The entire investor community remains focused on silver priced in USD, painting a not-so-bullish picture for silver, seemingly ‘forgetting’ that silver in Euros is inches away from ATH.

RELATED – When Exactly Will Silver Hit $50 An Ounce?

Before looking at the silver price charts in Euros, we assess some of the recent headlines (which, as expected, as confusing and misleading).

Silver in the news

First of all, there is Goldman Sachs turning ‘less bullish’ on gold now. While in their gold prediction 2025 published in Sept/Oct they remained firmly bullish, it now seems they are less so.

Their rationale seems to be based on the number of rate cuts:

Goldman Pushes Back $3,000 Gold Forecast on Few US Rate Cuts

While this is certainly an important price influencer, we thought to understand that real interest rates was the ultimate price driver. So, we certainly partially disagree with the Goldman statement, irrespective of a similar focus by other sources:

Gold Steady as Traders Eye US Data That May Shape Rate Path

Even more interesting is this interview on CNBC:

Silver prices can ‘get some gravity’ if industrial production begins to pick up, says UBS

Did the world forget about the 4th consecutive year of a silver market deficit as explained in our article:

Another Annual Silver Market Deficit: Implications for Future Silver Prices

As always, the headlines about gold and silver are confusing at best, probably it’s fair to say they are misleading.

Silver in Euros about to hit ATH

Financial media outlets continue to focus on silver priced in USD, still 40% below ATH.

This seems to confirm the misleading focus.

The reality is that silver in AUD has hit multiple ATH in 2024.

Similarly, silver priced in Euros is close to hitting ATH.

RELATED – Silver prediction 2025

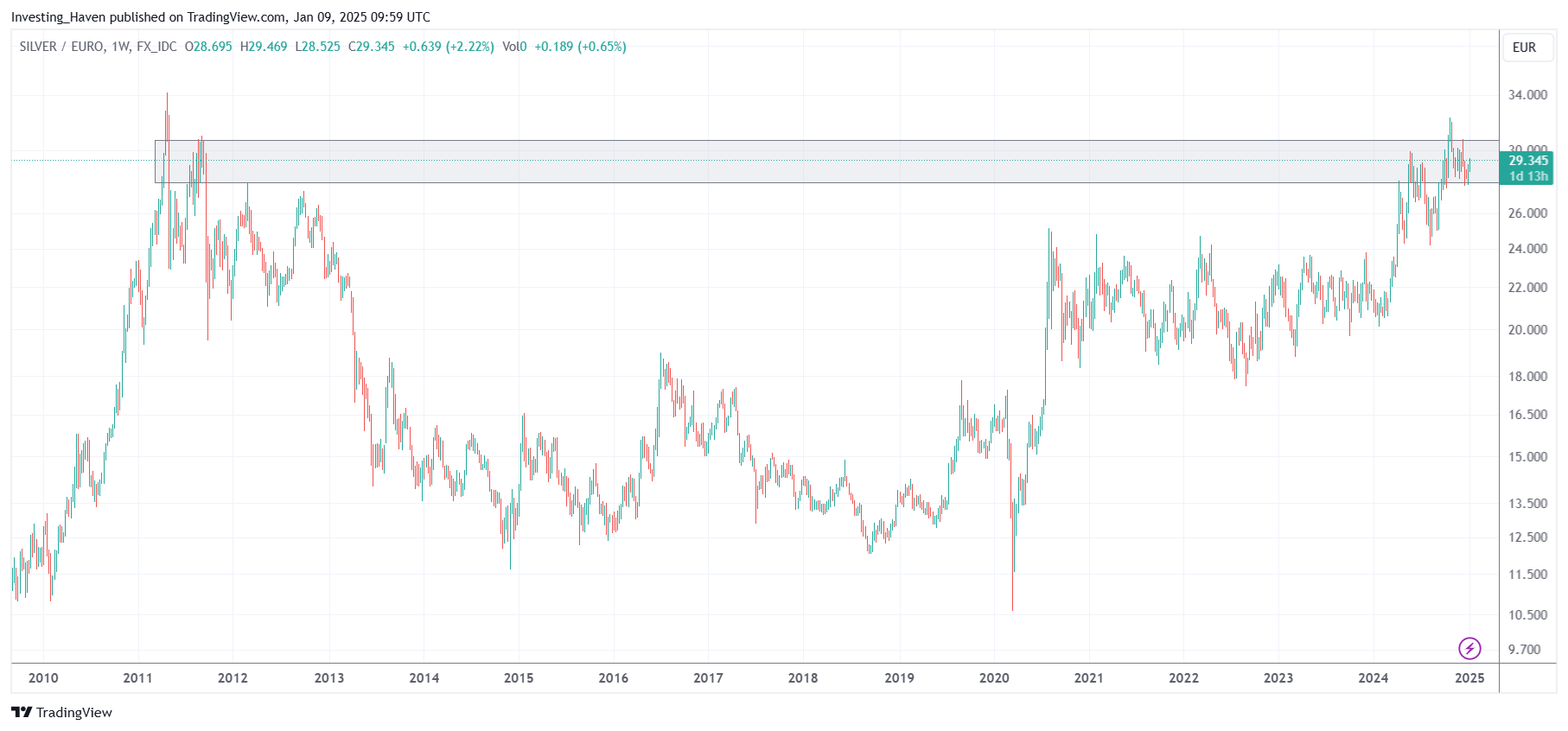

The weekly chart over 15 years, shown below, makes the point very clear – silver priced in Euros (XAGEUR) is inches away from testing its 2011 highs.

