In recent times, the sentiment around gold has been paradoxical. Despite bullish trends on the charts, the mood among many investors remains cautious, if not outright skeptical. This divergence requires deeper analysis, starting from the facts, first and foremost the charts.

RELATED – Read our updated 2024 gold forecast.

Gold Chart Analysis

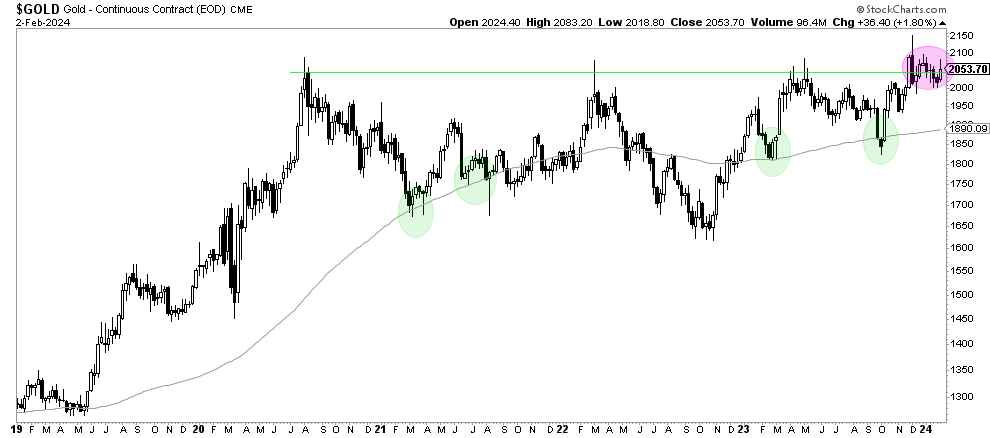

A glance at the weekly gold price charts offers a valuable insight.

Gold prices are not just hovering above the long-term moving average; they are showing a narrative of strength and potential with a series of the highest weekly closing prices observed in recent times. This should be combined with a series of reversals, over 3.5 years, all above the long term moving average which is trending higher.

This chart setup suggests a solid bullish momentum, underscored by a breakout consolidation phase that hints at stability following a period of upward movement.

Such a configuration in the charts typically signals confidence among investors who are keen on the metal’s long-term prospects, despite the current sentiment. The fact that gold is stuck for two months between 2000-2070 USD/oz is not a bad thing, it certainly may feel uncertain and ‘frustrating’ to gold investors.

Moreover, this bullish trend seen in the charts speaks volumes. It highlights gold’s resilience.

The sustained positioning above the long-term moving average and the consistency of weekly closing prices near ATH could be interpreted as a sign that gold is setting the stage for further upside in gold. The uptrend is very soft, so soft that it creates doubt and uncertainty.

This analytical perspective, based in chart analysis, is in contrast to the prevailing sentiment. It is also in contrast to the headlines like the ones here and here.

Speculators and the Gold Market

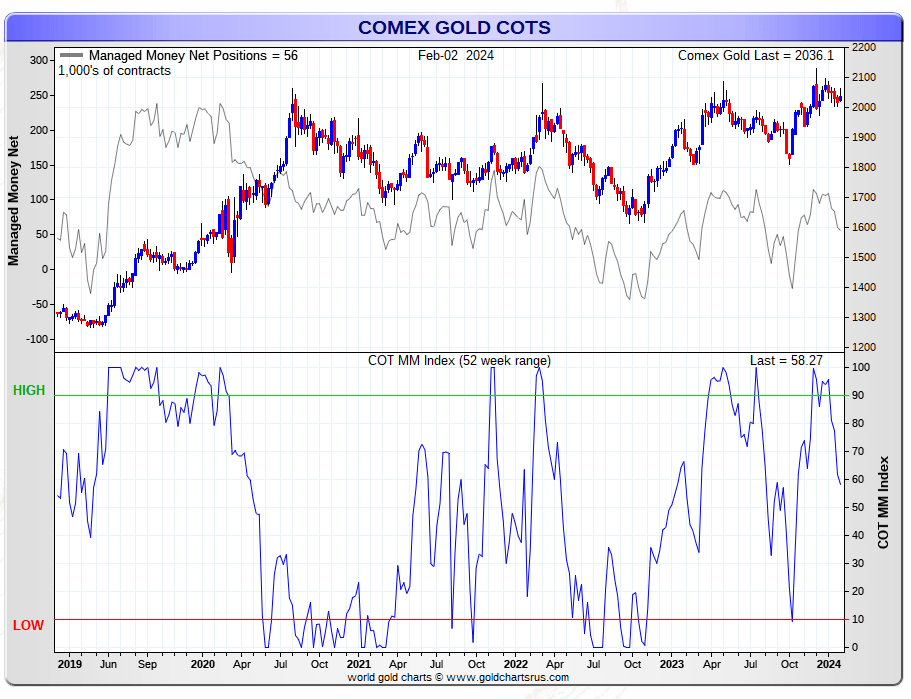

In an interesting turn of events, speculators seem to be withdrawing from the gold market, particularly within the COMEX gold futures market.

While such a trend might typically raise alarms, from a contrarian perspective, it signals a positive development for gold’s prospects.

With speculators stepping back, gold transitions away from being a consensus trade, thereby reducing the speculative froth that can often lead to heightened volatility and uncertain price movements.

As seen on below chart, managed money participants were collectively long, about two months ago (lower pane, next chart). As we all know, consensus trades are short-lived. Gold was no exception to this ‘unwritten rule’ as evidenced by the steep drop in relative number of long positions by managed money traders.

Ted Butler would note that the reduction of managed money long positions was purely the result of buying by commercials. This dynamic, at the heart of price setting in COMEX futures market, as opposed to normal and regular supple/demand dynamics setting price, is the key determinant of gold’s price.

The Federal Reserve’s Influence

The Federal Reserve’s monetary policy plays a pivotal role in shaping asset classes in financial markets.

Its impending decisions could serve as a fundamental driver for gold prices. Anticipations of the Fed cutting rates and decelerating the pace at which they offload Treasuries from their balance sheet create a fertile ground for gold to thrive. Lower interest rates typically diminish the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors.

Fed meeting likely to see start of debate over ending balance sheet contraction

Fed plans ‘in-depth’ talks on balance sheet run-off in March: Powell

Additionally, a slower pace in the reduction of the Fed’s balance sheet could signal a more cautious approach to tightening monetary conditions, possibly in response to concerns about economic growth or inflationary pressures.

Such a scenario bodes well for gold, as it is traditionally seen as a hedge against inflation and a safe store of value during uncertain economic times (read Gold demand hit record highs in 2023 amid geopolitical risks, China weakness). The nuanced interplay between Fed policy and gold prices underscores the importance of understanding macroeconomic indicators and their impact on investment strategies.

Conclusion

While the charts signal a bullish future for gold, the sentiment among investors does not yet match this optimism. This disconnect presents both a challenge and an opportunity. For the analytical and critical investor, the current climate offers a chance to look beyond the surface sentiment and base decisions on the underlying trends and fundamental drivers that shape the gold market. As financial markets evolve, slowly but surely moving towards a point of rotation out of tech stocks (at a later point in 2024), it seems obvious that precious metals will be a beneficiary of rotation.

While strong momentum in the price of gold may not be imminent, the soft uptrend looks better than it may feel.