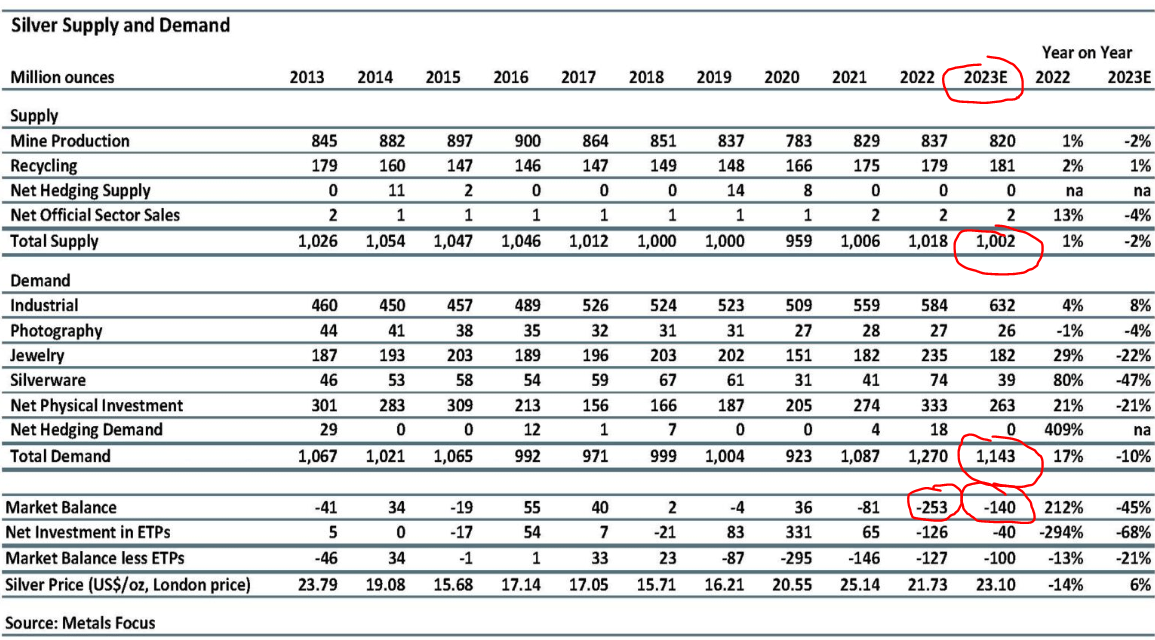

We look at the latest data shared by the Silver Institute. Their research reveals another silver supply shortage. The physical silver market is in a deficit, for three years in a row. The price of silver, however, remains consolidating. Who can spot the anomaly, or better the opportunity?

The supply shortage is prevailing since a few years. We have the topic covered in many of our silver articles like our most recent silver forecast, and also the silver supply shortage article mentioned above. We concluded:

Within the silver market dynamics, the looming silver shortage stands out as a ticking time bomb. Despite COMEX silver price setting, the law of supply and demand will eventually prevail. As we approach a true silver supply shortage, the silver market’s true potential awaits, ready to reshape the price setting dynamics and elevate silver to new heights.

Let’s revisit the latest data point(s), and bring up three important considerations and implications for silver investors in 2024.

Silver supply shortage continues

The 7 take-aways from the last physical supply/demand situation in the silver market (source):

- Global Silver Demand to Reach 1.2 Billion Ounces in 2024: The forecasted global silver demand for 2024 is an impressive 1.2 billion ounces, potentially the second-highest level ever recorded. This growth is primarily driven by strong industrial demand.

- Industrial Use at Record Highs: Silver industrial fabrication is predicted to rise by 4 percent in 2024, reaching a record 690 million ounces. Key drivers include the photovoltaic (P.V.) and automotive industries, with the adoption of N-type solar cells and increased electronic components in automobiles.

- Jewelry Demand to Increase: Jewelry demand is expected to increase by 6 percent, with India contributing significantly to this growth. This follows a slowdown in 2022 and is attributed to a positive economic backdrop and consumer acceptance of higher silver prices.

- Silver Physical Investment to Decrease: Silver physical investment is projected to decrease by 6 percent, primarily due to solid economic growth and gains in the U.S. stock market, which reduce investor interest in precious metal coins and bars.

- Global Silver Supply on the Rise: Total global silver supply is expected to grow by 3 percent in 2024, reaching an eight-year high of 1.02 billion ounces. This growth is mainly attributed to a recovery in mine output.

- Silver Market Remains in Deficit: Despite increased supply, the silver market is forecasted to remain in a deficit for the fourth consecutive year in 2024, though the deficit is expected to ease compared to the previous year.

- Market Expectations and Silver Investment: The article notes that market expectations of U.S. interest rate cuts and a stronger U.S. dollar could temporarily affect silver investment. However, silver’s positive fundamentals and the expected future easing by the U.S. Fed are likely to encourage renewed investment in silver.

With these facts and figures in mind, we can add two considerations for silver investors.

Silver market anomaly: Consideration #1

First, total silver demand last year was 1.2 billion.

