The copper market is talking. Are you listening? It has a similar message as steel stocks although the difference between both markets is that copper is a leading indicator. The copper price chart says “no stock market crash in 2023” which is consistent with so many indicators that we are tracking (please also read our 2023 forecasts).

The field of leading indicators is fascinating.

One of the reasons why it is so fascinating is that there are meaningful and strong correlations between what may seems completely different and unrelated markets.

Take copper for example. Who would think of the copper price as an influencer for global stock markets?

While there is no direct influence from copper to stocks, there are direct intermarket relationships between both. The price of copper may be rising for different reasons. But one thing is pretty consistent: when copper is rising, it tends to correlate with economic strength which is strongly correlated to stock market strength.

That’s primarily why we examine the copper price chart.

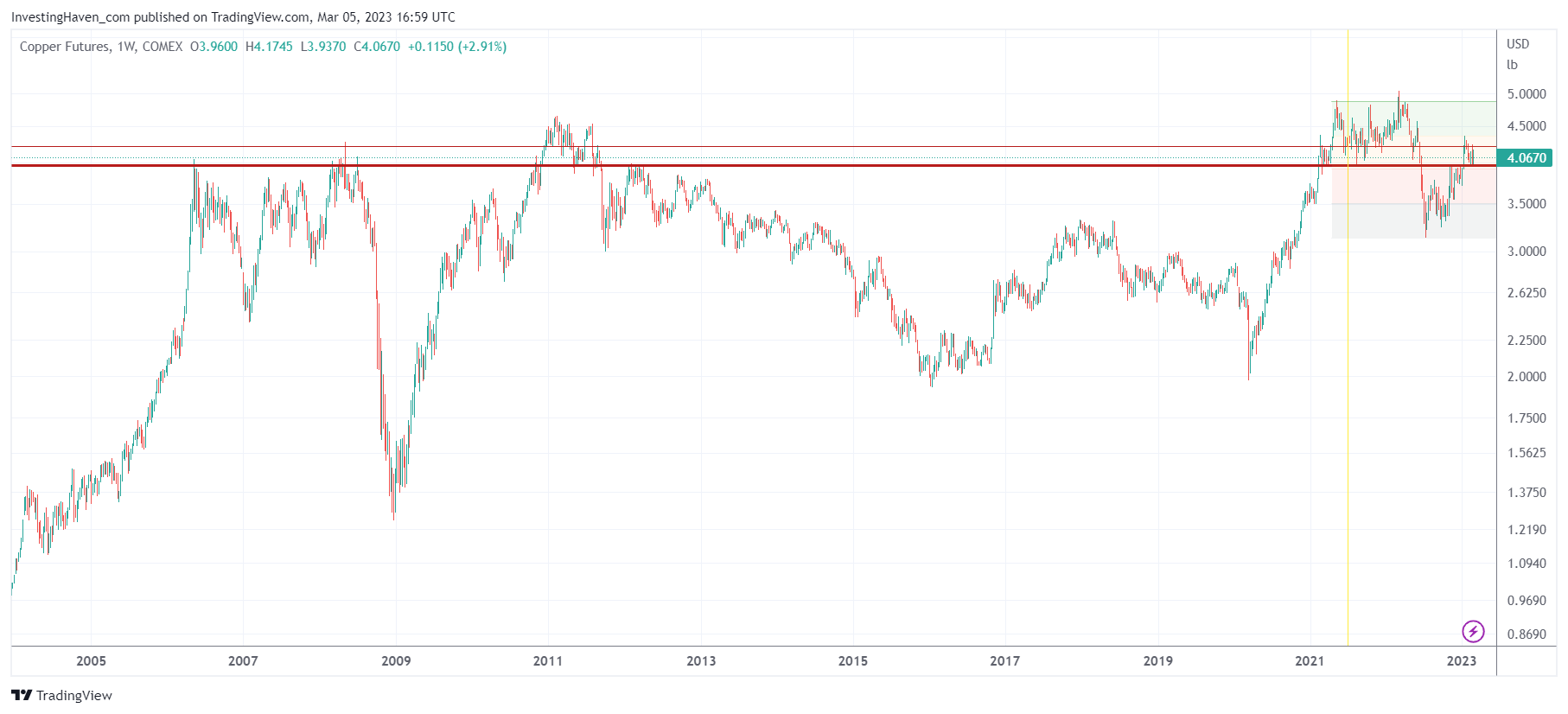

The weekly copper chart has a giant triple bottom with higher lows, between 2009 and 2021. The copper price went to 5 USD per pound. It came down in 2022 with the global stock market sell-off. It now trades back above what we consider the ‘line in the sand’ level which is 3.95 USD/pound.

