The silver price exceeded $30 between May 17th and May 31st, 2024, for the first time in 11 years. Since September 19th, 2024, it cleared $30 again. Is silver ready to move to $37.70? Or even higher?

This is what we wrote on February 11th, 2024, when the initial version of this article was published:

A silver price of $30 an Ounce seems a very conservative silver price target considering a silver supply deficit, bullish secular silver chart, silver’s undervaluation relative to gold.

October 6th, 2024 – At the time of updating this article, it is clear that silver is eager to clear $30 an Ounce, and potentially even never look back. The $30 – $32 area might need to be tested once more, but the charts suggest that silver is preparing its move to its next target: $37.70.

RELATED – Silver Is Officially In A New Secular Uptrend

What’s next for the price of silver, is the million dollar question: Will silver surpass $30 an Ounce, if so, when exactly? Hint: The silver charts suggest that the first half of 2025 might become super bullish according to silver timeline analysis.

Note – The best time of the year for silver is upon us: Silver Price Seasonality Charts: Essential Insights for Silver Investors. Regardless of silver seasonality, readers can find our latest silver price prediction here.

Silver supply/demand research

The Silver Institute released its latest physical silver market report, early February 2024.

In summary, while silver demand is forecasted to remain robust, supply is expected to increase slightly, leading to a physical silver market shortage.

- Demand forecast: Global silver demand is projected to reach 1.2 billion ounces in 2024, potentially the second-highest level ever recorded. This growth is driven by stronger industrial offtake and is expected to hit a new annual high, propelled by increased industrial end-uses and a recovery in jewelry and silverware demand.

- Industrial fabrication: Silver industrial fabrication is forecasted to rise by 4 percent in 2024, reaching a record 690 million ounces. Key drivers include the photovoltaics and automotive industries, with technological advancements contributing to higher silver offtake.

- Jewelry and silverware demand: Jewelry demand is expected to increase by 6 percent, led by growth in India. Recovery in jewelry consumption and normalization of demand levels are anticipated, alongside a rise in silverware fabrication by 9 percent.

- Silver Investment Projections: Silver physical investment is projected to decrease by 6 percent, with economic growth and gains in the U.S. stock market driving weaker investor interest.

- Supply forecast: Total global silver supply is forecasted to grow by 3 percent in 2024, reaching an eight-year high of 1.02 billion ounces, driven primarily by a recovery in mine output. Silver recycling is expected to decline, with lower jewelry and silverware scrap supply accounting for most of the losses.

October 6th, 2024 – The latest silver demand data is in (source):

Silver demand is surging, with solar power alone expected to account for 23% of the 2024 supply. However, in 2023, the silver market faced a 15% supply deficit.

Market deficit and investment outlook: The silver market is expected to remain in a deficit for the fourth consecutive year. Market expectations of U.S. interest rate cuts and a stronger U.S. dollar could temporarily affect silver investment, but silver’s positive fundamentals should encourage renewed interest once the Fed begins to cut rates.

Silver price forecast

What’s certainly interesting is that the report by The Silver Institute did not mention the word ‘silver shortage’ nor did it mention a forecasted silver price of $30.

We brought up all those points in our market anomaly analyses published in the public domain in the silver section:

In an interview with CNBC, however, executive director of The Silver Institute brought up the $30 silver target:

“We think silver will have a terrific year, especially in terms of demand,” Michael DiRienzo, executive director of the Silver Institute told CNBC. He expects silver prices to reach $30 per ounce, which would be a 10-year high, according to data from LSEG.

It is unclear why this $30 silver price target for 2024 did not appear in the report itself but was only given in an interview.

More importantly, why ‘only’ $30? Consider the following:

- Most commodities, if not all of them, exceeded their 2008-2012 peak.

- Silver is the only commodity that did not even come close to hitting its 2011 peak.

- At the time of writing, the price of silver is more than 50% below its 2011 highs.

- All this is occurring while there is a silver supply shortage.

