Markets change trends every 3 to 12 months. The key to profitable investing is to get the market trends right. Right now, we see the emergence of 3 new and maybe profitable market trends: falling rates, inflation expectations, silver price. These are start of new trends, and they need to develop … but it’s important to follow the emergence of new market trends in order to get in early enough to benefit from it in case they become a raging trend. All this is what we also discussed in our 100 investing tips.

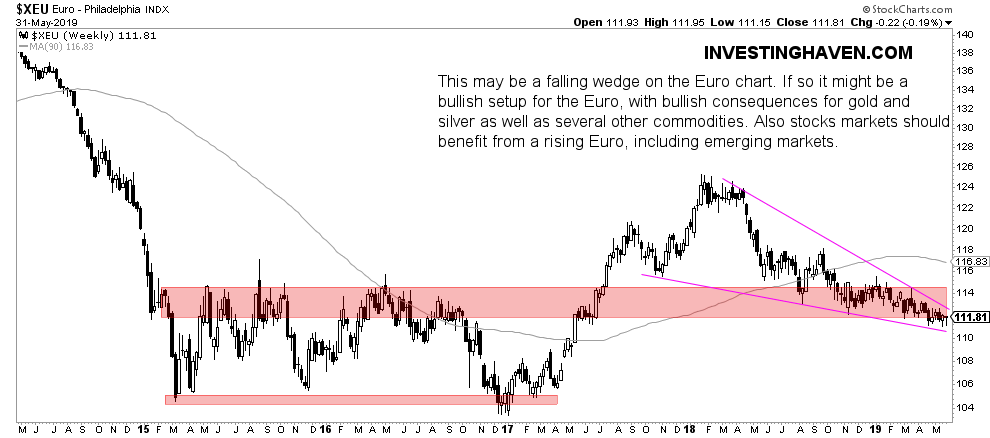

As said many times the Euro is by far the most important asset for global markets. We also refer to Leading Indicator: The Message Of The Euro which we wrote a few months ago.

The Euro may be setting a falling wedge. If this is the dominant pattern it may resolve into an upside trend for the Euro. It would be hugely bullish for our gold forecast and silver forecast, be the antidote against a stock market crash and support other commodities.

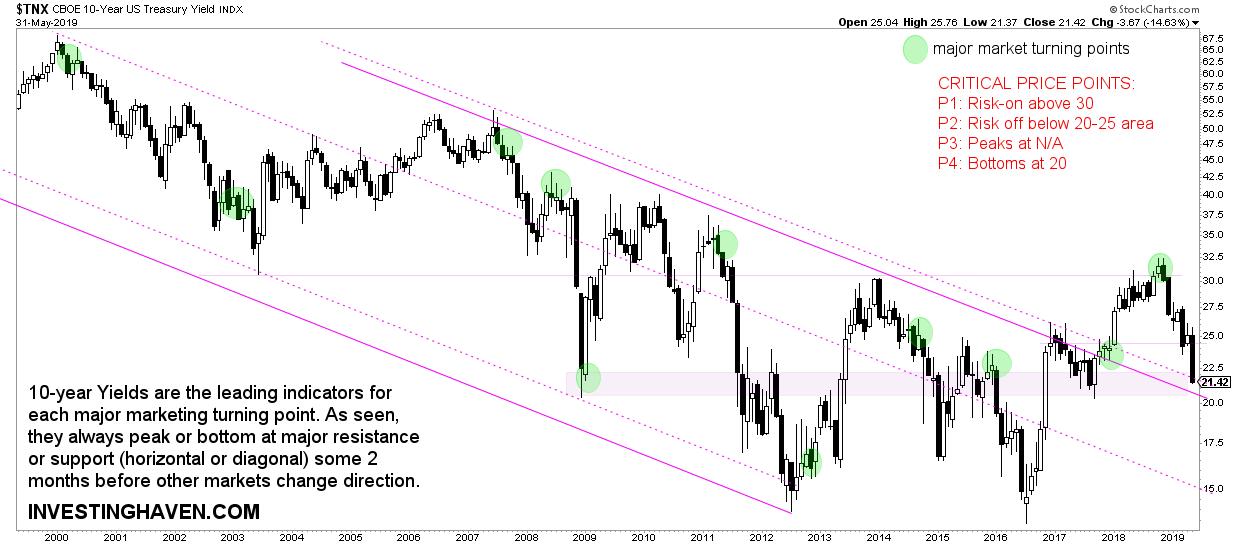

Equally important, according to us, is the 10 Year treasuries chart.

It clearly arrived at its MOMENT OF TRUTH.

It crashed more than 30% crash in the last 6 months. This resulted in less than a 10% decline in stock indices. A continuation of this decline in rates, though, will result in a much stronger stock market decline. That’s because the 2.00 area is of crucial importance as suggested by the chart pattern(s) on the next chart.

