Silver prices point to a growing supply gap as technology demand rises faster than production.

EV manufacturing and AI hardware now absorb silver at a pace mines struggle to match.

Silver traded around $98.70/oz after touching $99.20 in the latest session, a level that indicates sustained pressure on available supply.

Industry data shows silver demand running ahead of mine output for several years, with inventories playing a shrinking role as a buffer.

RECOMMENDED: Silver Eyes $100 After Surging 30% YTD – Risky To Buy Now?

Why Silver Supply Is Tight

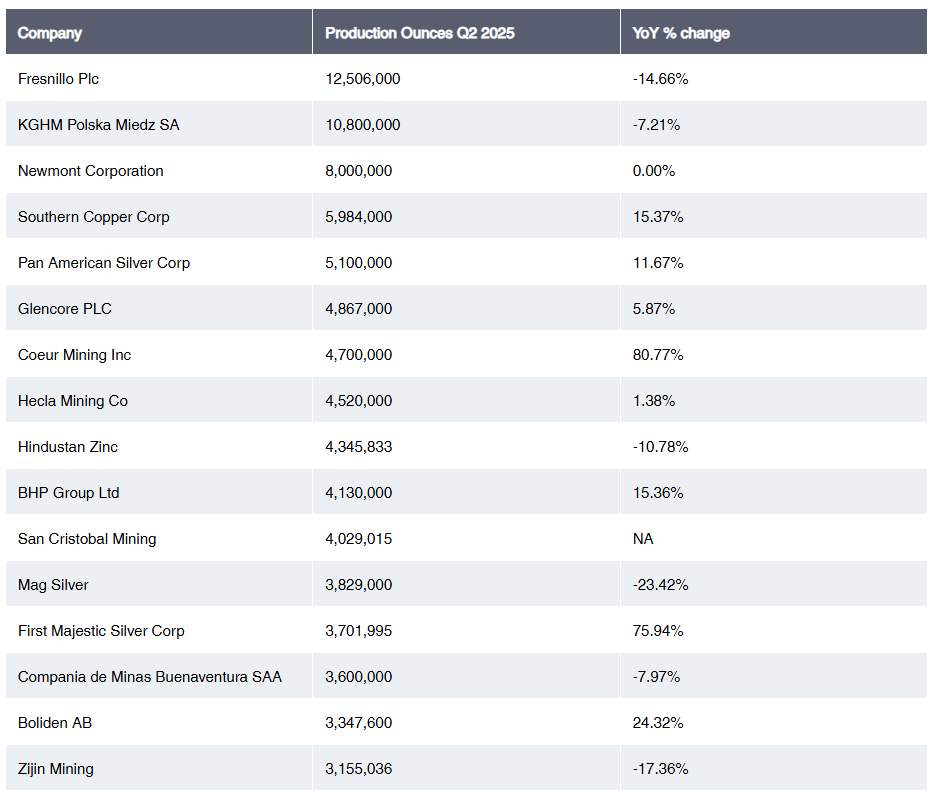

Global silver mine output remains limited, with annual production sitting in the low-800 million ounce range.

New projects take years to plan, permit and build, which slows any response to rising demand.

Industry surveys also show consecutive years of market deficits, meaning consumption exceeds new supply.

Above-ground inventories once absorbed these gaps.

That cushion has thinned. As stocks fall, even moderate increases in demand push prices higher faster than in past cycles.

This structure leaves little room for supply surprises in the short term.

