Silver surged past $110/oz after a sharp rally that pushed prices up about 45% YTD.

Extreme moves and rising speculation now raise bubble concerns.

Silver’s price action turned explosive in recent weeks, with rapid daily swings and strong buying pressure pushing the metal to fresh record highs above $110/oz.

The speed of the rally stands out, with gains stacking up faster than most historical silver cycles.

RECOMMENDED: Silver Becomes The Most Crowded Commodity Trade Ever As $922 Million Floods In

Why Silver Prices Are Rising So Fast

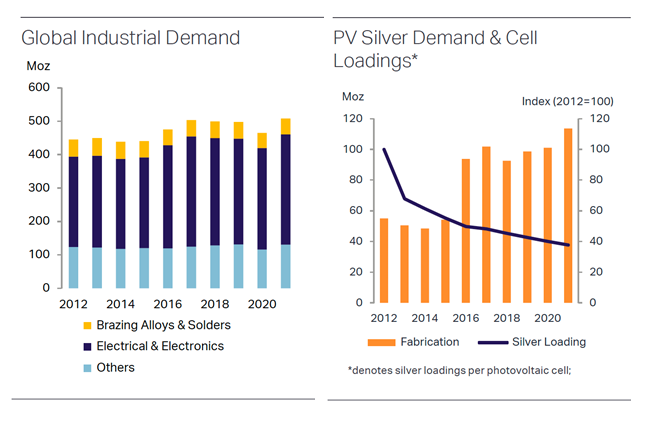

Silver supply has not kept pace with demand. Mining output remains limited, while industrial use continues to grow in electronics, solar panels, and energy infrastructure.

At the same time, retail buyers and ETFs absorbed large amounts of physical silver, reducing available stock.

This imbalance pushed prices sharply higher in a short time. In parts of Asia, buyers even paid large premiums above global benchmark prices, signaling stress in the physical market.

These pressures helped lift silver far beyond its recent trading range.

ALSO READ: Silver Shortage Looms As EVs And AI Chips Consume Supply

Signs The Silver Rally May Be Overheating

Price charts now show a steep upward curve, often seen late in strong rallies.

Silver recorded several large single-day jumps, a pattern that usually appears when momentum traders and short-term buyers dominate activity.

Speculative interest also rose quickly. Many professional investors reduced hedges while retail participation climbed.

When markets lean heavily in one direction, even small shifts in sentiment can trigger fast reversals.

Thin liquidity around holidays and volatile trading hours adds to that risk.

RECOMMENDED: Gold And Silver Explode To Record Highs After Greenland Tariff Shock

What This Means For Investors

Two outcomes stand out. Silver could pull back sharply and erase a portion of recent gains, which often happens after parabolic moves.

Another path involves continued strength if inventories keep falling and industrial demand stays firm.

If this happens, risk control is more important than prediction.

Long-term holders may prefer physical silver, while short-term traders should limit exposure and avoid leverage during extreme volatility.

Conclusion

Silver’s rally blends real supply pressure with speculative excess.

Inventory levels, ETF flows, and physical premiums will determine whether prices stabilize or correct from historic highs.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

-

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

-

Turning-point forecasting across multi-timeframe charts.

-

Actionable insights on GDX, GDXJ, SIL, and SILJ.

-

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

Read our latest premium alerts:

- Gold to Silver Ratio at 50. Ready for Rotation? (Jan 25th)

- Time To Take Profits? (Jan 17th)

- Why January 2026 Is An Unusually Important Month for Precious Metals(Jan 10th)

- Where or When Will Silver Set A Top? (Dec 29th)

- Watch the USD! (Dec 21st)