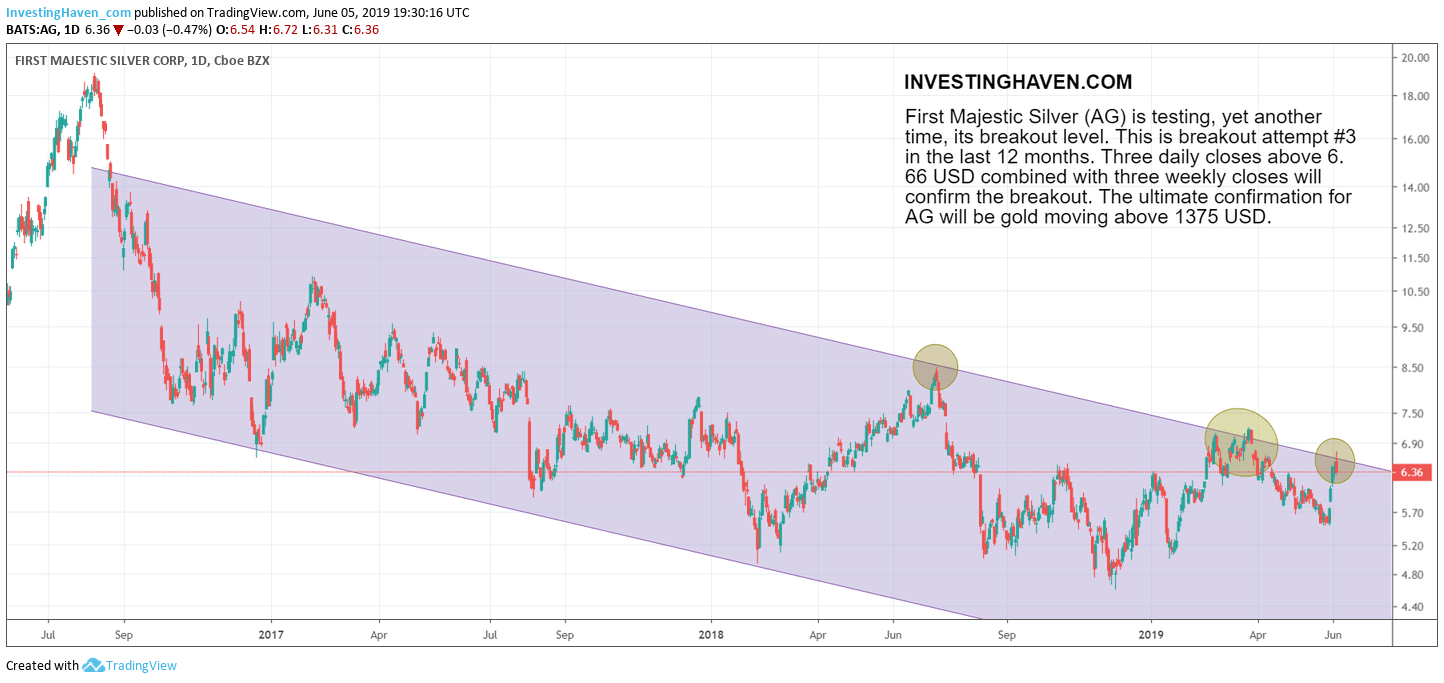

There we go again. First Majestic Silver (AG) which is our top silver stock is attempting to break out, again. It’s attempt number 3 in less than 12 months. As per our First Majestic Silver stock forecast we stick our investing thesis that once it confirms its breakout it will run 2 to 3 times higher in less than 9 months! It all starts with a gold price breakout which we still expect to take place this year, as per our gold forecast 2019.

We covered First Majestic Silver extensively. And we followed its breakout attempts in the last 12 months:

First Majestic Silver Rises 6% Today. Welcome New Bull Market? (May 2019)

First Majestic Silver Breaks Out, About To Double In 2019 (February 2019)

First Majestic Silver At The Verge Of A Giant Breakout (January 2019)

First Majestic Silver: Time For A Big Move After 20 Flat Months (August 2018)

First Majestic Silver About To Start A Monster Rally In 2018? (June 2018)

We will not cover the fundamentals, as they are still exceptionally good. We covered them in our 2019 forecast.

