The lack of speculative appetite in the silver futures market might be the ultimate silver price catalyst that will trigger an epic silver bull run in 2024.

Read – When Exactly Will The Price Of Silver Start A Rally To $50?

After a very long consolidation the price of silver, there is obviously no silver left.

That’s, anecdotally, the best contrarian indicator.

Interestingly, there is not only anecdotal evidence but also factual evidence of the lack of speculation – see below.

Remember, the absence of speculation (a quiet market) offers the best possible opportunities. Bull markets require limited participation to become powerful. The silver market is no exception – a silver bull run mostly starts with quiet conditions with great fundamentals.

Related – Silver Shortage: A Closer Look at Market Dynamics In 2024

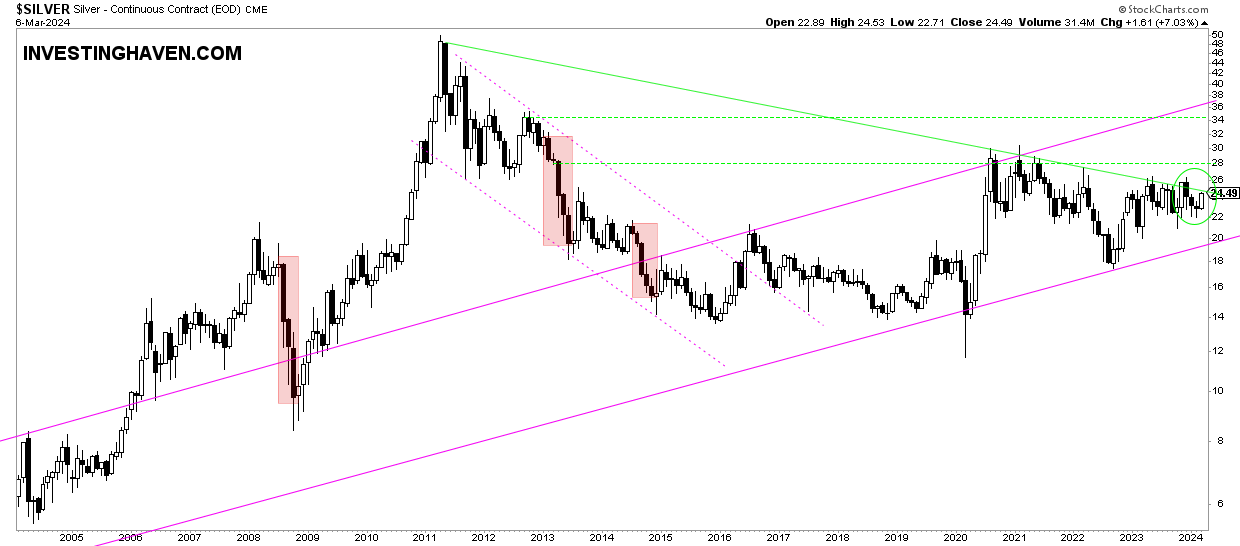

Silver price chart – tremendously bullish setup

If anything, the silver price chart is phenomenal.

The secular breakout attempt that is currently ongoing says it all – silver is trying to stage a breakout.

A move higher in the price of silver will trigger a strong bull run in the price of silver.

The silver price targets we have on this chart are 28/oz and 34.70 USD/oz, consistent with this must-read silver price analysis.

Now, the million dollar question is – can the price of silver move higher? In other words, is there a silver price catalyst? The answer is yes, please scroll down to understand the silver price catalyst.

