We have covered silver extensively in the last 2 years. Not only do we remain firmly bullish on silver, long term, we even turned out much more bullish as new data is coming in.

Note that everything we are writing in this article has a long term focus. We don’t care about what silver is going to do tomorrow or next week, it’s meaningless. Silver is for long term investors, not traders, let that be clear!

Very recently, we wrote that gold has a very powerful long term setup. Gold is a leading indicator for silver. We said that gold as a Leading Indicator for Silver Is Turning Bullish As 2023 Kicks Off.

Moreover, back in September, when the world was thinking that the world would fall apart and that silver would crash big, we said: One Silver Chart Justifies “Buy The Dip” For Long Term Positions. It was the gold/silver ratio which came in a STRONG BUY area.

The message of the silver chart

Let’s start off by the chart. As said many times “start with the chart.”

We feature a silver chart from our premium research.

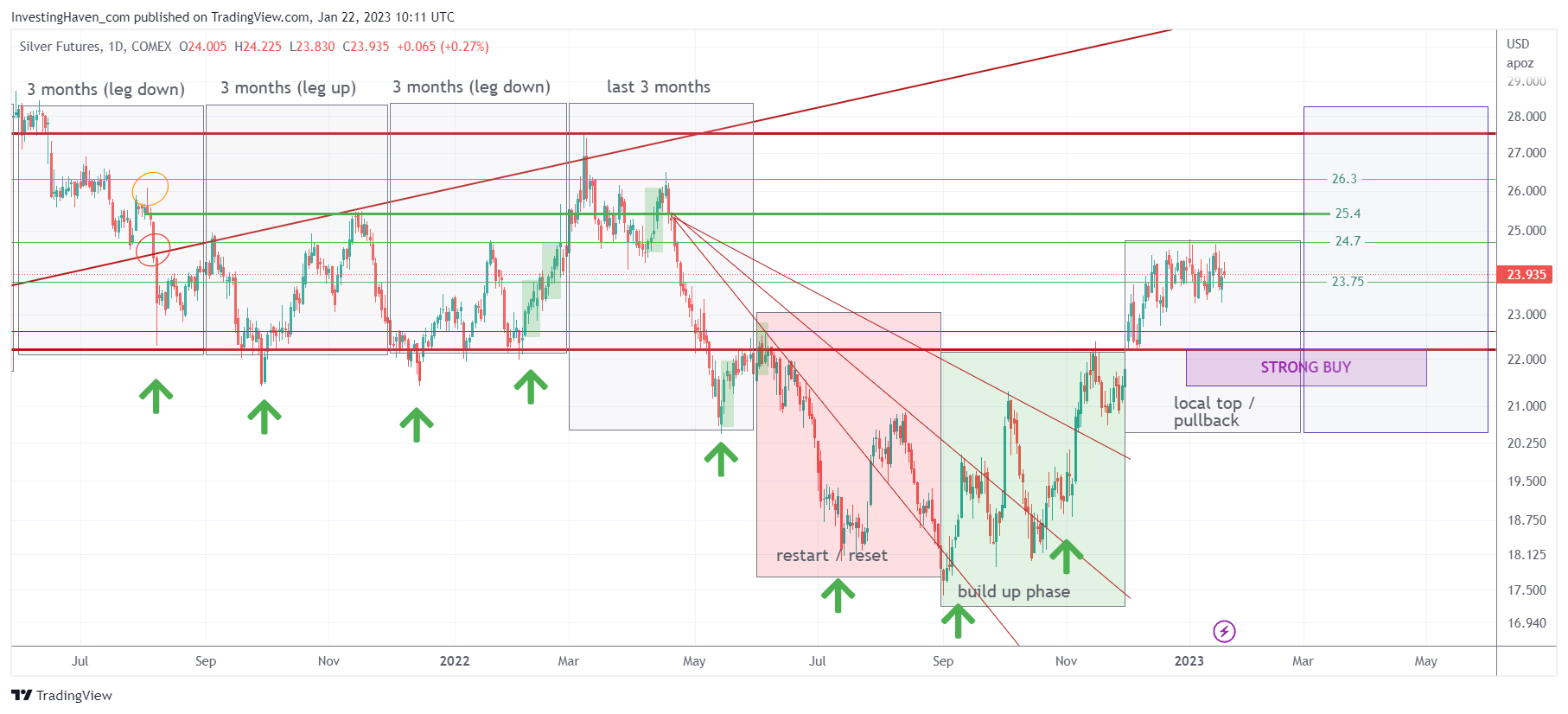

The silver price chart shown below is structured around the 3 month cycles. The silver cycles are very different than the stock market cycles.

You will notice 4 cycles of 3 months, 12 months in total, between May of 2021 and 2022, which marked a bullish reversal. However, at the end of the reversal, the fastest rate hike in history pushed commodities lower. Silver did not escape the selling and started a bullish reversal at a lower level.

Note that this is not per se bad on the long term, on the contrary, there is a lot of analogy with the Tesla setup back in 2019, before Tesla took off, as explained here Silver vs. Tesla: Similarities and Differences.

The June cycle and September cycle in 2022 coincided with a bullish reversal which we believe will turn out to be a lasting bottom for years to come.