Silver in Euros – rising trendline perfectly respected

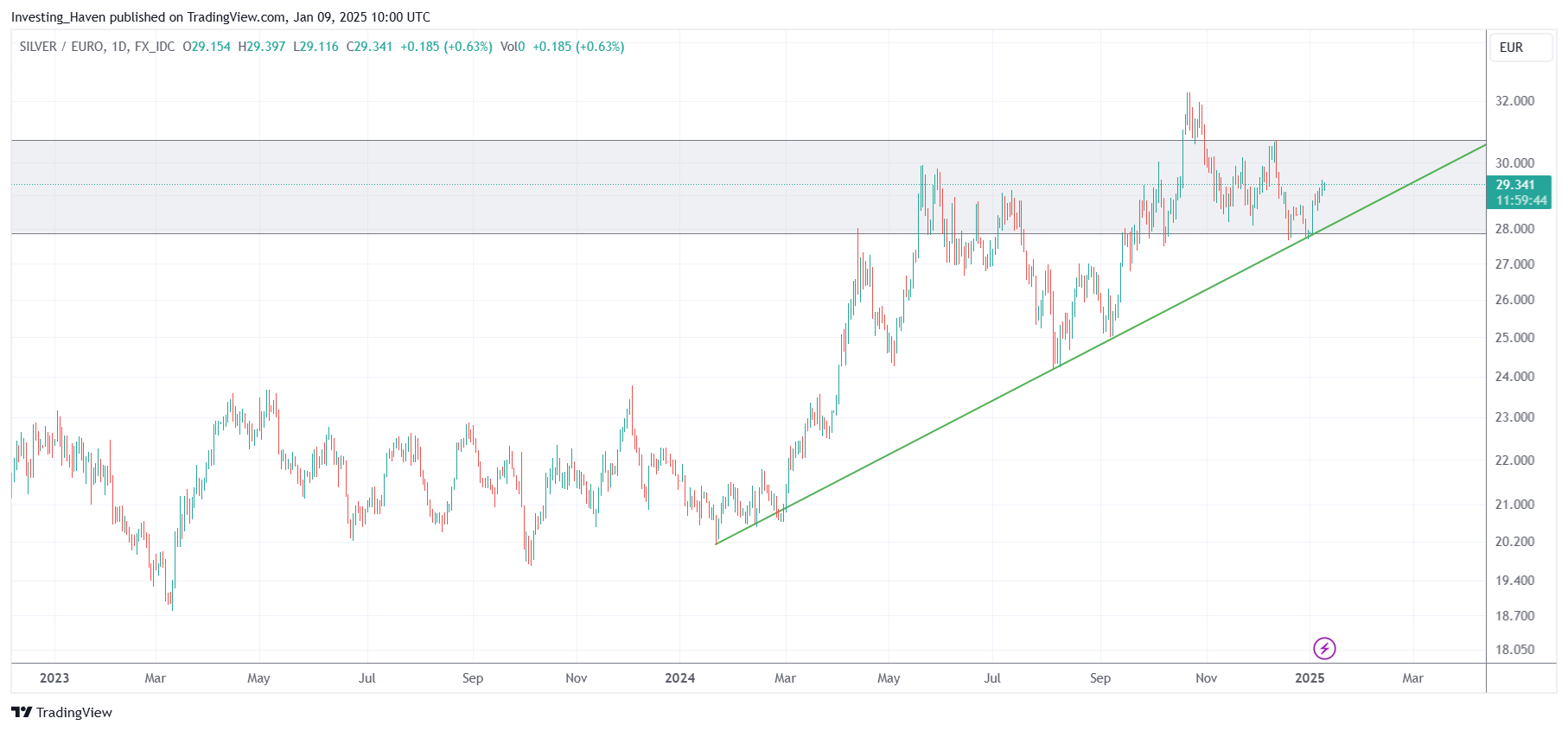

If we zoom in on the XAGEUR chart, we see a perfect rising trend that started on March 1st, 2024.

So far, this rising trend in silver in Euros is perfectly respected.

On the daily XAGEUR chart, below, we also see the confluence of the medium term oriented rising trendline (green) and the very long term resistance area (grey area). The green rising trendline will cross the grey bar in March/April, in fact the trendline entered that ‘grey’ shaded area on Jan 1st, 2025.

This really means that the period February to April 2025 will be a high intensity period for silver priced in Euros. Expected fireworks in the coming 4 months!

Conclusion

While Europeans have not enjoyed great market conditions lately, especially not considering most of European stock markets, the exact opposite applies to European silver investors.

The fact of the matter is that the drop in the Euro (USD strength) rewarded precious metals holders in Europe.

This offsets the weakness in European stocks.

While silver priced in Euros (XAGEUR) did not hit ATH, like silver in AUD, it is very close to testing the ‘ATH area’. We consider €28 to €31 to coincide with the ATH area.

At the time of writing, XAGEUR is creating a very nice pattern in that ‘ATH area’, one that is solid to attack all-time highs which, per timeline analysis, may happen in the period February to April 2025.