Any rational analysis of the silver market, based on the data points at hand, comes with one and only one conclusion: a huge undervaluation.

Silver price chart

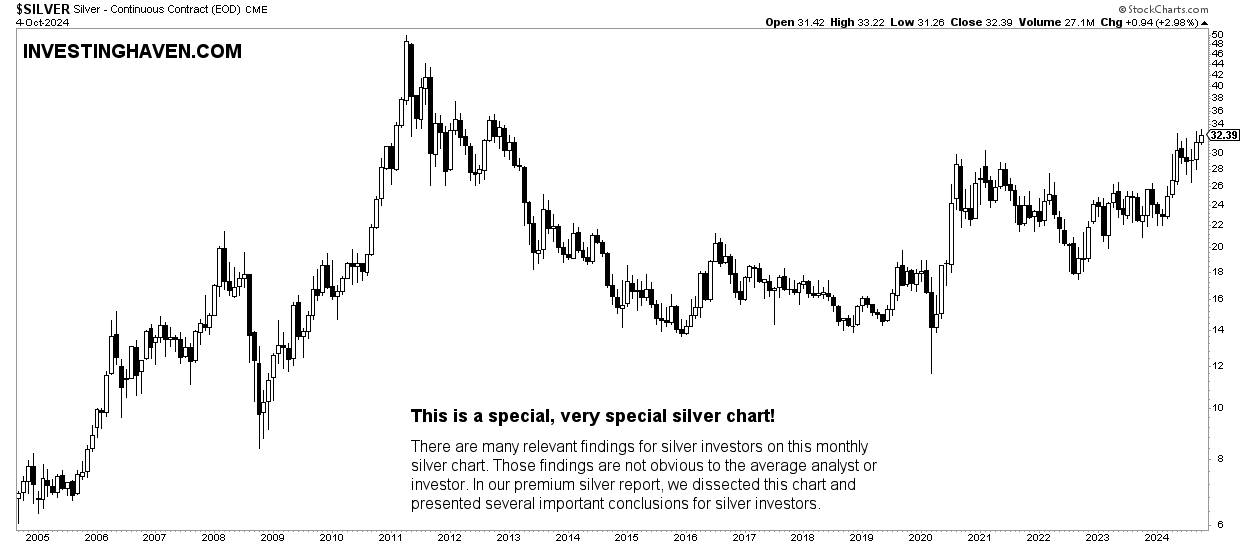

In the meantime, the silver price chart continues to test its 13-year falling trendline.

As seen on below chart, the silver price is essentially flat for 3.5 years now.

More importantly, silver is working on an uptrend when looking at it from a secular perspective (the last 20 years).

Whenever the 24-26 area is broken to the upside, the price of silver will move to our $34.70 target. Sooner or later, silver is expected to hit $50.

According to the chart, the silver price target of $30 given by The Silver Institute does not make any sense. There is no reason why the price of silver would stop rising at $30 once past $26.

October 6th, 2024 – The silver price is ‘consolidating’ right above 30 USD an Ounce. We firmly believe this area will hold. Why? Because of the detailed silver chart insights shared in our silver special edition report shared in the premium gold & silver research service on August 10th, 2024. In it, we explain why exactly and which support level exactly we expect to hold, also on which timeframe(s).

