We are watching the commodities space very closely. If anything, gold’s fast rise in 2019 and 2020 was a first sign that inflation acceleration is on the horizon. This implies that commodities could (should) be the next big thing in markets, in 2021. No surprise our 2021 forecast and our commodities outlook is really bullish for commodities.

The top sector(s) we like a lot are cobalt / lithium / rare earths, as said in Are Lithium and Cobalt Set To Become The Hottest Commodities and a Rare Earth Metal Stocks Forecast For 2021.

However, the entire commodities space should be watched closely, as for instance Wheat is showing a drastic turnaround from long term bearish to starting up a new powerful bullish trend.

As a north star indicator for commodities we use the AUDUSD currency pair. A rising AUDUSD is strongly supportive for commodities, it’s sort of a leading indicator.

The weekly chart shows a dramatic turnaround that started in November when the AUDUSD broken out from a 9 year falling trend (small yellow circle). Since then, it’s in an uptrend.

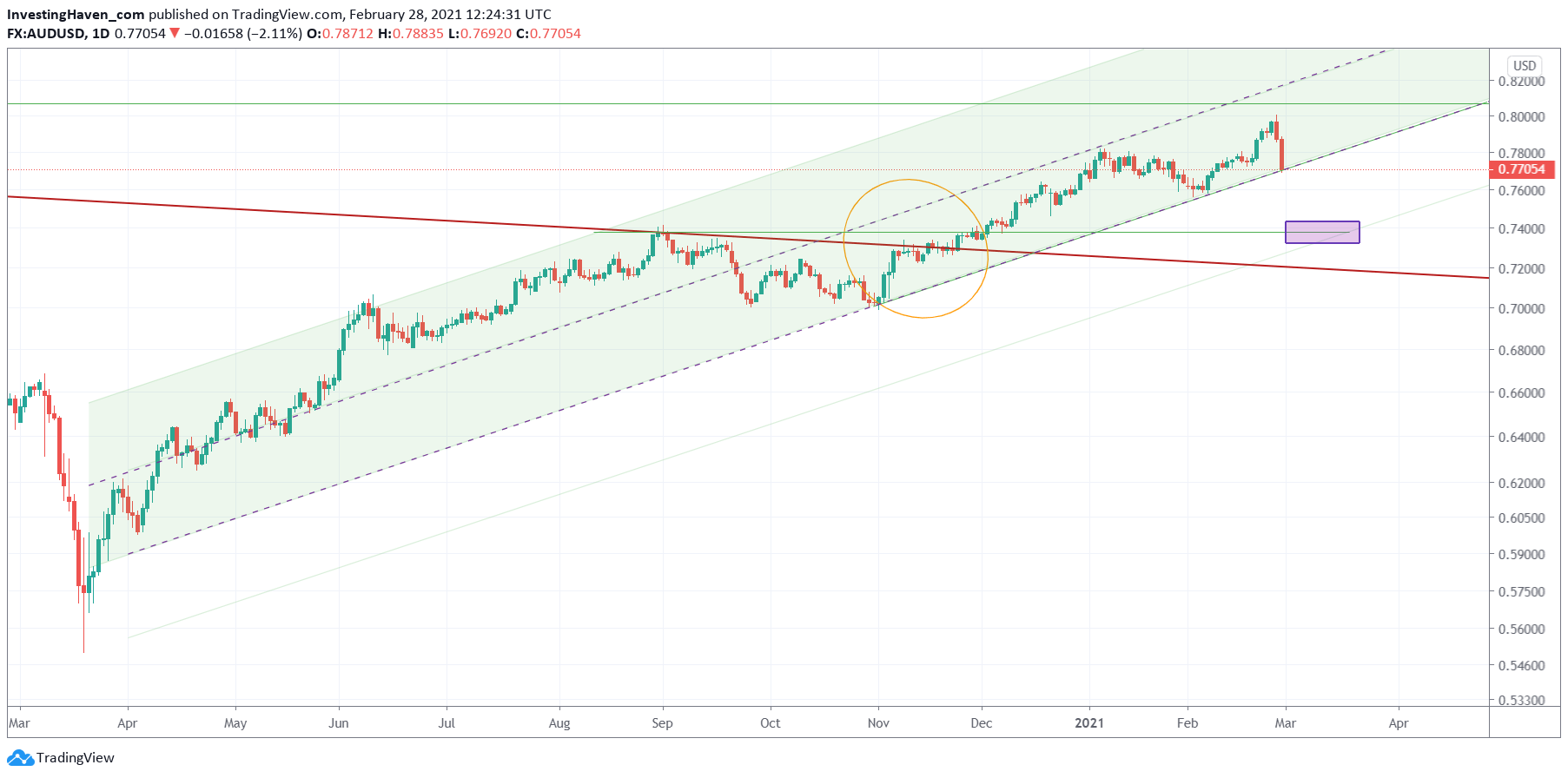

The daily chart gives more detail shows the real turnaround point mid-November of last year, yellow circle.

It also shows how the AUD came down a few days ago, to test support of its rising channel.

We do expect some weakness in March, after which the uptrend resumes. The level to watch 0.74 points, see the purple area indicated on below chart. If the AUD falls to that level, and bounces up strongly, it’s the ultimate confirmation of an uptrend continuation.

It may never fall that low, it may find support at 0.76 points or just bounce higher next week though. IF this were to happen it would be indicative of an ultra bullish setup!