In this article, we discuss why silver is an attractive investment in 2025. Moreover, we explain how to invest in silver in 2025.

RELATED – 5 Reasons Why Silver Is The Investment Opportunity Of The Decade

Silver, often referred to as “the gray metal,” enjoys both favorable chart patterns and strong market dynamics. Here are the key reasons why:

- Intermarket dynamics: Silver has a close correlation with price action in gold, which typically leads the way in precious metals markets.

- Increased demand: Silver is essential in industries such as solar panels and electronics.

- Supply constraints: Depleting mines and fewer new mining projects coming online are tightening the market.

Introduction to Silver Investment

Silver serves both industrial uses and as a store of value. In 2025, silver will remain in demand as a hedge against geopolitical uncertainties and increased industrial demand.

Its affordability compared to gold also makes it an attractive option for investors looking to diversify their portfolio within the precious metals market.

Historical Context: Silver’s Performance Over Time

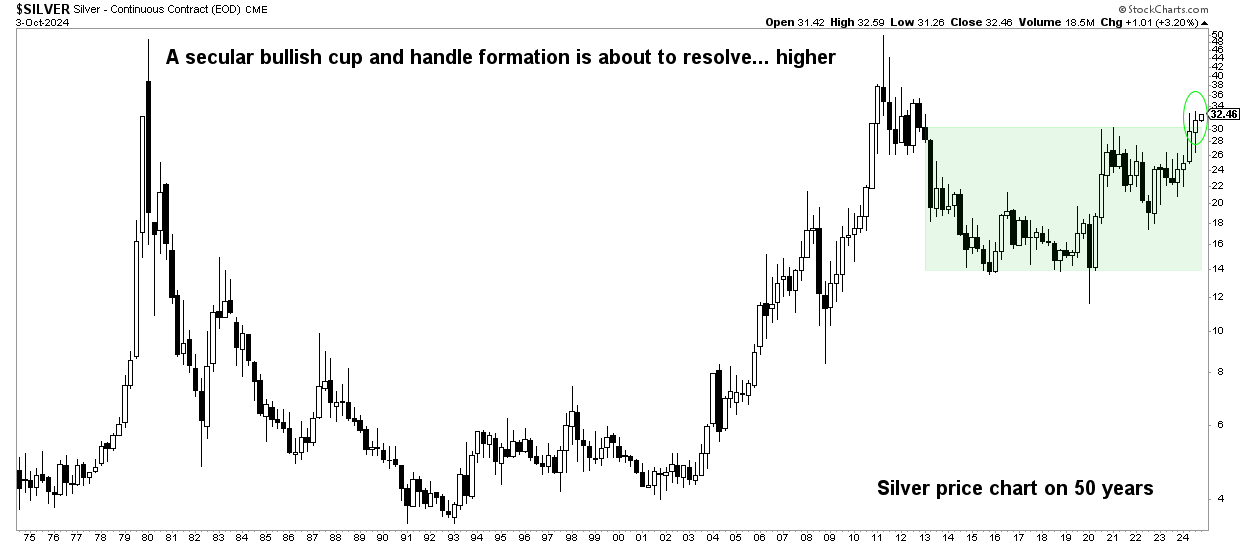

Silver has historically been a volatile investment.

Significant silver changes occurred throughout the 20th and 21st centuries. It reached its apex in 1980, dipped, then spiked again during the 2008 financial crisis.

More recently, silver saw renewed interest during the COVID-19 pandemic. It deserved status as a safe-haven asset during global uncertainties. Moreover, gold broke out to stage a new bull market since the market started anticipating easing monetary policies (rate cuts).

Going forward, many analysts believe silver still has upside potential, especially considering its sensitivity to industrial demand and inflation. InvestingHaven’s analysts are in the camp of ‘much higher in the year(s) to come.’

Why Silver is an Attractive Investment in 2025

1. Bull market dynamics and relationship with gold

Silver often mirrors gold’s movements. When gold enters a bull run, silver typically follows, sometimes delivering even larger percentage gains due to its smaller market size.

Gold is expected to perform well into 2025 according to our most recent gold prediction 2025.

Because of this, silver is likely to experience a significant price inflation. That’s because investors prefer relatively cheaper alternatives to gold. Read more in our silver forecast 2025 – 2030.

2. Chart patterns & dominant chart dynamics

Silver’s price charts display long-term patterns like the cup and handle and bullish triangle, both of which suggest strongly bullish trends.