ALSO READ: Silver Becomes The Most Crowded Commodity Trade Ever As $922 Million Floods In

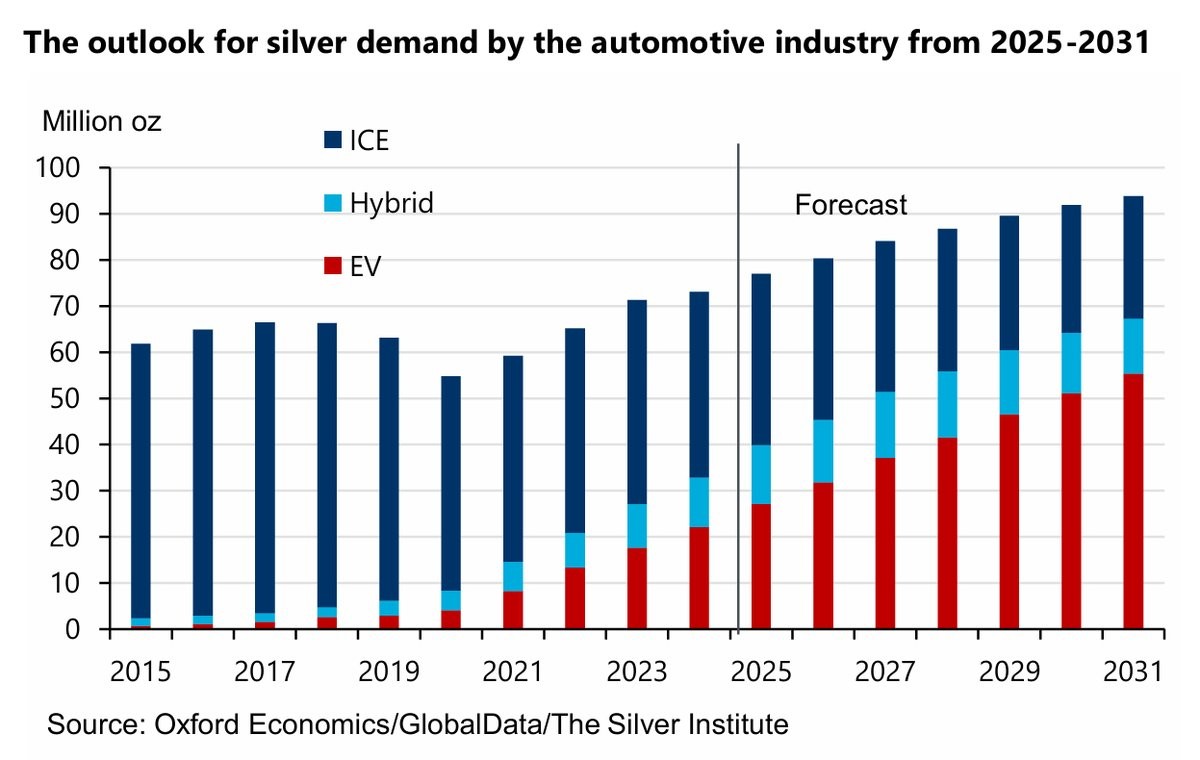

How EVs And AI Are Changing Silver Demand

Electric vehicles use silver in power electronics, battery connections and charging systems.

At roughly 25–50 grams per vehicle, large-scale EV production translates into tens of millions of ounces each year. Even small increases in global EV output add noticeable strain on supply.

AI hardware is also increasingly thinning silver supply. High-performance processors and advanced chip packaging rely on silver for efficiency and heat control.

Estimates suggest these designs use about 15–20% more silver than older electronics.

As data centers expand and AI hardware scales, this demand stays consistent. Reports indicate the U.S. and China alone consumed an estimated 350 million oz in 2025, more than 50% of mining supply.

Can Supply Catch Up With Demand?

Supply responses move slowly. Recycling helps, but volumes grow gradually. Substitution remains limited due to silver’s electrical properties. New mines could lift output, yet timelines stretch across several years.

READ NEXT: Gold And Silver Explode To Record Highs After Greenland Tariff Shock

Conclusion

Silver now sits at the intersection of technology growth and constrained production. With EVs and AI absorbing more metal each year, the supply gap looks structural rather than temporary, keeping upward pressure on prices.

Where Are The Best Opportunities Right Now?

Before you invest in Silver, you’re going to want to read out latest Premium analysis which will be published in just a few days.

We called Gold and Silver before the rally, now we have a look at what could be next.