The commodities space is very close to a major turning point. A moderate increase of just 10% in the commodities index will result in the end of the 8 year commodities bear market. You read this correctly, the bear market that is ongoing for +8 years now may be ending soon. These major cycles that last close to a decade are very powerful, and they have created a lot of damage for commodities prices. However, what is equally important is the trend change after such a long downtrend. The fact of the matter is that commodities bulls are a rare species. That’s a good thing when a trend change takes place, because after so much selling there are hardly any sellers left. This is a great setup for a powerful new bullish trend, one that may start as early as 2020. There is one important caveat though, and that’s an actionable tip that we discuss in this article! Note that a commodities forecast for 2020 and beyond is underway.

First of all what’s the typical mistake that investors tend to make in a downtrend?

As per our 100 investing tips:

Falling in love with the investment is killing your profits. Love is an emotion, and emotions are your biggest enemy, and have the potential to destroy your account value. The one characteristic of all these top investing opportunities is that they have a short-lived period in which they really go ballistic. After that it is over for a couple of years at best (many, many years worst case). Never fall in love!

The problem with investors that had exposure to commodities in the previous decade is that they did extremely well. A great investing experience in the past is a recipe for future disaster. Investors tend to stick with the same sector just because of the way the human psyche works. Good experiences tend to last long, and we tend to try to go to the areas where we had those good experiences.

With investing it is the exact same opposite.

The best thing to do after success in a specific area is to stay away from it for a long time until selling has exhausted. However, investors need to follow the sector to know when all selling is over.

The simplest way to know when it is time to start becoming interested again is … the news. If nobody, literally nobody, shows any interest of covering a market and there is hardly any news reported it is a great sign to become interested.

Any similarity with the commodities space in 2020? Yes, absolutely!

Commodities investing news at the time of writing is as boring as anyone can imagine.

But what do the chart tell us?

They do confirm our thinking.

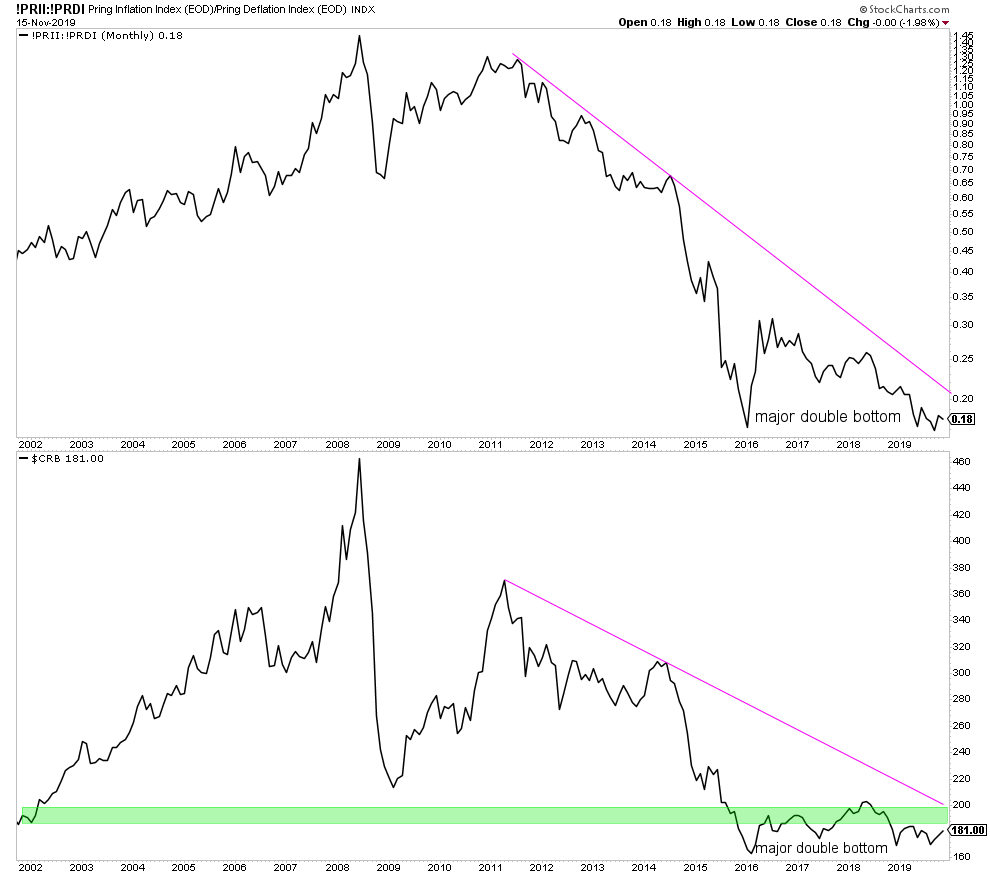

The inflation/deflation indicator is setting a major bottom, as seen below. This double bottom formation is extremely powerful in signaling the end of selling.

Note that this inflation/deflation indicator is strongly correlated to the commodities index as seen on the lower panel of the first chart.

Three important things to add to this.

First, as seen on above chart, lower panel, the CRB index trades at 181 points currently. The downtrend comes in at 200 points. A mild rise of 10 pct in the CRB index would confirm the end of the 8-year bear market in commodities!

Exciting, isn’t it.

Second, major turning points in commodities have always been signaled by double tops (signaling a new bear market) or double bottoms (signaling a new bull market) in the inflation/deflation indicator. Watch this historic chart below. If history is any guide then we are about to start a new commodities bull market in 2020.

Third, don’t go all in right away. A new bull market starts slowly and picks up in speed over time. So gradually building up positions is what smart investors are doing. Moreover, they keep a close eye on all commodities to identify the ones that start rising first, as commodities never rise collectively.

The picture is clear, the actions are clear. We are closely monitoring the commodities space to find the first segment that will do extremely well in 2020 with the idea to find a multi-bagger investing opportunity.