These formations point toward strong price movements once this pattern is complete, amplifying silver’s bullish outlook in 2025.

3. Supply constraints vs. demand increase

Silver’s supply is constrained due to depleting mines and fewer new mining projects coming online. Meanwhile, industrial demand especially from sectors such as solar energy and electronics is on the rise.

This supply-demand imbalance could drive silver prices higher, as has been the case in previous cycles of tight supply and rising demand.

4. Geopolitical turmoil

Economic uncertainty, inflationary pressures, and geopolitical tensions increase demand for silver as a safe-haven asset.

Given its lower price compared to gold, silver is likely to see higher demand during times of market volatility. The weakening of major currencies like the USD also makes silver more attractive to foreign investors.

5. Diversification benefits in portfolios

Silver’s price movements don’t always correlate with those of stocks, bonds, or even gold, making it an excellent asset for portfolio diversification.

During periods of turmoil, particularly geopolitical, silver & gold often move independently, providing a hedge against systemic risk.

Silver Outlook for 2025

Silver price predictions for 2025 vary widely, depending on a range of influencing factors. Here’s a summary of the potential outcomes:

- Moderate predictions: Prices stabilizing between $27 and $34 per ounce, supported by steady industrial demand.

- Bullish outlook: Prices ranging from $34 to $50 per ounce, driven by rising industrial applications and investment demand.

Optimistic scenarios beyond 2025: Extreme bullish predictions place silver at up to $100 per ounce, assuming high demand, supply constraints, and inflationary pressures align.

The range of predictions highlights silver’s speculative nature, but most forecasts indicate upward potential for the grey metal in 2025.

How to Invest in Silver #1. Physical silver

For many investors, holding physical silver is an easy and safe way to gain exposure to the metal. Silver bullion and coins offer tangible value and provide direct ownership of the asset without counterparty risk.

Below are 3 options to invest in physical silver.

1. Bullion bars: Silver bullion bars are typically available in sizes ranging from 1 ounce to 1,000 ounces. For large investors, bullion bars are often preferred due to their lower premiums over the spot price. Premiums are the markup above the current market price, which accounts for manufacturing and distribution costs. Bars tend to be more cost-effective for substantial investments, but they require careful storage, as large quantities can become cumbersome.

Best practice: Investors should consider buying bars from reputable dealers and ensuring that the bars are accredited by recognized institutions, such as the London Bullion Market Association to ensure authenticity.

2. Coins: Silver coins, such as the American Silver Eagle or the Canadian Maple Leaf, are popular for their smaller size, liquidity, and aesthetic value. Coins usually carry higher premiums than bullion bars due to minting costs and their appeal to collectors, but they are easier to sell in smaller amounts. Coins can also have added numismatic value, which means some collectors are willing to pay more than just the silver content price.

Best practice: Investors looking for liquidity should prioritize widely recognized coins, as they are easier to sell globally, especially during market fluctuations.

3. Collectible coins: For investors with an interest in numismatics (the study or collection of coins), rare or historical coins can offer additional upside. However, these investments require specialized knowledge, and their value often depends on scarcity and condition rather than silver content alone. This makes them less ideal for pure silver exposure but potentially lucrative for those with expertise.

How to Invest in Silver #2. Silver Miners

For investors who prefer not to deal with the logistics of owning physical silver, there are several ways to gain exposure to silver through the stock market. Here are the most common options:

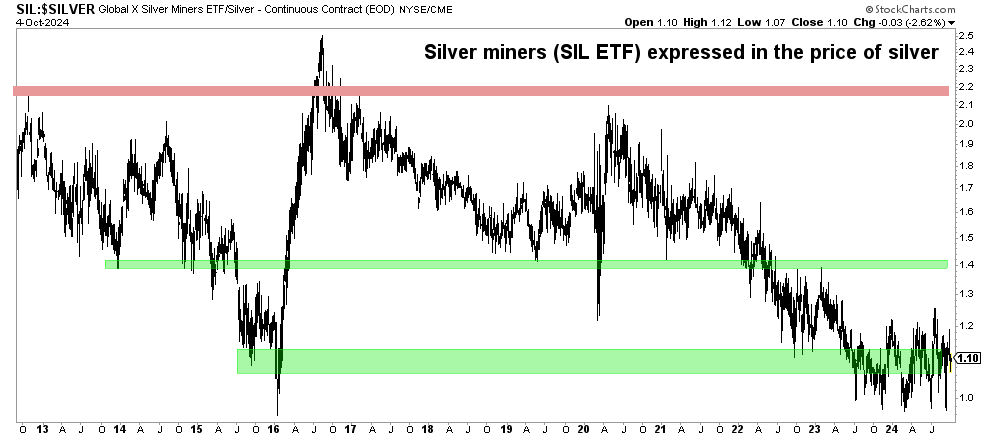

1. Silver ETFs: Silver ETFs offer a convenient way to invest in silver without owning physical metal. ETFs like iShares Silver Trust (SLV) track the price of silver and are highly liquid, making them accessible for both small and large investors. Investors can also explore silver mining ETFs like SIL ETF that track a basket of mining companies, reducing the risk of betting on a single stock.

