Silver threatens to outperform gold in 2025 due to surging industrial demand, persistent supply deficits, and a historically high gold-to-silver price ratio signaling strong investment potential.

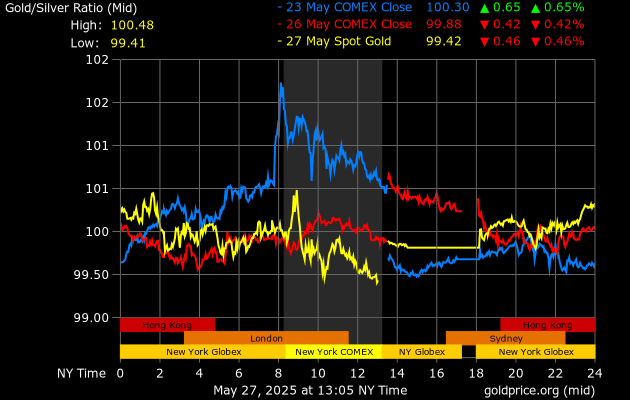

The gold-to-silver price ratio currently sits near 100:1, well above the historical average of 60:1, suggesting that silver may be significantly undervalued. As industrial demand for silver surges, we are left wondering; could 2025 be the year silver outshines gold?

Industrial Demand: The Driving Force

Silver’s value is increasingly tied to its industrial uses. In 2025, global industrial demand is projected to surpass 700 million ounces, up 3% from last year, according to the Silver Institute.

Key sectors fueling this growth include solar energy, where silver is a critical component of photovoltaic cells. The NEOM Green Hydrogen Project alone is expected to consume over 319 metric tons of silver.

Silver’s role in electronics and artificial intelligence is also expanding. Data centers—which rely heavily on silver for its conductivity—are growing at an annual rate of 33% through 2030.

Meanwhile, the EV revolution is increasing the use of silver in batteries, wiring, and onboard electronics, further boosting demand and making investing in silver an exciting proposition.

Supply Struggles to Keep Up

While demand accelerates, supply growth remains modest. Global mine production is expected to rise just 2% to 844 million ounces. Recycling will help, with output predicted to exceed 200 million ounces for the first time since 2012, but it’s not enough.

You may also like to read: A Silver Price Prediction For 2025 2026 2027 – 2030

Investment Outlook: Time for Silver to Shine?

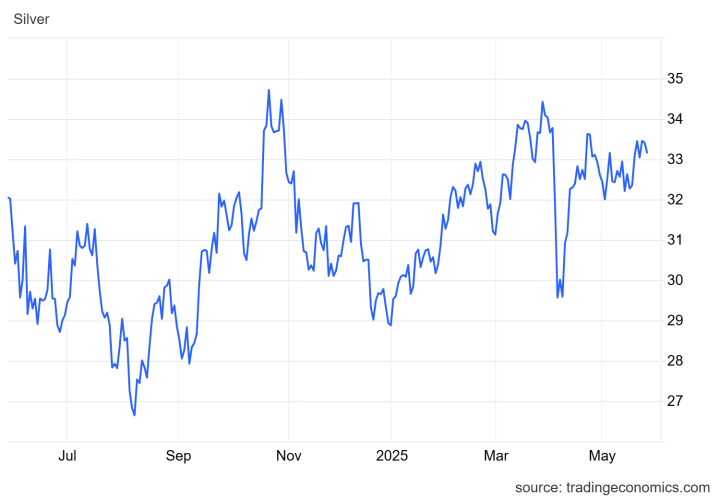

With prices forecasted to reach $35–$49 per ounce in 2025, silver presents a compelling investment case. Analysts cite the high gold-to-silver ratio as a signal that silver remains undervalued.

Historically, silver tends to outperform gold during economic recoveries—a pattern that could repeat in the coming months.

Conclusion

Silver’s unique position at the crossroads of industrial innovation and investment opportunity makes it one of the most promising precious metals for 2025.

With persistent supply deficits and rising demand, it may finally be silver’s time to shine.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)

- Gold Close To Hitting Our First Downside Target. Silver Remains Undervalued. (May 18)

- A Divergence In The Precious Metals Universe (May 10)

- Gold Retracing, Silver and Miners at a Critical Level (May 4)

- The Precious Metals Charts That Bring Clarity Through Noise (April 27)