Silver is now going through a secular breakout process that is lasting 44 trading days! That’s a lot. It’s also good. Why? Because a long and slow process comes with a powerful outcome. We continue to be strongly bullish on silver, as per our silver forecast and the silver supply deficit of 2023.

Early April, we wrote that Silver Is Officially In A New Secular Uptrend.

It still is, now 44 days later.

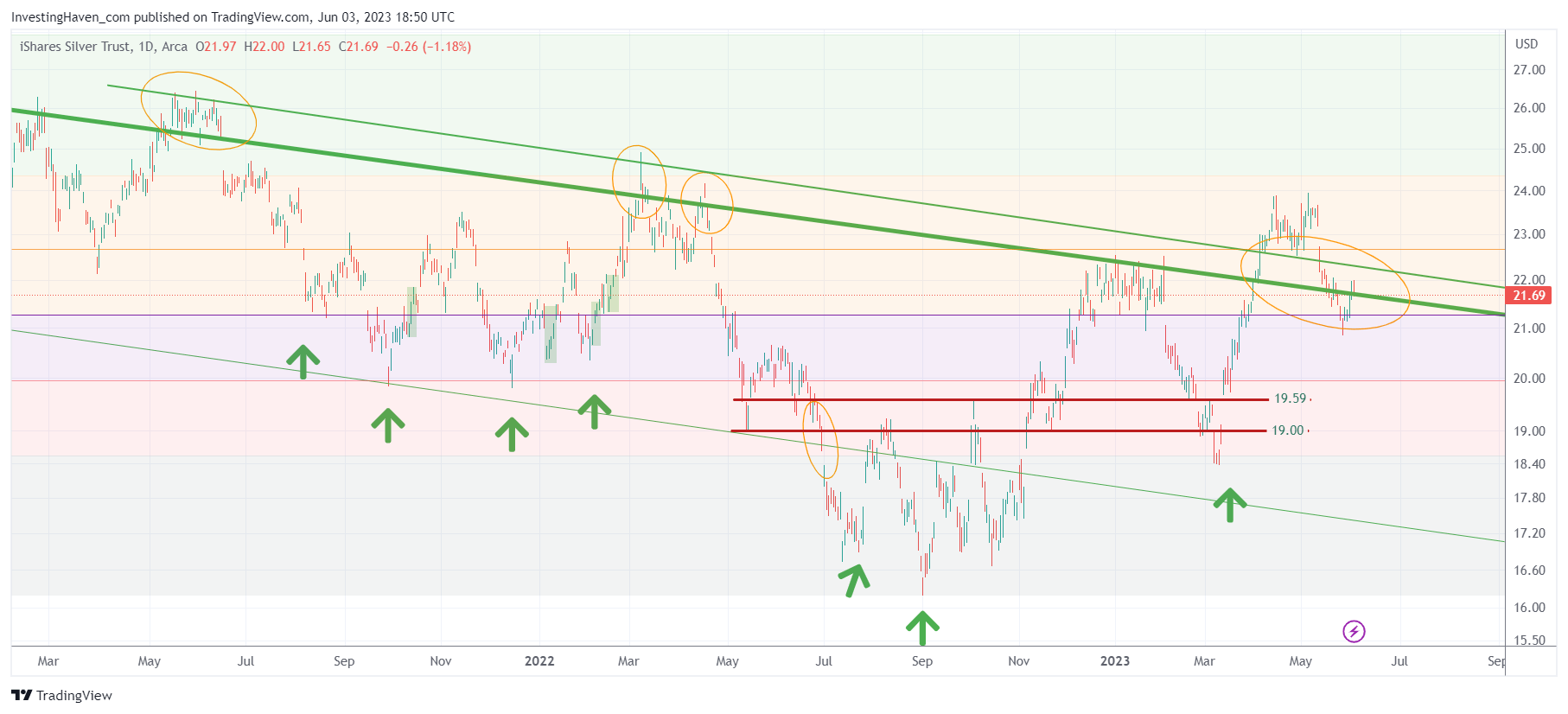

The secular breakout started in the first days of April, when silver cleared the multi-year falling trendline. No, this is no technical analysis, it simply is charting 101. The entire investor and trading community looks at these trendlines, the help in decisioning.

Here is the point with the 44 day secular breakout process: bulls or bears will give up at a certain point. It is too costly to keep on betting if you are on the wrong side of the trade, especially if it lasts +44 days.

What’s the case in favor of bulls? There is plenty of very strong support over here, as evidenced by the inability of bears to push below the critical 50% retracement level (purple shaded area). This should keep the bears awake at night.

There is something much more concerning for the bears: the falling multi-year trendline (green thick line) is about to fall below the 50% retracement level.

Stated differently, as long as silver is able to trade around of above current levels, support will be moving lower. When former resistance becomes support below price, you know what it means, right? Bears will run for the hills.

We believe this summer will be an inflection point for silver. It will be a hot summer, the foundation is there for a quick move to 28 in spot silver (26 in SLV ETF) followed by 34 in spot silver (31 in SLV ETF).

Please re-read: Why We Are Very Bullish On Junior Silver Miners (Chart Secret Revealed).

For our Momentum Investing members, we created a selection of top silver miners:

Top Silvers Stocks For Long Term Portfolios >>