Best practice: ETFs are ideal for investors seeking broad exposure to silver while maintaining flexibility and liquidity. Make sure to compare expense ratios and performance history before investing in any silver ETF.

2. Silver mining stocks: Investing in companies that mine silver provides indirect exposure to silver prices. These stocks often outperform silver during bull markets because mining companies’ profitability increases with rising silver prices. However, they also carry risks related to operational challenges, such as mine productivity, and fluctuating mining costs. That’s why silver mining ETFs are a less risky choice.

Best practice: Look for mining companies with strong financials, low debt, and favorable geopolitical conditions. Large-cap mining companies tend to be more stable, while junior miners offer higher potential rewards but also come with greater risk.

How to Invest in Silver #3. Futures & options

Futures and options are advanced financial instruments that can provide significant upside but also carry substantial risk. These tools allow investors to speculate on the future price of silver or hedge against price fluctuations.

Silver futures: Futures contracts allow investors to agree to buy or sell silver at a predetermined price on a future date. These contracts are leveraged, meaning you can control a large quantity of silver with a relatively small initial investment. Futures trading can amplify profits, but losses can also exceed the initial investment, making it a high-risk strategy suitable only for sophisticated investors.

Best practice: Investors should use futures cautiously and ensure they understand margin requirements and the risks of leverage. Futures can also be used for hedging if an investor holds significant physical silver and wants to protect against short-term price declines.

Silver options: Options provide the right (but not the obligation) to buy (call options) or sell (put options) silver at a specific price before the contract expires. Options are less risky than futures because the maximum loss is limited to the premium paid for the option. However, they still require a clear understanding of price movements and volatility.

Best practice: Options are a useful tool for experienced investors looking to hedge positions or speculate on silver’s short-term price movements. Beginners should avoid options unless they have substantial knowledge of derivatives.

How to Invest in Silver #4. Storage & security

When investing in physical silver, secure storage is crucial. Unlike stocks or ETFs, silver needs to be stored physically, and the choice of storage can significantly impact the safety and liquidity of your investment.

Home safes: Storing silver at home in a safe offers easy access, but it also comes with risks, including theft, fire, or natural disasters. Home insurance policies often don’t fully cover precious metals unless specifically included, so it’s important to review your coverage and take necessary precautions.

Best practice: Invest in a high-quality safe designed for precious metals and ensure that it is securely installed. Also, check with your insurance provider to confirm coverage.

Allocated storage: Allocated storage involves paying a third-party service, such as a bank or a bullion vault, to store your silver in an insured, secure location. With allocated storage, you maintain ownership of specific bars or coins. These facilities offer higher security and peace of mind, though they come with additional storage fees.

Best practice: Choose vaults or storage services accredited by reputable organizations and ensure that your silver is fully allocated (i.e., segregated from other clients’ holdings) to avoid any ambiguity in ownership.

Unallocated storage: Some storage facilities offer unallocated storage, where your silver is pooled with others’ holdings. This option is cheaper, but you don’t own specific bars or coins, and in the event of a company’s bankruptcy, retrieving your silver could be challenging.

Best practice: If you value liquidity and ownership, stick to allocated storage. Unallocated storage should only be used for short-term holdings due to the risks involved.

Conclusion

From positive market dynamics, reflecting a tremendous run similar to gold, to its application in modern technologies that involve renewable energy, silver becomes an extremely multipurpose investment. It acts as a hedge against inflations, providing diversification benefits in an economic uncertainty at the portfolio level.

Besides that, its surging industrial demand and tight supply could drive up the price of silver steadily in the future. Prudent diversification with silver may, therefore, yield considerable returns with minimal risks from economic cycles and market volatility.

Investors are thereby advised to constantly monitor the movement of silver and consider it an efficient element of a diversified investment strategy, while entering into the second decade dominated by technological advancement and economic transformation.