HSBC expects silver to average $35.14/oz in 2025 and remain elevated through 2027 amid record-high gold and ongoing supply deficits. Fundamentals remain intact, yet closely tied to external forces.

HSBC recently raised its average silver price forecast to $35.14 per ounce for 2025, $33.96 for 2026, and $31.79 for 2027.

Strong gold performance and heightened safe-haven demand underlie the HSBC silver market outlook. We explore whether silver’s momentum stands on solid ground or hinges on broader market pressures.

RECOMMENDED: Is Silver A Good Investment Right Now?

Silver Forecasts and Market Context

The bank lifted its 2025 forecast from $30.28, its 2026 projection from $26.95, and its 2027 estimate from $28.30, signaling an upward shift in expectations.

HSBC frames this change as linked more to silver’s correlation with gold, now trading at record levels, than to silver’s own fundamentals.

Gold climbed roughly 29% this year, reaching $3,500 per ounce in April amid geopolitical and trade tensions. Silver itself recently surpassed $35/oz, its highest level in over 13 years, crossing $35.82 per ounce on June 5, marking a 24% gain year-to-date.

RECOMMENDED: A Silver Price Prediction For 2025 2026 2027 – 2030

Silver Supply-Demand Dynamics and Drivers

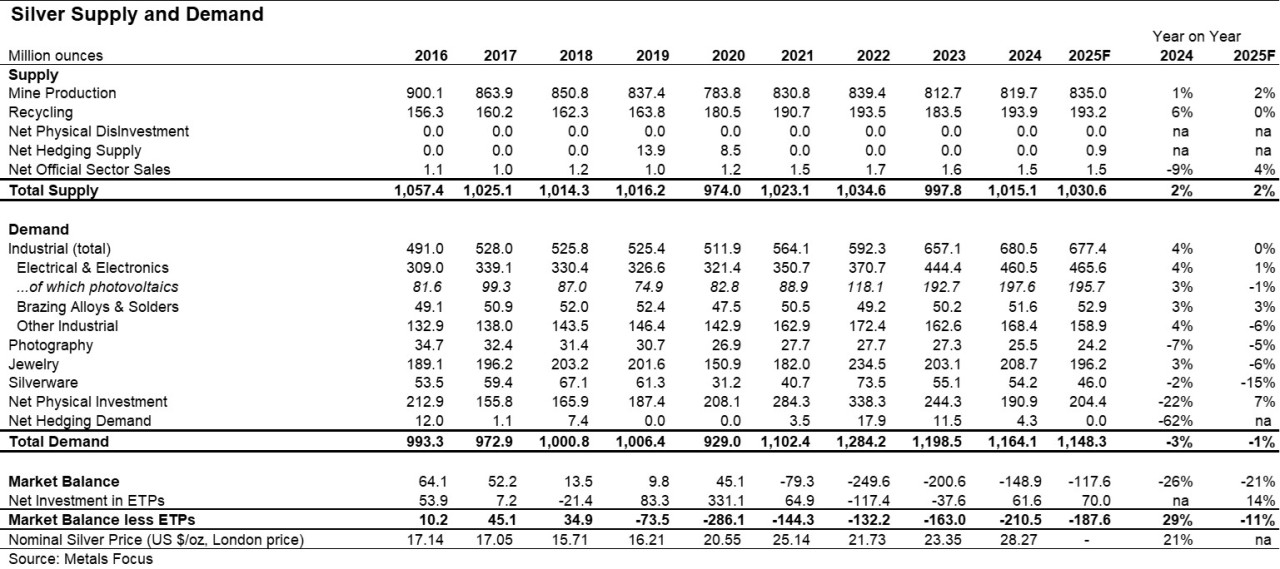

HSBC projects a 206 million-ounce silver deficit for 2025, up from 167 million ounces in 2024, with the gap narrowing to 126 million ounces by 2026.

The bank expects industrial demand for silver to dip slightly this year after four years of record expansion but to rebound in 2026, particularly in photovoltaics and electronics.

Meanwhile, jewelry and silverware segments may weaken further due to elevated prices. Coin and bar demand, already strong, may ease following recent robust purchases. Silver mine production continues to grow slowly and seems unlikely to eliminate the deficit.

RELATED: Silver’s Surge: Outshining Gold in 2025

Conclusion

HSBC delivers a cautiously bullish stance on silver. The elevated forecasts reflect persistent structural deficits and gold’s influence as a safe-haven trigger rather than unique silver strength.

Going forward, changes in gold prices, U.S. dollar direction, and industrial demand gains will determine if silver’s momentum proves sustainable.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service, delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Must-See Secular Charts: Precious Metals Mining Breakout & More (Aug 9)

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)