Silver is outperforming gold in 2025, thanks to strong industrial demand, tight supply, and record ETF inflows fueling bullish momentum.

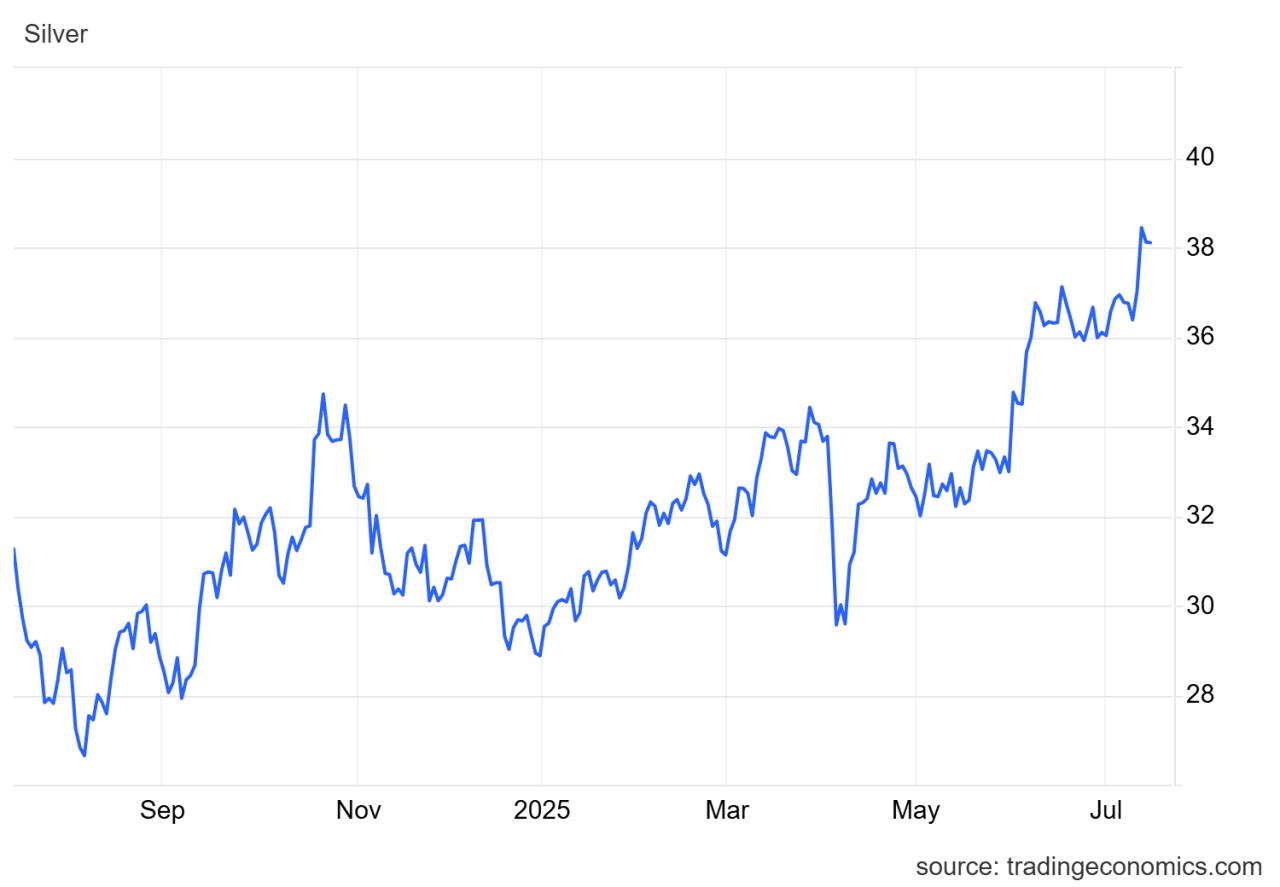

Silver seems to be getting the attention of investors in 2025, boasting a 32% year‑to‑date rally—clearly surging past gold’s 27% run this year.

It’s not just the shiny appeal: both industrial demand and ETF inflows are fueling real momentum, billing silver as a potential crypto-style breakout play in the metals space.

Breaking Out & Technical Alignment For Silver

Silver surged past the $35/oz resistance, marking a 13‑year high, a strong technical strength. Chart patterns now echo historic momentum plays, reminiscent of the late‑2010s breakouts.

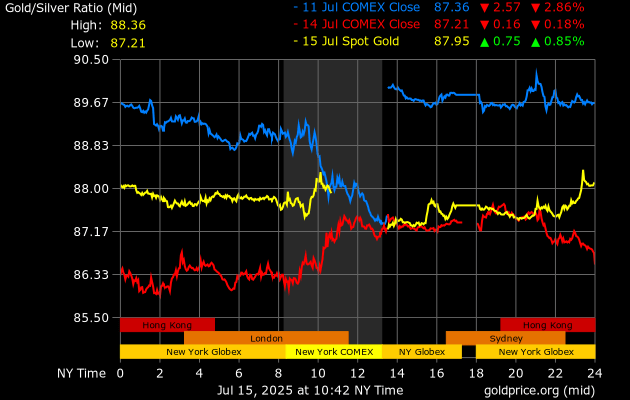

With the gold‑silver ratio falling from above 100 to the mid‑90s, technical signals suggest silver remains underpriced versus gold. Analysts say this is a good sign for further upside.

Industrial Revolution Meets Metals

With 60% of silver consumption tied to green‑tech and electronics, the industrial demand case is compelling. The Silver Institute estimates 95 Moz of net ETF inflows in H1 2025, and industrial demand is forecast to exceed 700 Moz, outstripping buoyant supply growth of just 2%.

With solar panels, EVs, AI chips and battery tech hungry for silver, physical inventory is tightening fast, similar to crypto asset scarcity dynamics.

ETF Inflows & Sentiment Shift For Silver

Silver ETPs hit record institutional demand: 95 Moz added in six months, pushing global holdings near 1.13 bn oz. Indian inflows soared too – ₹20 bn in June and ₹39 bn in Q2, outpacing gold ETFs, according to Reuters.

That’s not just momentum trading; it’s a sentiment shift, akin to capital rotating from underperforming cryptos into next-gen metals.

Conclusion

Silver’s role as both industrial workhorse and value store, combined with technical breakout signals and record inflows, makes its 2025 surge one to watch.

With Silver forecasts near $40‑50/oz by year‑end, this could be a smarter play than gold; and one you shouldn’t ignore if you are building a crypto‑savvy portfolio.

Our most recent alerts – instantly accessible

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)

- The Two Only Silver Charts That Matter In 2025 (July 6)

- Quarterly Gold & Silver Charts Are In, Here’s the Big Picture (June 29)

- Gold & Silver – The Big Picture Charts That Matter (June 21)

- Gold & Silver Shine but Not Simultaneously… The Market Loves To Confuse Investors (June 15)

- Silver On Its Way To 50 USD/oz (June 8)