Silver price catalyst suggests lots of upside potential

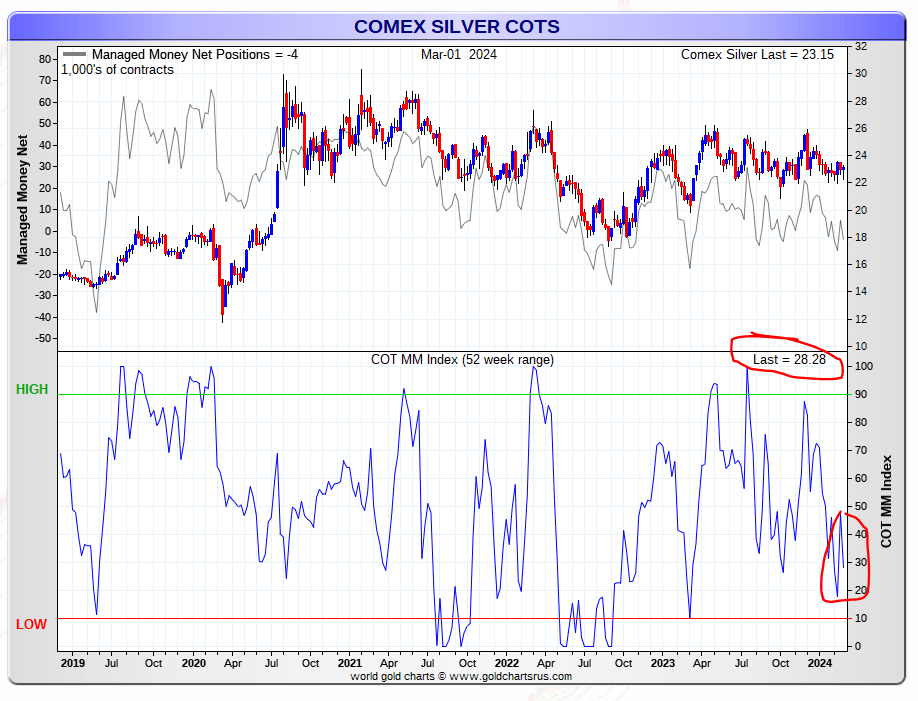

The one silver price catalyst we cover in this article is speculative positions in the silver futures market.

Below is the the silver price chart (upper pane) and the speculative positions of ‘managed money’ traders in the silver futures market COMEX (lower pane).

The way we read this chart – lower pane represents speculative appetite by participants that manage money on behalf of others on a scale from 0 (low) to 100 (high). When there is an outspoken speculative setup, it represents the perfect contrarian setup.

In July of 2023, speculative positions were unanimously long – it was a consensus trade long – silver went lower.

Recently, there were hardly speculative long positions – the consensus was ‘not long’ – silver has lots of upside potential.

Chart courtesy – GoldChartsRUs

Note – the positioning of commercials, as a market dynamic, triggering speculators in a certain direction, touches the core of the silver price manipulation thesis. We encourage readers to look up the details about the manipulation thesis, particularly Ted Butler. However, we will not go deeper into this matter in the context of this blog post.

Silver price catalyst in the past

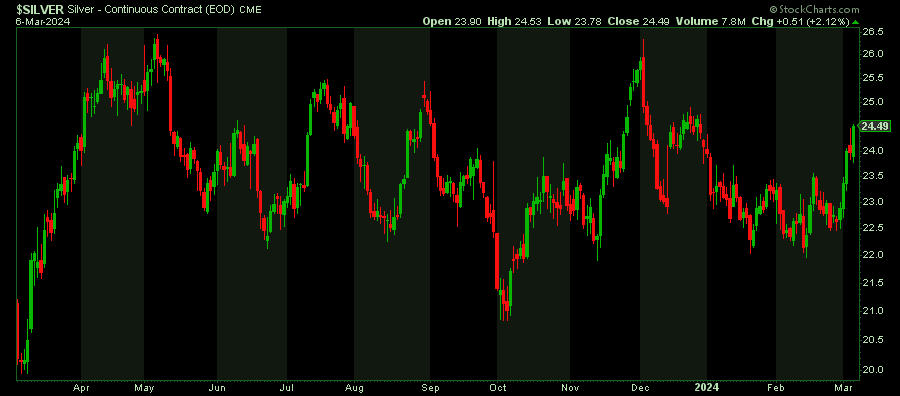

The critical reader and investor might argue that the long term silver chart may look good. However, the short term silver price chart looks ‘boring.’

Below is the daily chart – we did bring the consolidation period into the focus area of the picture, on purpose.

It is indeed true that the silver price chart, at this point in time, looks ‘boring’.

Here is the point though – boring setups are the right foundation for big moves.

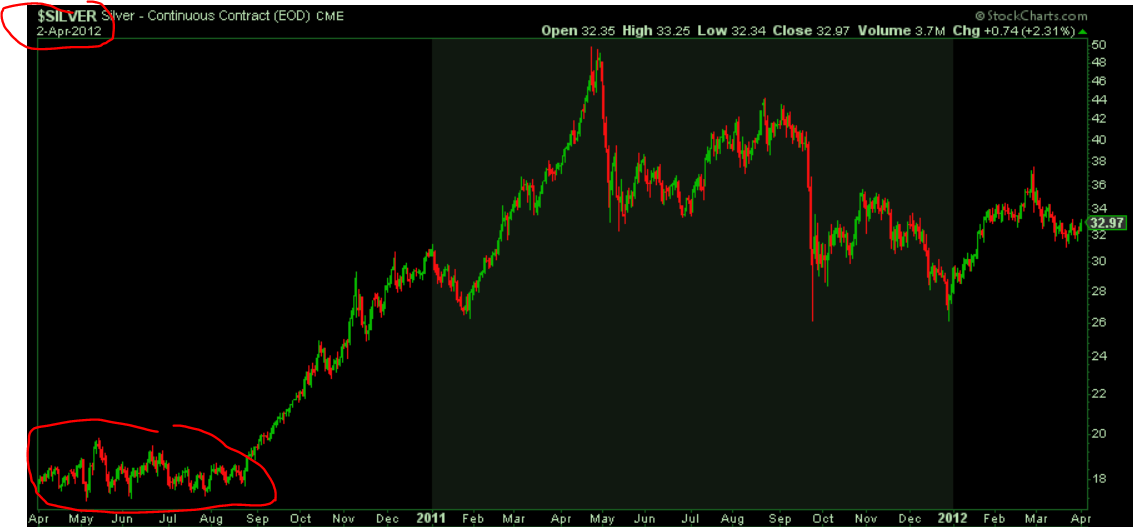

As a reference point – below is the silver price chart from back in 2010-2012. What do you see in 2010? A ‘boring’ setup? Do you see similarities with the current ‘boring’ setup?

