Silver is playing catch-up to gold in the precious metal bull market, with 6% year-to-date gains. But that’s not the only reason to buy Silver right now.

Over the last 16 months, Silver prices have been on a sustained uptrend. And it has culminated with a climb back above $30, after the precious metal reached the current peak of $34.4, for the first time in 13 years.

At the time of writing, Silver has already been up by 7% in the last four months and by as much as 19% in the past year.

The spirited gains have rekindled the debate of whether Silver can outshine gold and added to the reasons why precious metal investors should add the metal to their portfolio.

Below, we tell you why, at current prices, silver isn’t just a bargain but a must-have investment.

Potential for larger gains than gold

While gold often takes the spotlight, silver has historically outperformed gold in bull markets due to its lower price point and higher volatility. During the precious metal bull run of late 2010 to mid-2011, for example, silver dramatically outperformed gold.

Its prices surged from around $17 to the current all-time high of $49, posting gains of 188% in comparison to gold’s 73%.

The current market environment has analysts convinced silver can pull a similar move before the end of this bull cycle.

Geopolitical risks abound

Silver is a safe haven asset, which implies that the ongoing conflicts, trade wars, and global economic instability heavily influence its prices. Today, a serious trade war is brewing between the US, China, and the rest of the world, which threatens global economic growth.

This makes it necessary for any investor looking to preserve and grow wealth to start buying the precious metal.

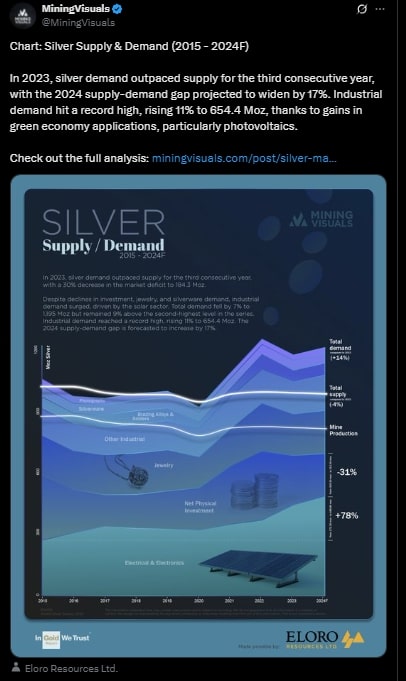

Widening demand and supply gap for Silver

As much as half of the world’s silver is absorbed by the global industries. Currently, the demand for silver is on the rise, thanks to the surging needs for green energy, electric vehicles, and industrial technology.

On the other hand, its supply has been on a sustained decline. For four consecutive years, 2020 -2024, the demand for silver has consistently outpaced its supply, and the trend is projected to continue into the foreseeable future.

Can Silver Prices Reach $100?

Yes, it is likely that Silver will eventually hit $100. The journey here will, however, start when it clears the current target of $50.

Our analysis then shows that the more realistic target will be $88 by 2027 or 2028, with a stretched target of $100 by the turn of the decade.

We also project that the catalysts for this price action will be increased supply squeeze, rate cuts, and heightened global inflation.

Check out our most recent alerts – instantly accessible

- The Precious Metals Charts That Bring Clarity Through Noise (April 27th)

- Highly Unusual Readings In Gold & Silver Markets (April 20th)

- Gold Miners Breaking Out, Here Are A Few Gold Stock Tips. What About Silver & Miners? (April 13)

- Gold, Silver, Miners – Bottoming or More Downside? (April 5th)

- Why Next Week Matters for Gold — But Less So for Silver (March 29th)

- Is the USD About to Bounce? What Are the Implications? (March 22nd)

- Silver Hit Its Acceleration Point. 5 Critical Dates Every Silver Investor Should Watch. (March 15th)