Silver did hit resistance, exactly as laid out in our premium services and even in several public posts (read our silver articles). Here is the one price point that qualifies as a buy the dip opportunity. Here is the caveat: silver price action will not make it easy to confirm the buy opportunity, it will be volatile and intransparent, as always, which is because silver is the restless metal.

In our research service, we guided members with a buy alert on SLV at $17.30 on October 17th, 2022. Members were guided to take profits on January 23d, in order to lock in +27.8% profits. We also provided an alternative option which was a hybrid trading + investing approach. Our silver alert for premium members, published on Jan 23d: SLV Guidance: Close The Trade Or Turn The Position Into An Investment Or Both.

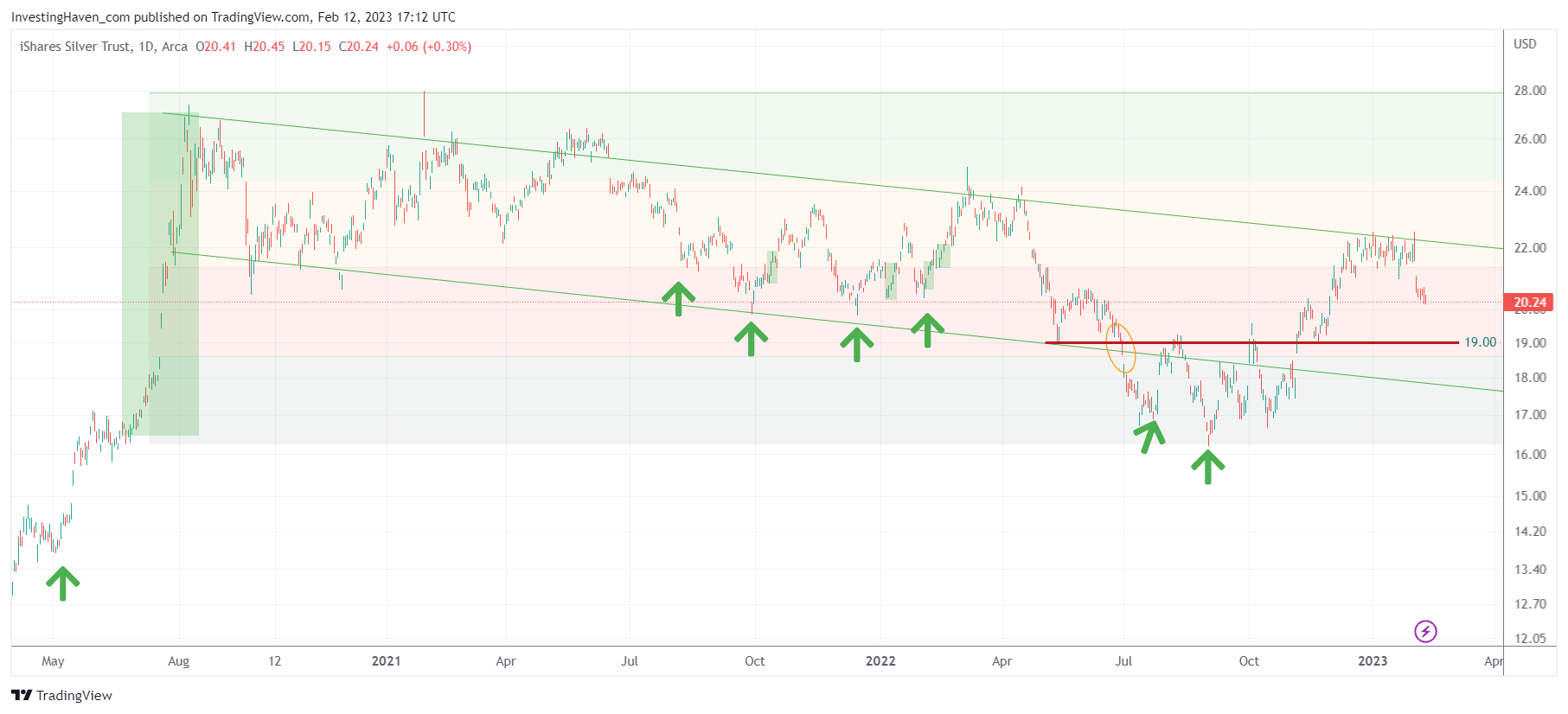

That said, there is one really important level to watch as per the daily SLV chart: 19.00 USD.

Rest re-assured, it won’t be clear whether 19.00 will come with a buy opportunity. Whenever SLV will be trading around 19, it will be very volatile. Scarily volatile.

Emotions stand in the way of ratio, volatility is the trigger. We explained this in 7 Secrets of Successful Investing.

You will either need a very well trained eye to read the chart and micro-patterns and/or an algorithm to flash a buy signal. Or both.

All we can say is that price action around 19.00 in the period mid-Feb to mid-March will be crucial, it will either come with a strong buy or the start of a bigger downtrend. We believe the former is what we’ll get, but we are convinced it won’t be a clear setup… until a few weeks after the buy signal came in.

Further reading

Silver Miners To Silver Price Ratio Flashing Long Term Buy Signal

Why Junior Silver Miners Will Have An Amazing 2023

Silver Miners To S&P 500 Ratio: An Epic Test Ongoing As 2023 Kicks Off