Silver’s sell-off on September 29th was clearly and visibly a bear trap. Why? Because silver‘s key leading indicators are bearish, printing bearish turning points, which is obviously bullish for silver itself. There is no escape of silver moving to 50 USD, the only question is WHEN it will start. The market, obviously, will do everything it can, even more than that, to shake off every bull before it starts an epic rally.

We are not going to cover fundamentals in this article. We did so extensively, with primary and secondary data points:

- Primary: Can Time-Price Relationship Forecast a Major Interest Rates Peak in 2023?

- Primary: Gold-to-Silver Ratio and Historic Silver Rallies

- Secondary: What The Mysterious Silver Shuffle Suggests About The Physical Silver Market

In this short update, we look at 2 of 4 silver’s leading indicators. Much more detail is shared in the detailed weekend edition of Momentum Investing.

First, rates have been too strong in the month of September. That’s because crude oil was rising, the Fed had a hawkish tone, the government shutdown in the U.S. was looming. All, combined, resulted in a rising dollar. That’s the setup that won’t allow silver to break out.

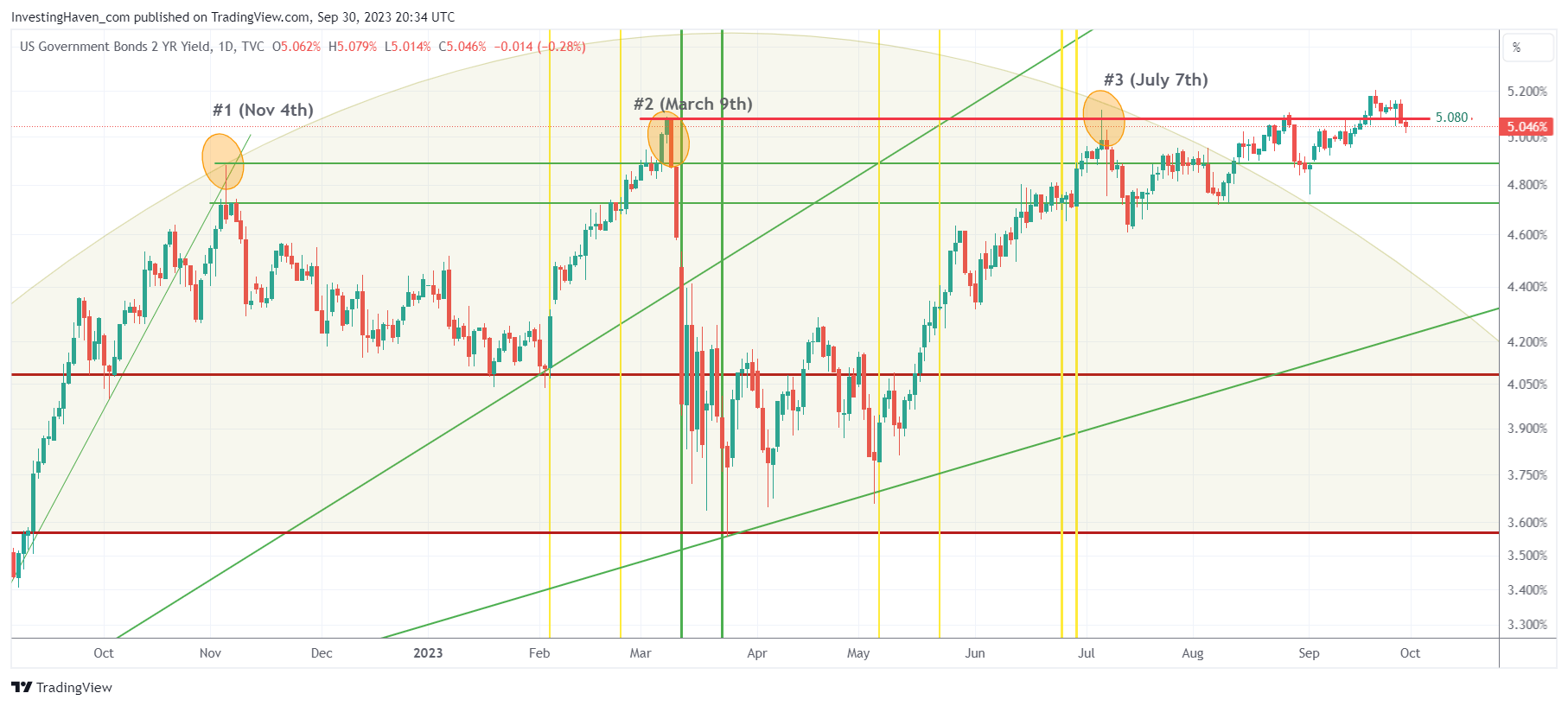

In the meantime, as a government shutdown was averted, with crude oil prices hitting too much resistance, it is blatantly clear that rates will not move higher. In fact, 2-Year Yields already invalidated the breakout attempt at 5.08%. This chart is printing a bearish turning point, bullish for silver.