Now, if we compare this with the previous news release by Metals Focus / The Silver Institute (source), released in November of 2023, we see that the confirmed number is 20% higher than the estimated number.

Is the market imbalance over 2023 higher than expected?

With a flat silver price, is the undervaluation of silver growing?

Which market dynamics are keeping the silver price ‘in check’?

Silver market anomaly: Consideration #2

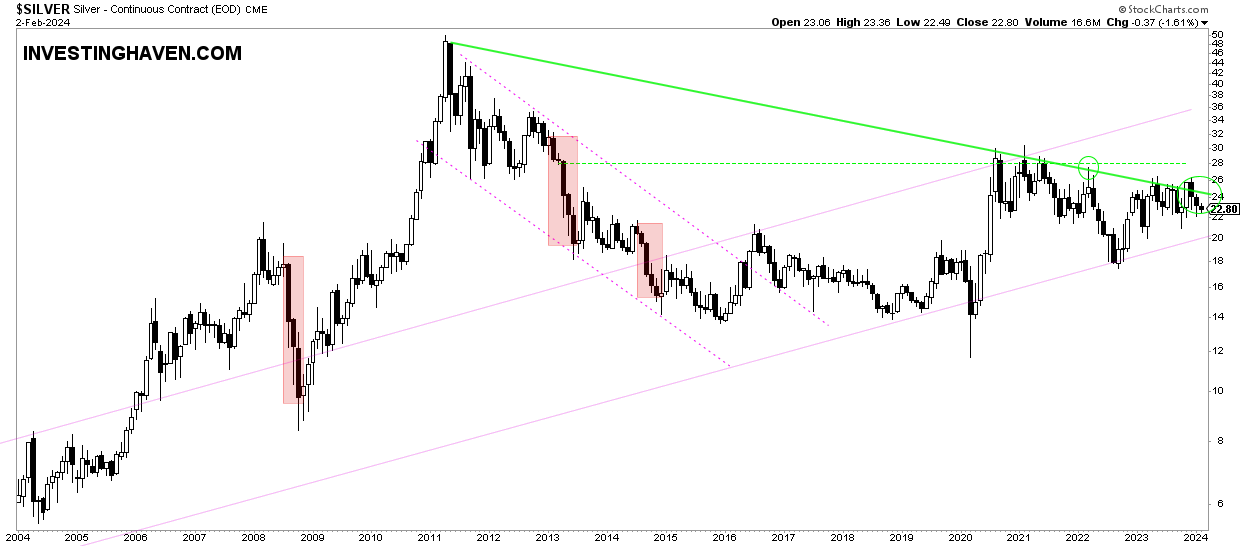

The price of silver “should” have reacted to the upside, with the big news of another year in which the physical silver market experienced a supply deficit.

It didn’t.

The silver price, over 20 years, keeps on consolidating around its breakout level.

What to make out of this?

First of all, the good news. The pattern on this chart is really bullish. Sooner or later, silver will move to the top of the channel. Our forecasted price remains 34.70 USD, it’s a first target.

Sooner or later, silver will move to 50 USD.

On the other hand, a supply deficit, for 3 years in a row, with a price adjustment to the upside, is not just odd, it’s suspicious.

In this post, Ted Butler shares his thoughts that are all centered around the dominant force of silver price setting: the COMX silver futures market.

A Big New Development

By Ted Butler

The sharp increase of 60% in the number of new long traders (29) and the total gross longs of 30 million oz. of silver over the past five reporting weeks most likely involves collusion.https://t.co/qy6dAdNexs

— SilverSeek.com (@SilverSeekcom) February 1, 2024

Silver market anomaly: Consideration #3

While the above points support an upward adjustment of the silver price, supporting the undervaluation thesis, it becomes even more extreme when comparing gold to silver.

The gold price to silver price ratio is near all-time highs.

Gold is nowhere near a supply deficit, certainly to the extent that silver is in a supply deficit.

This speaks to the undervaluation of silver.

The silver price will take off

Conclusion from the above data points and considerations?

Our viewpoint is that the silver price will take off, sooner or later.

Here is our forecast. It is based on the document from the Silver Institute, in particular this point:

Silver Physical Investment to Decrease: Silver physical investment is projected to decrease by 6 percent, primarily due to solid economic growth and gains in the U.S. stock market, which reduce investor interest in precious metal coins and bars.

We disagree.

And we might be proven wrong.

We feel strongly, very strongly, that market dynamics will change throughout 2024. We expect a ‘sell the news’ activity, particularly when the Fed will announce their re-balancing act in their balance sheet (decelerate the current pace at which they are offloading Treasuries).

Moreover, while stocks are doing well currently, there will be a point in time, later in 2024, when the tide will turn. With massive rotation dominating markets since 2022, silver will be a beneficiary, sooner or later:

Fed meeting likely to see start of debate over ending balance sheet contraction

Fed plans ‘in-depth’ talks on balance sheet run-off in March: Powell

We thoroughly disagree with the viewpoint that silver investment demand will decline in 2024.

We agree that it will temporarily decline, and that (some tech) stocks will steal the show.