While the above does not necessarily guarantee that silver will start its epic run to $50, we would also not exclude it. All we are saying is that this current setup is a great foundation for much higher prices – 28, 34.70, 41, 50 ultimately (at ‘a’ point in time).

Silver – the ultimate contrarian play

One thing to remember – managed money participants (aka speculators) may have lots of funds to manage. This does not imply they all qualify as ‘smart money’.

In this respect, we believe the following quote from commodity investor Rick Rule says it all (applied to the silver market, more specifically silver miners):

Primarily of interest to silver mining speculators. This is a thoroughly hated and very volatile asset class, with no positive momentum, which is precisely why I like the sector. The population of viable silver speculations is tiny, and if the narrative begins to shift in their favor, their combined market capitalizations will be unable to contain any reasonable influx of speculative capital. That circumstance has occurred three times in my investment career, thus far! Contrarian, or victim, the choice is yours.

While his quote was primarily affecting silver mining investing, we truly believe it applies to silver investing in general in 2024… prior to the 2024 silver bull run.

Anecdotally, we may need to watch Wall Street Silver for a turning point in contrarian sentiment.

Silver or gold? Silver much more upside potential!

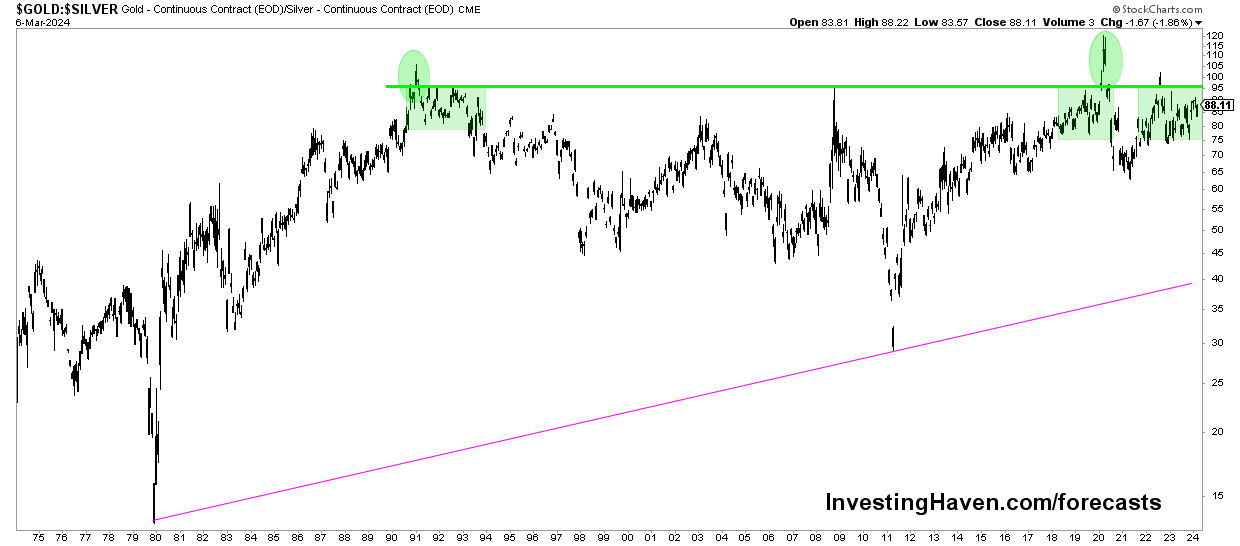

The silver price has so much more upside potential than gold. It is so obvious.

The gold to silver price ratio, over 50 years, makes the point. As explained in Gold-to-Silver Ratio and Historic Silver Rallies:

The historical evidence suggests that the gold-to-silver ratio entering the 80 to 100x range may act as a signal for a significant rally in the price of silver. At this very point in time, the gold to silver ratio chart shows how this ratio is above 80x since early 2022. This ratio is not a timing indicator, it is a stretch indicator. It suggests that silver is extremely undervalued relative to gold, it suggests that it’s a matter of time until spot silver starts reacting to the upside!

A drop in this ratio can easily be envisioned – it is the most likely outcome.

Silver is able to stage a strong bull run, is what this chart screams.

Sign up to receive silver price analysis charts every weekend >>