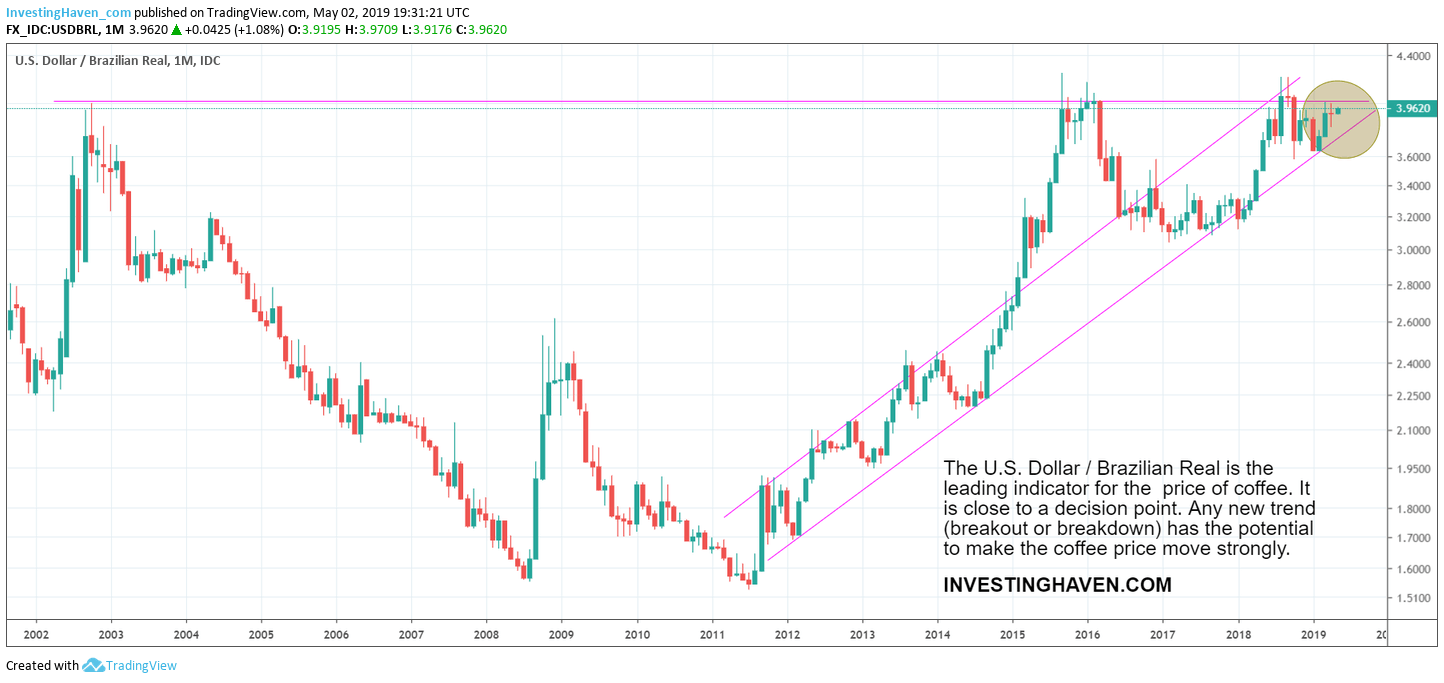

Our coffee price forecast part of many tens of other 2019 forecasts was straightforward. By far the most important leading indicator for the price of coffee (COFFEE) is the U.S. Dollar to Brazilian Real currency pair. Smart investors identify leading indicators, and closely watch how they evolve before taking a position. This applies to the coffee market as well. We now see that the USDBRL currency pair is ready to start a new trend in the context of its 20-year chart pattern. An aggressive trend reversal of the USDBRL will push the price of coffee seriously higher.

Even financial media picked this up: the coffee price is declining at an alarming rate.

In our coffee price forecast we identified the following critical price points:

- P1 Bullish above $1.17

- P2 Bearish below $1.0

- P3 Major peak at $2.0

Coffee managed to fall below $1.0. This is certainly the bearish area. There is no reason whatsoever to take positions at this point in time.

If there is one thing we know from the past is that coffee moves ultra fast higher once it starts trending (read: once it breaks out).

Before talking about anything bullish in the coffee market we must see “a combination of a sustained breakout above $1.17 combined with a strengthening Brazilian Real.” We said that “in such a scenario we believe the picture in the COT report will shift “back to normal”.

Both quotes are from our forecast published early this year.

The line in the sand is the USDBRL at 3.70. If this currency pair falls and starts trending below 3.70 we want to see a meaningful change in the COT report. Only if both conditions are met will we know that we can consider a position in coffee as it rises above $1.17.