Silver’s sharp rally shows signs of exhaustion as leverage builds, physical supply pressure shifts, and financial conditions tighten. These forces could pull prices back toward the previous $50 level.

Silver trades around $86 per ounce after an explosive rally earlier this year that briefly pushed prices above $120. Such fast moves often leave markets unstable.

Data from futures positioning, ETF flows, and interest rates suggest silver now faces strong downside pressure as speculative demand fades and financial conditions turn less supportive.

RECOMMENDED: Silver: This Leading Indicator Shows Potential Massive Reversal

Macro Factors That Can Pressure Silver Prices

Higher interest rates continue to weigh on silver. Recent data show real 10-year yields moving higher as markets price a tighter policy outlook.

When yields rise, investors prefer income-producing assets over metals that offer no yield.

At the same time, a stronger dollar makes silver more expensive for global buyers.

These forces often trigger selling after sharp rallies, especially when prices sit far above historical averages.

RECOMMENDED: Silver Shortage Looms As EVs And AI Chips Consume Supply

Leverage, ETFs, And Forced Selling Risk

Speculative activity remains elevated. ETF data show large retail inflows during the rally, similar to past squeeze episodes.

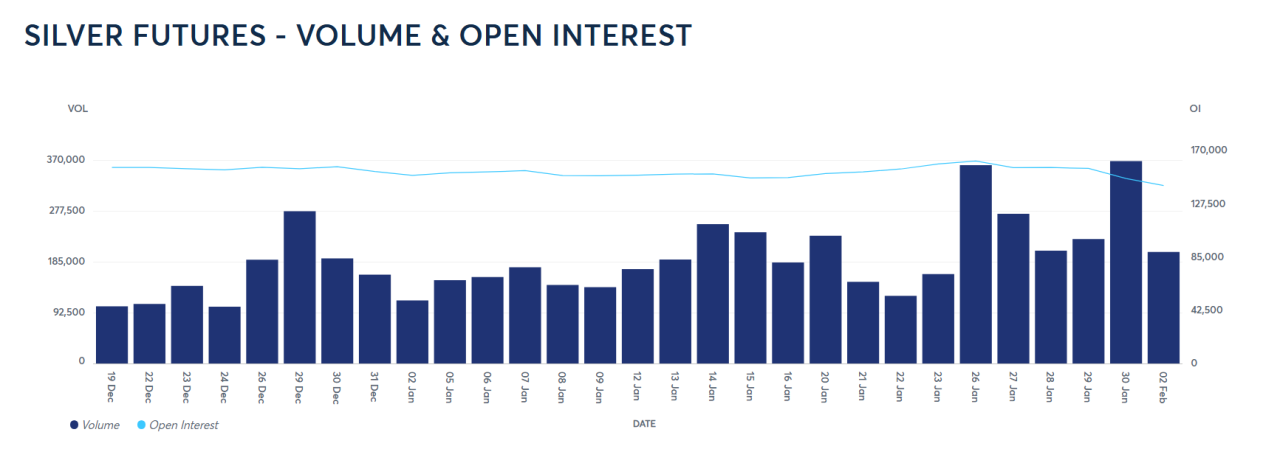

On futures markets, open interest implies claims on silver that far exceed available deliverable metal.

Registered COMEX inventories have dropped toward roughly 30 million ounces, while withdrawal volumes remain high.

This imbalance increases the risk of margin hikes and forced selling.

When leverage unwinds, prices can fall quickly toward previous breakout levels such as $50.

Physical Demand And Supply Can Shift Quickly

While industrial demand supports silver, it also adds risk. Solar and electronics demand can weaken if economic growth slows.

At the same time, physical silver that recently left warehouses can return when prices drop.

Once supply pressure eases, speculative positions lose support, and prices often retrace large portions of prior rallies.

RECOMMENDED: Will Silver Hit $150 An Ounce?

Conclusion

Silver now faces pressure from heavy leverage, changing supply flows, and tighter financial conditions.

These factors often lead to fast pullbacks after strong rallies. If they continue, a drop back toward the $50 level would not be surprising.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

-

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

-

Turning-point forecasting across multi-timeframe charts.

-

Actionable insights on GDX, GDXJ, SIL, and SILJ.

-

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

Read our latest premium alerts:

- Gold to Silver Ratio at 50. Ready for Rotation? (Jan 25th)

- Time To Take Profits? (Jan 17th)

- Why January 2026 Is An Unusually Important Month for Precious Metals(Jan 10th)

- Where or When Will Silver Set A Top? (Dec 29th)

- Watch the USD! (Dec 21st)