However, the chart is what we are interested in. At a certain point in time the chart will follow fundamentals. But it all STARTS WITH THE CHART as per our investing methodology.

First Majestic Silver shows this third attempt to break out. It really is a matter of waiting for a confirmation, and as it mostly goes in life the third attempt may be the one that succeeds.

We want to see 3 to 5 consecutive daily closes above 6.66 USD, as well as 3 consecutive weekly closes above the same 6.66 USD level.

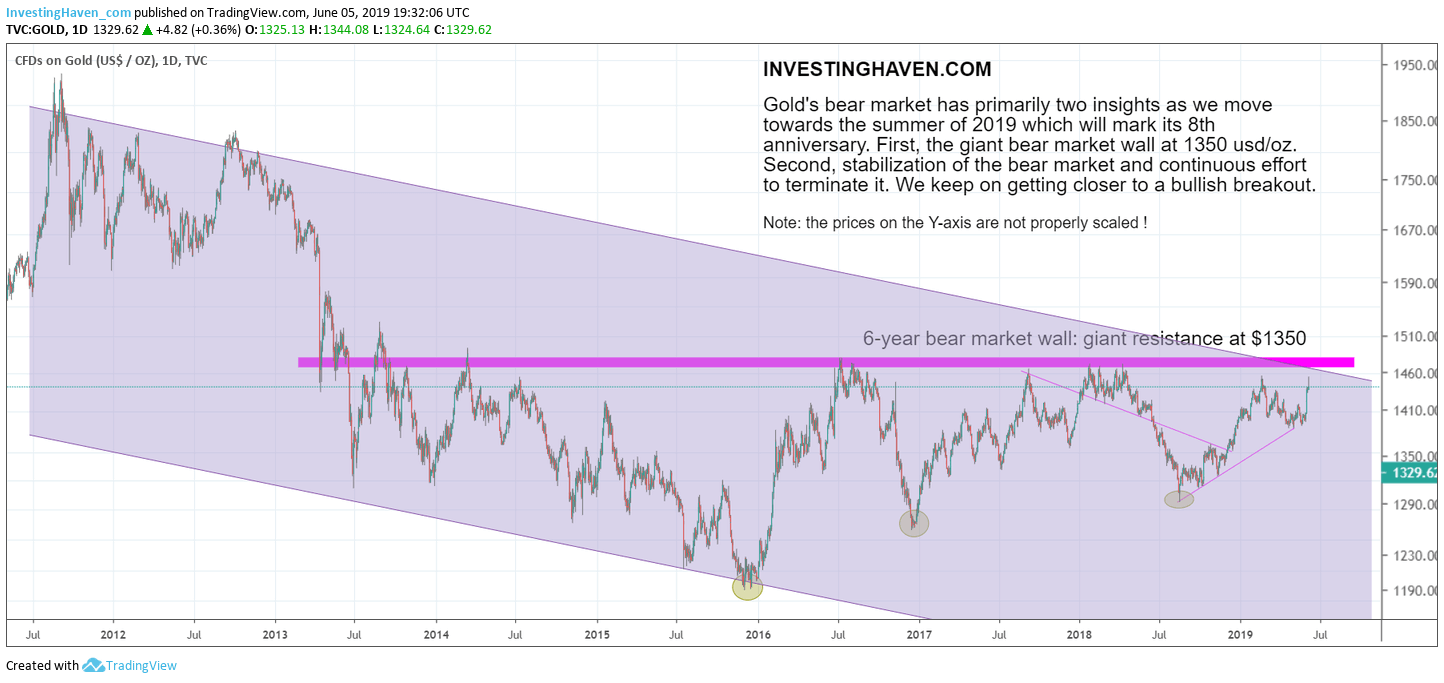

A lot will depend on what happens on the gold chart. It’s even stronger according to us: all depends on gold.

Gold shows attempt number 7 (or so) to break above its +6 year bear market wall. The giant resistance level at $1350 is indicated in purple on below chart.

We will know for sure that the precious metals space will be on fire once we see gold breaking above the $1350 to $1375 area, something it has not done for more than 6 years in a row.