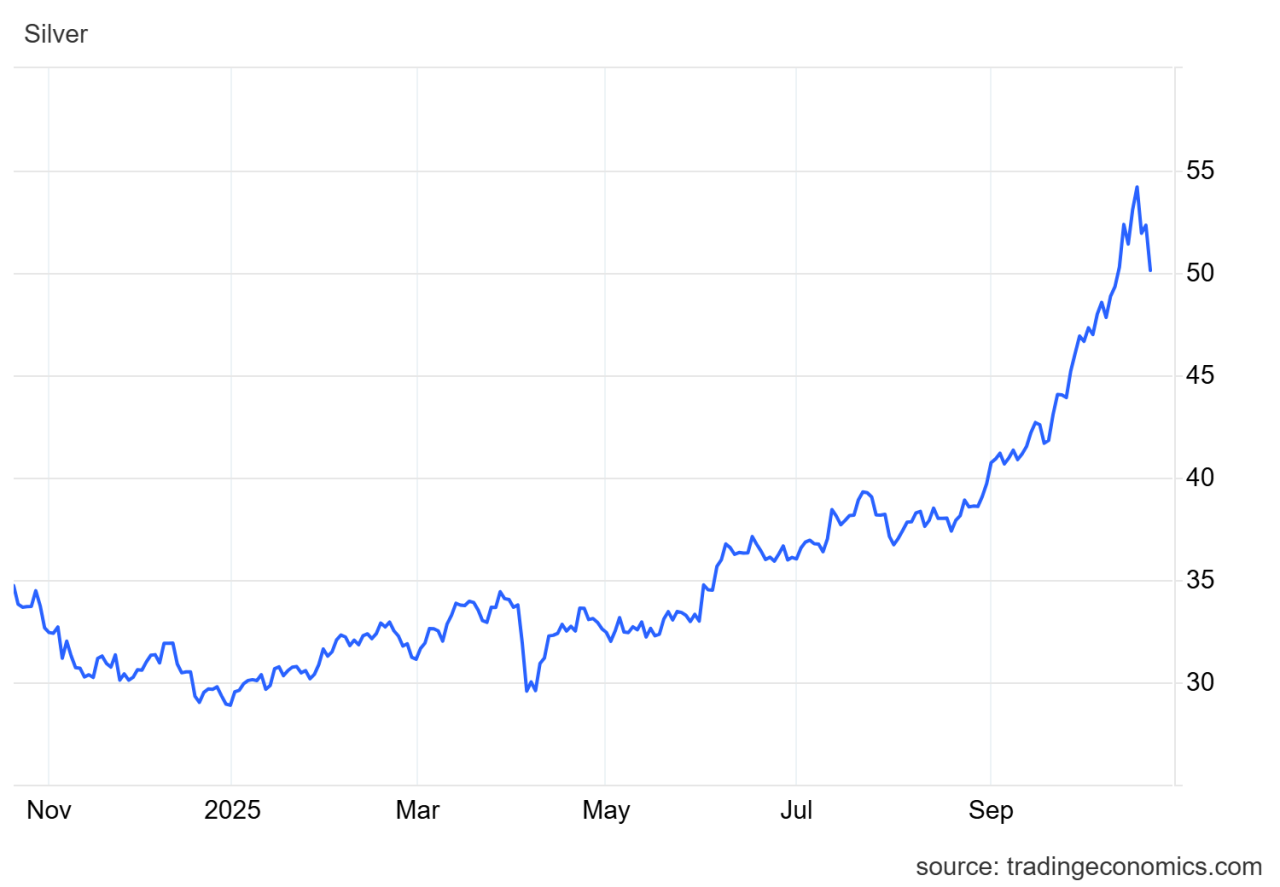

Silver ETFs have also seen strong inflows, with millions of ounces added in the first half of the year, reflecting growing interest from both retail and institutional investors.

RECOMMENDED: Week Ahead: Gold & Silver Real Rates and Safe-Haven Flows

How ETF Buying Tightens Physical Supply

When investors buy shares of a gold or silver ETF, fund managers must purchase the physical metal to back those shares. This process removes metal from available supply, which can create shortages and drive prices higher. Silver has shown this effect clearly.

Rising ETF demand, combined with reduced vault inventories and higher borrowing costs, has made the silver market tighter, triggering price spikes and short-term volatility.

RECOMMENDED: Smart Investors Are Buying Gold in 2025: 9 Must-Know Reasons

Are ETFs the Main Driver or Just an Amplifier?

ETFs have clearly become a strong price catalyst, but they are not the only factor. Central banks continue to buy gold at record levels, while changes in interest rates, inflation trends, and geopolitical tensions also influence demand.

ETFs tend to amplify these underlying factors rather than replace them. When macro conditions favor gold, ETF buying can turn steady gains into strong rallies.

RECOMMENDED: Overbought Signals in Metals: Will Gold and Silver Pullback?

Conclusion

ETFs and retail buying have reshaped how precious metals move. Their impact on supply and price momentum is clear, but they still operate alongside larger economic and central-bank forces.

Watching ETF inflows, metal inventories, and physical premiums can give early clues about where the next big price move is heading.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.