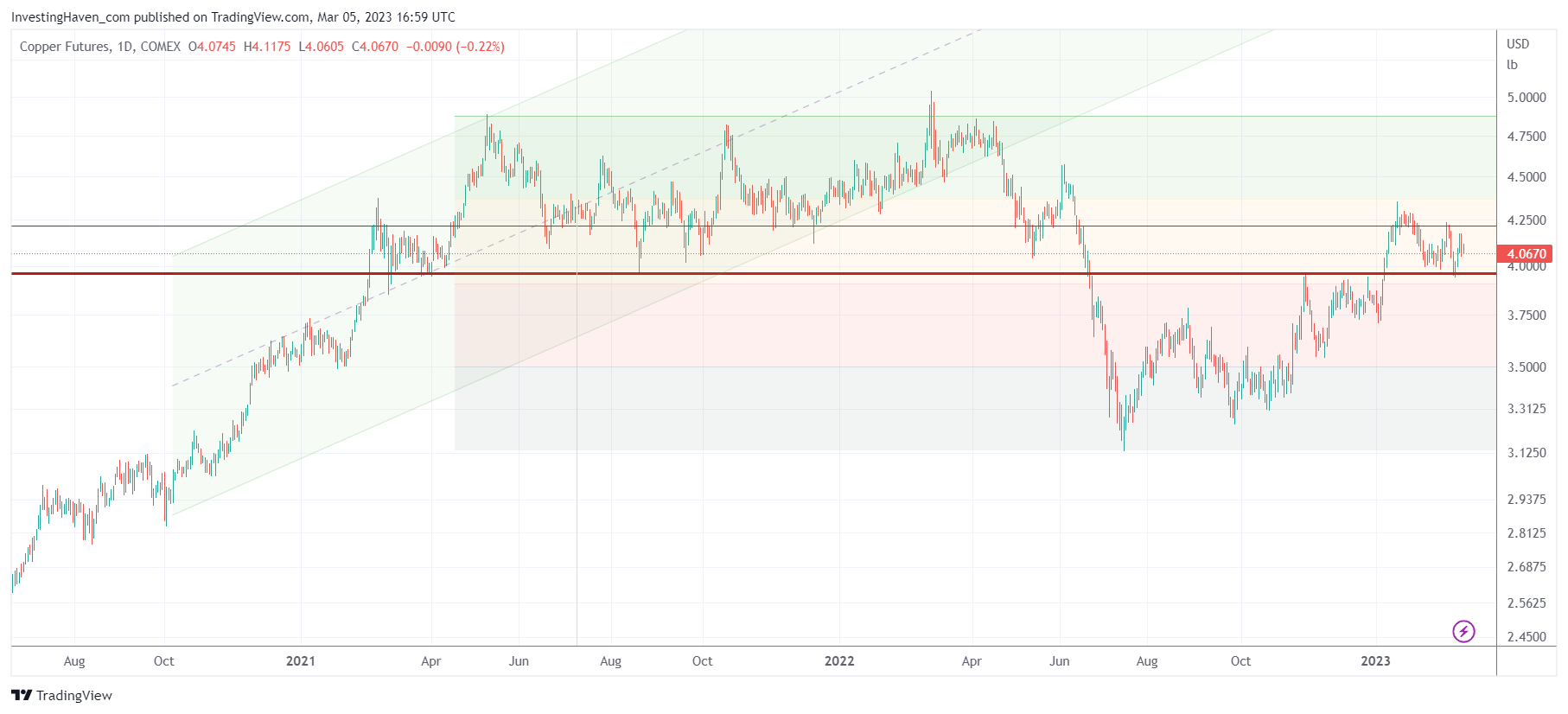

The daily chart, below, says it all: a nice reversal since June last year. As long as copper trades above 3.95 USD per pound, we are not concerned at all. We believe that copper is telling the world that things will be fine in the next few months.

Although we are not really interesting in actively investing in the copper market, we certainly consider the copper’s market message as ‘green light’ to go all-in with our stock market portfolio. In our stock market investing service Momentum Investing we are preparing our top stock picks in what we call our “stocks shortlist”. We are planning to be fully invested in stocks by the end of March.