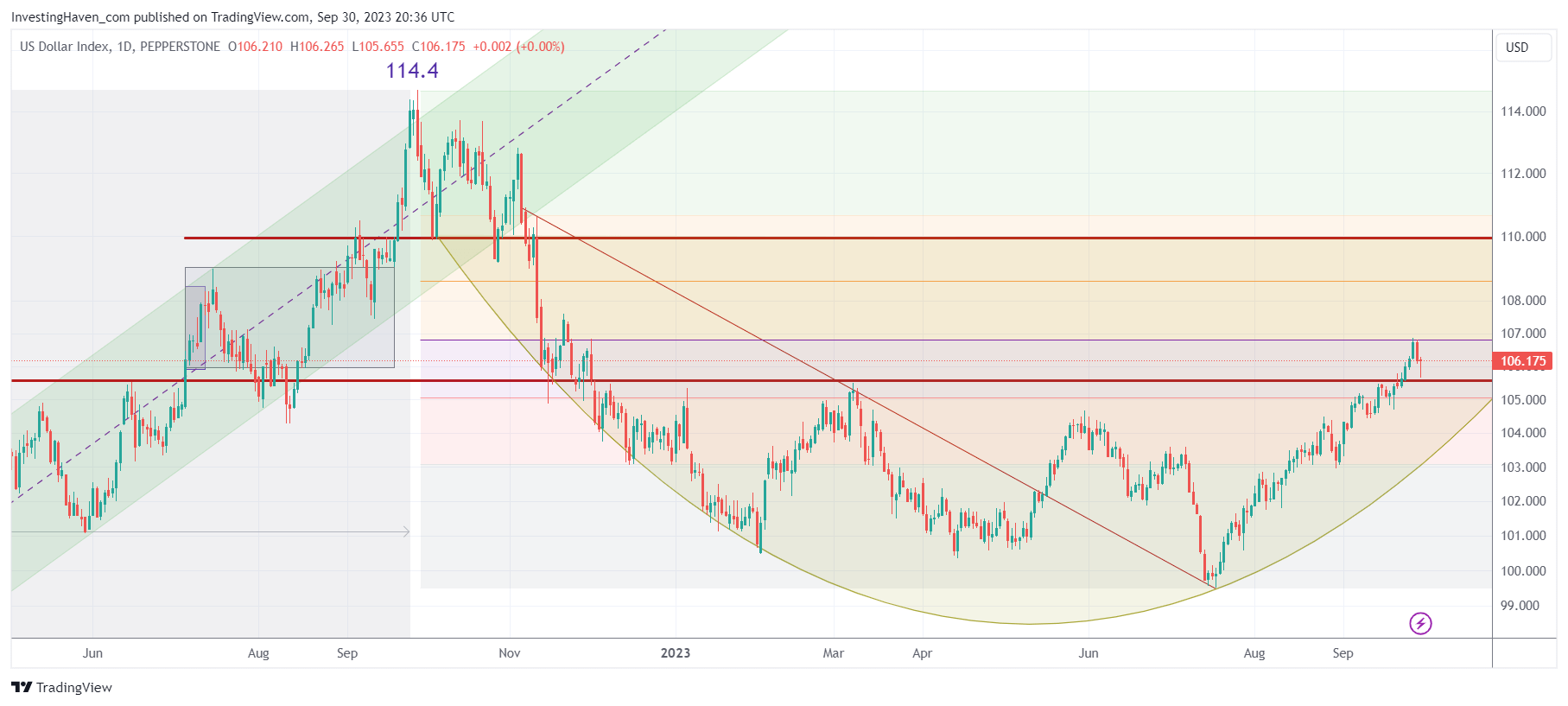

Consequently, the USD will also move lower. What’s even more important, is that the USD required a really big catalyst to get it through its 50% retracement level. Remember, the 50% retracement level is, by far, the biggest resistance point in any pullback. There is no way that the USD will move higher, it is a bearish turning point which is bullish silver.

Again, the market will do everything is possibly can to shrug off the silver bulls. We stay the course, the Friday sell-off was no fun to experience, but the only question is what leading indicators are suggesting about silver. They are hugely bullish, mid to long term, irrespective of short term price action.

Weekly Gold & Silver Price Analysis

We offer detailed gold & silver price analysis, as a premium service, covering every week leading indicators of the gold price and silver price. Premium Service: Gold & Silver Price Analysis >>