The silver chart that really matters

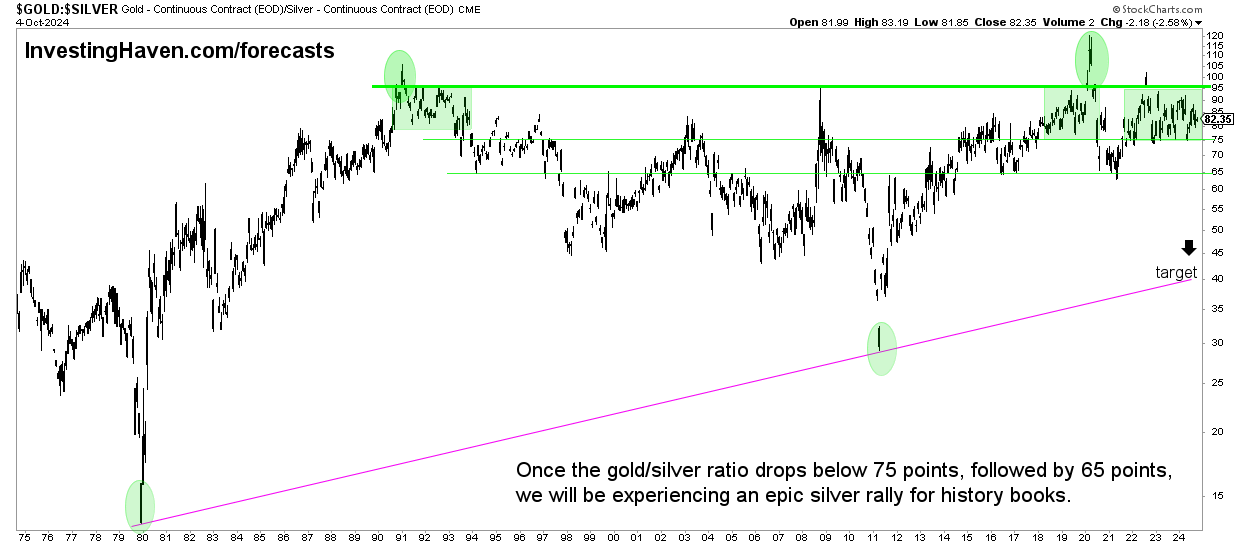

Moreover, the one chart that truly matters, is the gold to silver price ratio.

Below is the gold to silver ratio over 50 years.

We have mentioned in the past that the secular gold to silver price ratio can act as a ‘stretch indicator.’ This ratio tends to suggest when the price of silver is undervalued vs. overvalued compared to gold’s price.

Take a look at the horizontal green line. Any time, in history, when the gold/silver ratio achieved 92:1, it pushed the price of silver much higher. In some cases it took a few years, in other cases a few months, before silver became explosive.

October 6th, 2024 – The gold to silver ratio refused to drop below 75 points in 2024. We believe it is unavoidable for silver to move back above 30 USD an Ounce, leading the gold to silver ratio to drop well below 75 points. Reuters published this article today silver refuses to be left behind by gold’s bull run.

Silver price momentum?

The data points don’t lie: silver is a screaming buy, widely undervalued. There is a silver supply shortage, historical undervaluation of silver compared to gold, a secular rising channel on the silver price chart.

RELATED – Silver Is Ridiculously Undervalued | 7 Must-See Charts

Against the backdrop of phenomenally bullish data points, we observe lack of momentum in the silver market. Note, however, that this is partially true:

- On the one hand, the price of silver is flat. Investors seem very focused on trading AI & Robotics stocks. Highflyers in AI semis, AI ops, AI tech, are catching the attention. Most, if not all commodities, are simply not part of this current momentum cycle.

- On the other hand, the largest traders net short on the silver COMEX market hold historically low short positions. This is the pre-requisite for much higher prices to develop over time.

As noted by Ted Butler, commercials on the silver COMEX market have the ability to prevent the silver price from rising. The lack of momentum, in a way, is also the result of silver COMEX trading dynamics.

Conclusion

We conclude, based on the data at hand, that silver is a screaming buy:

- The gold to silver price ratio over 50 years.

- The physical silver supply deficit.

- The secular silver price chart exhibits a long term rising trend channel. Sooner or later, the secular rising trend will turn the 3.5 year consolidation into a bull run.

The mentioned silver price target of $30 did not make sense to us as a final target. The point is this: $30 an Ounce is a price point right above a breakout level, so from a chart perspective it cannot be an ‘end point’ but simply a point that requires a consolidation.

Moreover, given fundamentals and lagging price action of silver, it has always been clear to us that silver had different price targets: $34.70 and $50.00.

Continue reading – How To Invest In Silver in 2025