Silver has seen a significant rise in its value in 2024, with prices soaring from $22.55 USD/oz in February to a peak of $29.90 USD/oz on April 12th, reflecting a dynamic shift in market conditions and investor sentiment.

Related – When exactly will silver move to $50?

The big problem that the silver market is facing currently is the (too) high number of speculators positioned on the long side. Speculators, aka dumb money, are mostly positioned on the wrong side of the trade. Because of this, it looks like our forecasted silver price target of $34.70 might be delayed with a few months.

You look at this chart, the lower pane, representing the relative number of speculators positioned long in the COMEX silver futures market, and you conclude that speculators are desperate for some quick profit.

Speculators won’t benefit from this situation – they will be closing their positions as commercials push prices lower – this is the silver price dynamic that Ted Butler revealed many decades ago.

Speculators won’t benefit from this situation – they will be closing their positions as commercials push prices lower – this is the silver price dynamic that Ted Butler revealed many decades ago.

Silver Price Resistance and Reversal Indicators

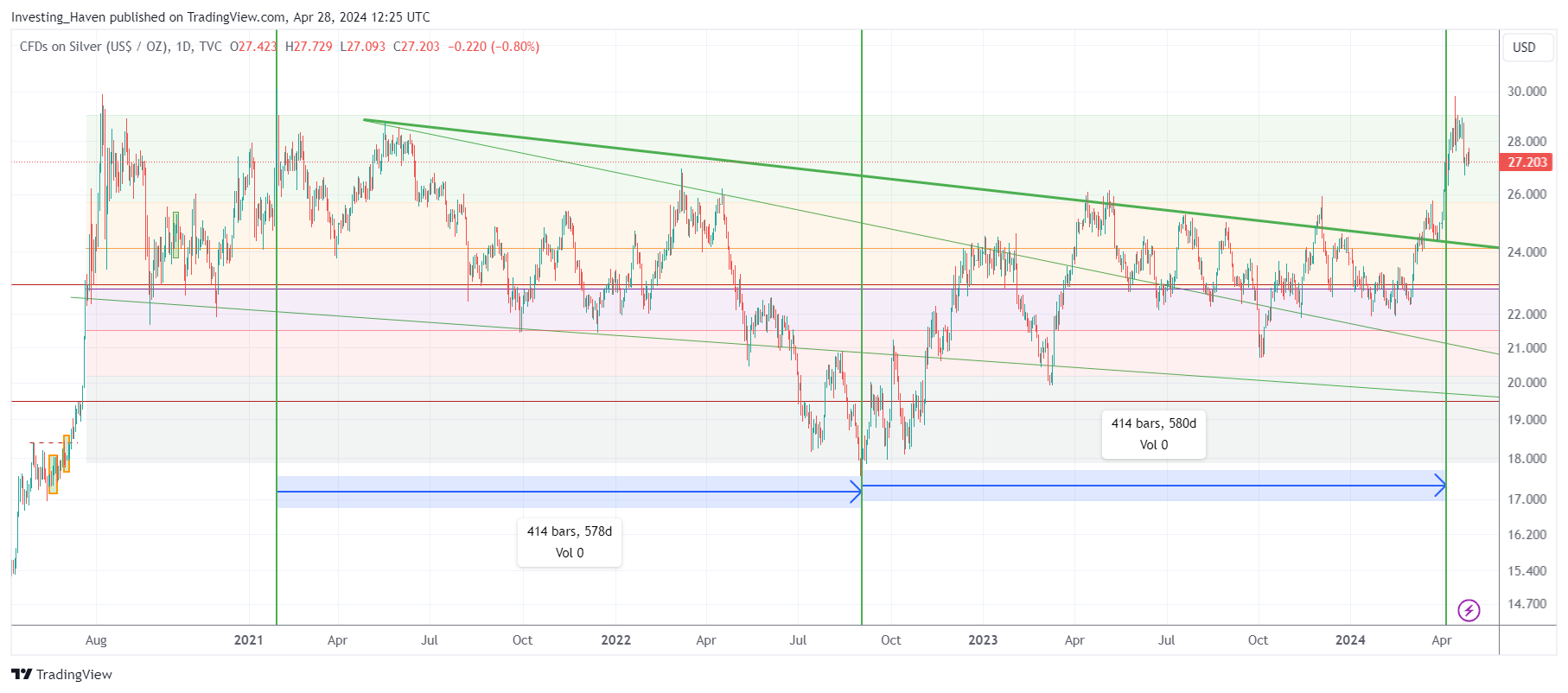

First, we look at the price of silver, the y-axis of the silver price chart.

Silver prices reached the peak levels previously seen in 2020 and 2021, encountering strong resistance. This resistance culminated in a significant intraday reversal on April 12th, 2024.

The formation of a ‘rejection wick’ on that day suggests that this peak might represent a local top.

Such a wick indicates that although the price pushed to a high, it closed significantly lower, suggesting a rejection at those higher levels.

This pattern often signals that the market may not be ready to sustain higher prices, hinting at a potential pullback.

Timing and Market Cycles

Second, we look at the timeline on the silver chart, the x-axis (very often overlooked)

The timing of the April 12th peak is notably precise, occurring exactly 414 days after the previous bottom in September 2022, which itself occurred 414 days after the peak in February 2021.

This cyclical pattern suggests a rhythm to the silver market that can provide insights into future movements.

Such precise timing between highs and lows indicates potential predictability in the market’s fluctuations, offering an opportunity for strategic planning in investment decisions.

Speculative Influence and Market Dynamics

The recent run-up in silver prices has been driven in part by heavy speculative investment (most recent data, weekly updates here), with many betting on continued upward movement. However, the large positions held by speculators can lead to volatility as these investors may quickly exit their positions on signs of market weakness, leading to rapid price declines.

The market may now enter a cooling-off period, driven by commercials rigging prices lower to make a profit on the desperate speculators.

This process will require fresh catalysts or ‘cover stories’ to reignite interest and drive prices towards higher resistance levels at $34.70 and eventually $50.00.

Interestingly, these rallies often occur when they are least expected, and after many speculators may have moved away from silver, forgotten the bullish arguments due to prolonged inactivity or stagnation in prices.

Conclusion

The recent surge in silver prices and the subsequent resistance highlight the complex interplay of market forces and the impact of speculative trading. For investors, understanding these dynamics and the historical timing of price movements in silver can be crucial for making informed decisions.

As the market digests its recent gains, investors should remain vigilant, watching for new developments that may serve as catalysts for future price movements. The silver market remains a field ripe with opportunities, but it requires a keen understanding of both its cyclical nature and the behaviors of other market participants to navigate effectively.

For silver investors, it will be important to watch when speculators will have left their massive and consensus long position. That’s when silver investors can add to their positions, leverage the buy the dip, doing the opposite of what desperate speculators are doing.

We track the data points and many more stats and charts in our Gold & Silver premium alerts >>