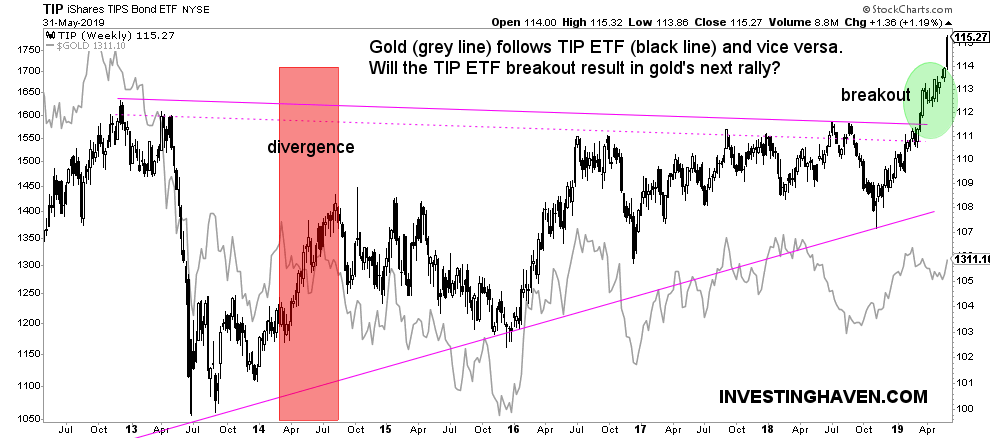

This results in a strong pick up in inflation expectations.

Why? As explained in Major Disconnect Between Inflation Indicator and Inflation Expectations the point is this: interest rates have fallen strongly in recent weeks, while deflationary forces were week. Consequently, real rates have risen.

This may lead to strongly rising gold and especially silver prices.

Moreover, some other commodities may start rising as well, though the inflation indicator needs to stop falling urgently. In other words the inflation expectations breakout may lead to a new market trend so it’s crucial to closely monitor different markets now and understand which ones get an influx from the inflation expectations breakout.

One example is Agriculture Index: From Giant Breakdown To Major Breakout as discussed earlier.

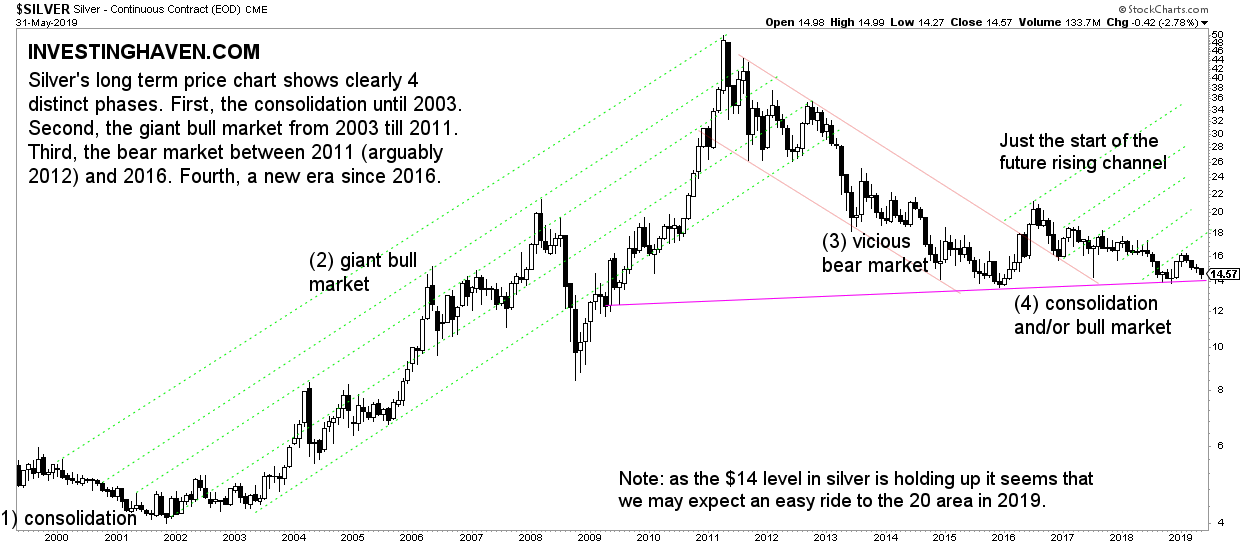

Which leads us to a potential major rally (bounce) in the silver market.

The long term chart of silver shows that it trades at major support. Similar to Jan 2016 a rally will bring lots of bullish energy in this market.

Because of this we keep on finding evidence that First Majestic Silver May Be Entering A New Bull Market as its our top silver pick.