KEY TAKEAWAYS

- Dealers, the category that includes big banks, hold the bulk of COMEX net shorts, a primary source of selling pressure.

- CME delivery reports show Deutsche Bank issuing large quantities of silver contracts on settlement days, mapping paper positions to physical flow.

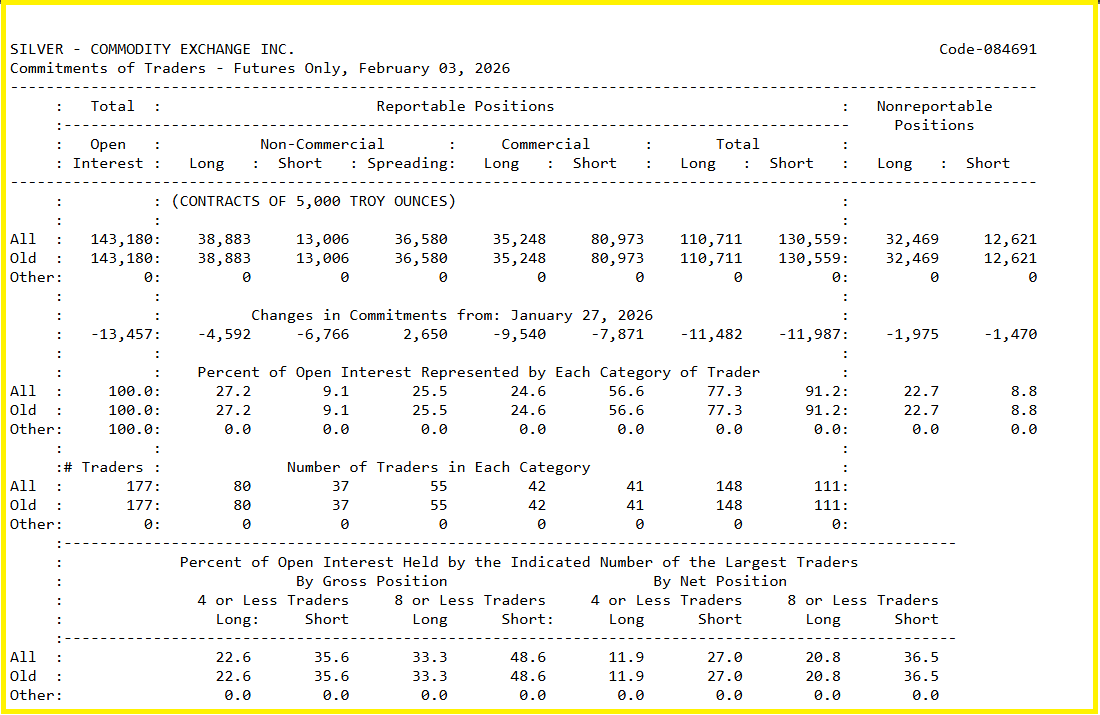

- Market coverage places the dealer net short at 46,389 contracts, which equals about 231 million ounces of silver.

- Higher CME margins in February increased the cost of short exposure and raised the chance of faster covering if banks need to adjust positions.

Silver’s market shows large dealer shorts, active bank-to-bank delivery flows, and higher exchange margins, a mix that creates real price risk.

Silver shows heavy commercial short exposure on COMEX, about 46,389 net short contracts, roughly 231 million ounces.

Delivery reports from the exchange list Deutsche Bank as a large issuer of contracts on key settlement days, while major clearing banks appear as large acceptors.

The exchange raised margins in early February to limit risk, which raises the cost of holding shorts.

RECOMMENDED: Can Silver Hit $200 An Ounce?

Who Is Shorting Silver? What The Public Data Reveals

Public records do not publish a neat list that says, “Bank X is short Y ounces,” but the available datasets let you draw a clear line from paper positions to bank activity. The CFTC Commitments of Traders shows the dealer or commercial category carrying the largest net short on COMEX silver.

That category covers banks and primary dealers that trade for clients, hedge option books, or run proprietary desks. On top of that, daily CME delivery reports list which approved vaults and clearing members issued deliverable contracts and which accepted delivery.

On Jan 5 and other early January dates, those delivery notices show Deutsche Bank named as a significant issuer, with large acceptances recorded by major clearing banks. Market observers identify some acceptances as associable with big dealers and clearing institutions.

These records show that bank-level activity sits behind the large commercial shorts flagged by the CFTC.

Silver Short Positions Explained: CFTC Data And The 231 Million Ounce Figure

If you read the two main public sources together, you will get the clearest picture. The CFTC weekly COT reports list gross short and long positions by category.

Market commentary has used those figures to calculate a dealer net short of about 46,389 contracts, which converts to roughly 231 million ounces using the COMEX contract size.

This is an important number because it represents a material share of deliverable stocks when physical demand rises. The CME’s year-to-date delivery notices show days when a single issuer supplied hundreds of contracts and other clearing firms took delivery.

Those delivery events move metal out of approved vaults and turn paper positions into physical obligations, which can force buying or transferring of bars rather than simply offsetting contracts.

Both datasets give public, verifiable evidence that major banks and dealers sit at the center of the short exposure.

ALSO READ: A Silver Price Prediction For 2026 2027 2028 – 2030

Why Banks Carry Short Positions

Banks short silver for several normal market roles:

- They hedge client flows and option books, which creates short futures exposure to offset other risks.

- They act as market makers, shorting to provide liquidity and later offsetting as inventory moves.

- Some shorts reflect directional trades, but most of the visible size comes from hedging and clearing activity. This is a crucial difference because hedge shorts behave differently during stress than speculative shorts, but both can force similar price moves when margin costs jump or deliverable supply tightens.

When the exchange increases margin requirements, holding short hedges becomes more expensive and a bank may need to buy back positions faster than planned, which can push prices up quickly.

What Large Bank Short Positions Mean For Silver Prices

Large dealer shorts create two practical scenarios:

- If physical supply stays abundant and demand cools, shorts can unwind gradually and cap prices.

- If physical demand tightens and deliverable stocks fall, short covering can trigger sudden price spikes.

Track these public indicators to understand which way the market is leaning:

- weekly CFTC Commitments of Traders for net short size

- Daily CME delivery notices for issuer and acceptor patterns

- COMEX warehouse inventories and withdrawals for physical tightness

- Exchange margin announcements for funding pressure.

These sources will tell you whether the banks’ positions look like routine hedges or unstable shorts at risk of rapid covering.

RECOMMENDED: Silver Shortage Looms As EVs And AI Chips Consume Supply

Conclusion

Public filings point to heavy dealer shorting on COMEX, with Deutsche Bank showing up in delivery notices and major clearing banks absorbing significant deliveries.

The roughly 46,389 contract net short and recent margin hikes create genuine price risk in both directions.

So follow CFTC and CME reports to separate routine hedging from positions that could force abrupt covering.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

Turning-point forecasting across multi-timeframe charts.

Actionable insights on GDX, GDXJ, SIL, and SILJ.

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

Read our latest premium alerts: