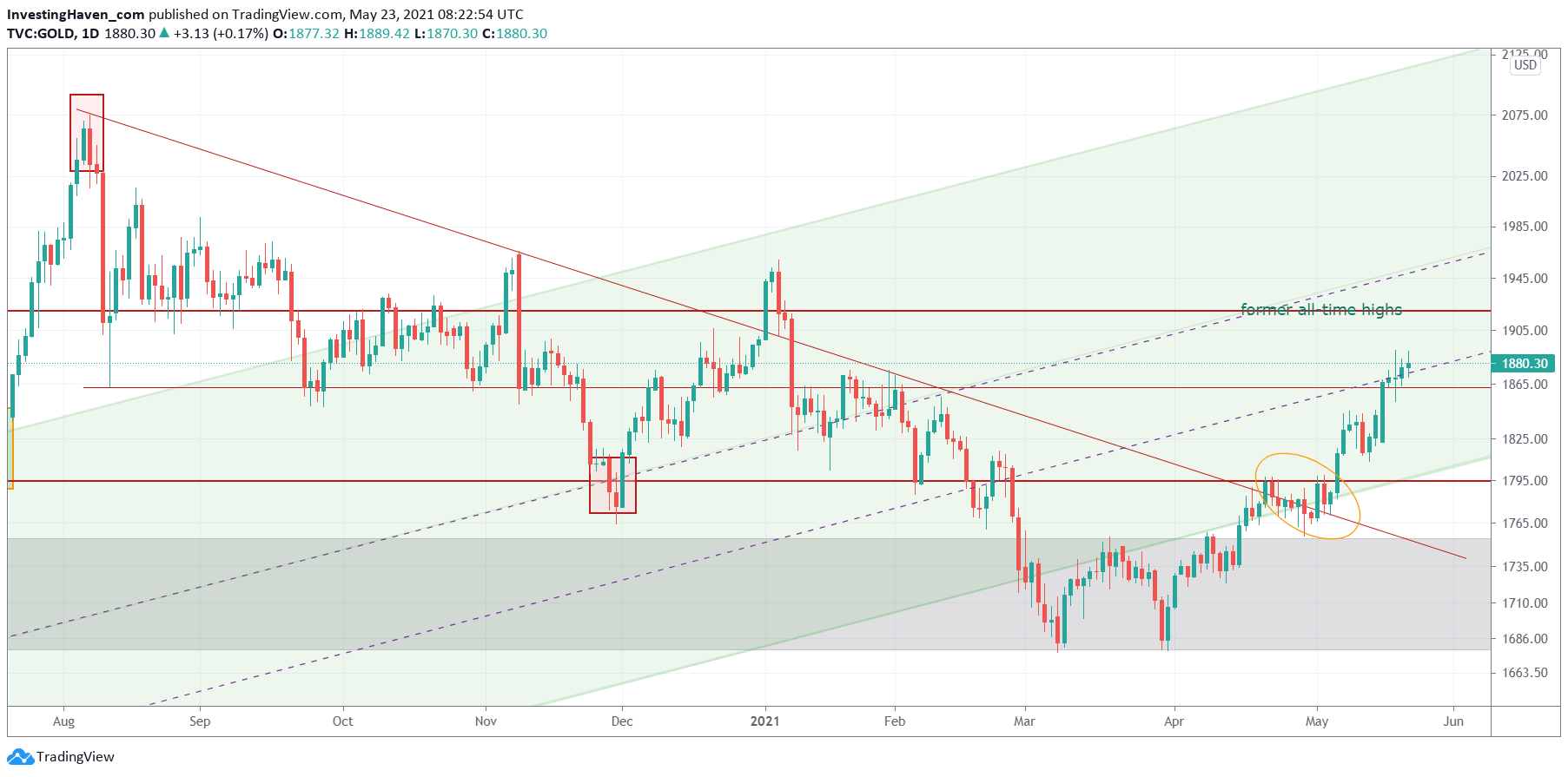

Gold is moving to its 2011 highs at 1925 USD/oz. After a solid bullish reversal in March of 2021 there is some good bullish momentum in the gold sector now. The question is for how long? Our gold forecast 2021 was bullish for the 2nd part of the year.

According to our cycle count we believe that gold’s uptrend started in May of this year. This is how we look at the gold cycles after its bull run last year:

- August, Sept, October: topping cycle.

- November, Dec, January: flat cycle with bearish bias.

- February, March, April: reversal cycle.

- May onward: bullish cycle.

If this 3 month cycle continues we should see gold rise going into July. If so, we can expect a mid-cycle retracement which is due in June somewhere.

The first hurdle to overcome, as per gold’s chart is former all time highs (2011 highs, 1925 USD/oz). This may coincide with the mid-cycle break that gold will take.

The one important question is whether the mid-cycle break will be the end of the mid term bull run. We cannot exclude a 3 month cycle that will fool bulls: 6 weeks up, 6 weeks down.

We are watching gold’s leading indicators to understand if this is going to morph into a 3 month bull run vs. 6 week bull run. The Euro is hitting resistance, while bond yields don’t have enough power to move higher. This is an ‘ok-combination’ for gold. The position of Euro and bond yields in June of this will be important.