The current cycle has a topping characteristic. We believe any pullback should be bought aggressively in the area which we indicated on the chart.

The chart is simply a reflection of actions of buyers and sellers.

If we read this chart correctly and conclude “the June cycle and September cycle in 2022 coincided with a bullish reversal which we believe will turn out to be a lasting bottom for years to come” than we should see this reflected in other data points.

4 structural changes in the silver market

We already mentioned that a shortage in the physical silver market is brewing: Silver: A Divergence Of Epic And Historic Proportions. That’s an epic development, a game changer.

But there must be more. Much more. If so, we should be able to verify these data points in an objective way.

That’s what we will do in the remainder of this article.

In the remainder of this article we will provide 3 more data points that are game changers in the silver market. They coincide with the bullish reversal pattern which we believe is a long term and lasting bottom. In the end, all these 4 data points are related to each other, it’s a matter of connecting the dots!

The data points we’ll feature confirm the chart and vice versa.

Courtesy of silver analyst Ted Butler who was kind enough to release most of the data points we will mention in the public domain.

The physical market shortage that is underway must have ripple effects. Or, stated differently, there must be additional data points that are proof of a physical market shortage.

Ted Butler puts forth evidence of this, particularly the physical turnover into the silver COMEX warehouse:

I believe the extraordinary physical turnover in the COMEX silver warehouses is the surest possible sign anyone could ever get in advance that the physical shortage is close at hand. I know that it has been 12 years since this physical movement began, so who the heck am I to suggest it is signaling we are close to the point where the silver shortage will soon be highly visible and unmanageable? I’d answer that, taken together with all the extraordinary developments over this time, from JPMorgan accumulating a billion oz silver and 30 million oz (maybe more) gold physical position, to then settling with the DOJ and double crossing its fellow big COMEX shorts, to more things than I can recite here. It’s the totality of the issues.

I would point out that it has been nearly three months where total COMEX silver warehouse inventories, after declining sharply over the two prior years (by as much as 100 million oz), have now hovered around the 300 million oz level. Yet, the turnover persists. Without getting too deep into the weeds, this suggests to me that we may be actually at the point where only new stuff brought in can satisfy new demands for physical silver – and where the silver in the warehouses are owned by those not interested in selling. Yes, this is very speculative on my part and it could easily turn out we’re not as close as I suggest.

The issue of physical silver turnover into the silver warehouses is a topic that remains underexposed. Ted Butler’s take on this is that it is the ‘symptom’ of physical silver shortage.

He continues on the same topic:

Perhaps the most singular spectacular achievement of the 12-year intense physical movement in the COMEX silver warehouses is that it has succeeded in keeping the world’s industrial silver users and fabricators fully-supplied in this just-in-time world. The minute the on-time silver deliveries hit a snag, some users, in seeking to avert future delivery delays, will move to order extra or stockpile silver. This will set off a chain reaction. The miracle is that it hasn’t happened to this point.

Moreover, the silver CoT report continues to be very bullish despite a strong rally in silver since October. This implies that commercials who dominate the silver futures market price setting are reluctant to add too much to their net short positions.

While this is subject to change, it is a game changer, as per Ted Butler’s analysis.

Lastly, complementary to the CoT report but still different, is the Bank Participation report. This report shows positions of banks in various commodities.

Again, courtesy of Ted Butler his findings – he is factual and data driven:

This month’s Bank Participation report featured a reversal of sorts from the prior report, in that the relative lack of bank selling was more pronounced in silver, whereas it was in gold in the prior report. From Dec 6 to Jan 3, while the total commercial net short position in gold increased by roughly 30,000 contracts, the banks in the BPR only accounted for 13,000 contracts of the selling, with non-banks (a variety of swap dealers), accounted for the balance of 17,000 contracts. A s a reminder, the price of gold rose about $80 over this time.

Looking back from the BPR as of Nov 1, the total commercial net short position in gold increased by 85,000 contracts to Jan 3, as gold prices rose by $200, and the portion of total commercial selling by banks was 30,000 contracts, compared to non-bank commercial selling of 55,000 contracts. This is about the smallest bank selling in memory.

Thus, the “thumbs up” as far as my tentative conclusion of a sea change in bank shorting. Of course, I suppose the banks could come onto the short side at higher prices, so nothing is written in stone at this point.

This is why we like Ted Butler so much:

I’m not trying to be a wise-guy with all the answers who will also be able to pinpoint accurately the precise moment of liftoff. As always, I’m just trying to make sense out of verifiable public data. At the same time, it’s high-time someone stands up to admit that the unprecedented physical turnover in the COMEX silver warehouses is so unusual that ignoring it is no longer a legitimate option if one professes to have an interest in silver.

All in all, we believe these developments in the silver market are epic, true game changers. They confirm our chart readings. We believe the new silver bull market is starting its engine. It has a long way to go. It will be a multi-year rise with bumps along the road.

And, remember, silver is only profitable for investors with a long term horizon.

Further reading

Silver Miners To Silver Price Ratio Flashing Long Term Buy Signal

Why Junior Silver Miners Will Have An Amazing 2023

Silver Miners To S&P 500 Ratio: An Epic Test Ongoing As 2023 Kicks Off