Gold was bullish on Friday, finally, after several very shaky weeks. Not only did we get a positive sign out of the precious metals market, but it was also confirmed by a breakdown in the US Dollar. Our gold price forecast was crushed this year, and we are preparing our 2021 forecasts, also for gold and silver.

Let’s start with the key intermarket driver for gold and silver prices: the US Dollar.

One important misconception is that gold/silver and the US Dollar are perfectly negatively correlated. That’s on day by day basis, almost an hour by hour basis.

That’s not how it works.

Gold and the Dollar are negatively correlated on a longer timeframe, say directionally. But what’s equally important is that they are negatively correlated once there are important ‘events’ on their charts. A major breakdown in the Dollar is a key driver for gold.

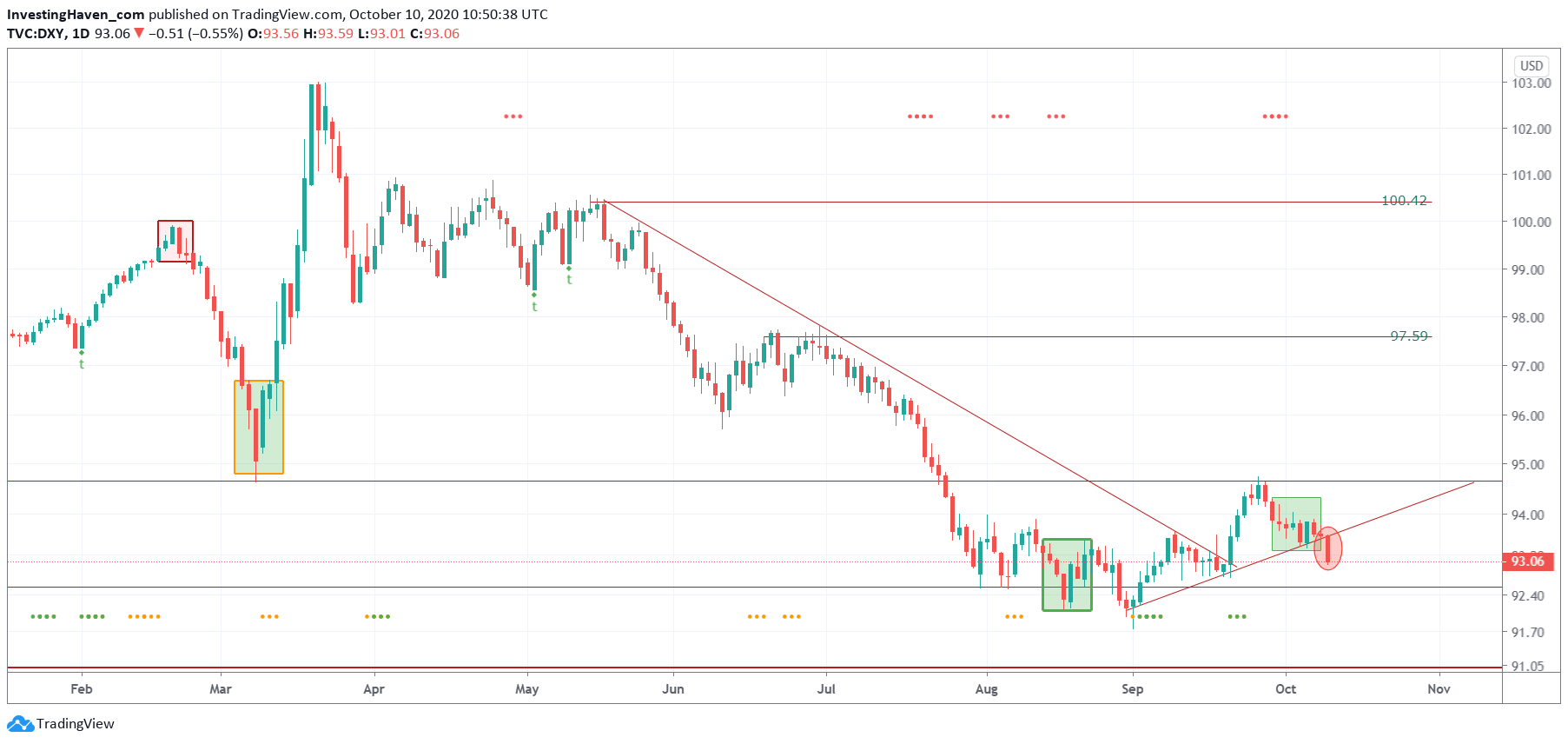

That’s what we see in below chart.

On Friday, the Dollar broke down from a 6 week rising trend. The Dollar was trying to break out towards the end of September. Not only did it fail, it did also result in a breakdown on Friday.

This means: green light for precious metals.

The gold chart shows a bullish reversal in the last few days. Friday was the first day above former all time highs, and the dips of September and October now can be connected with a trendline that connects the lows of April / June / September / October.

Yes this increases the odds of an uptrend.

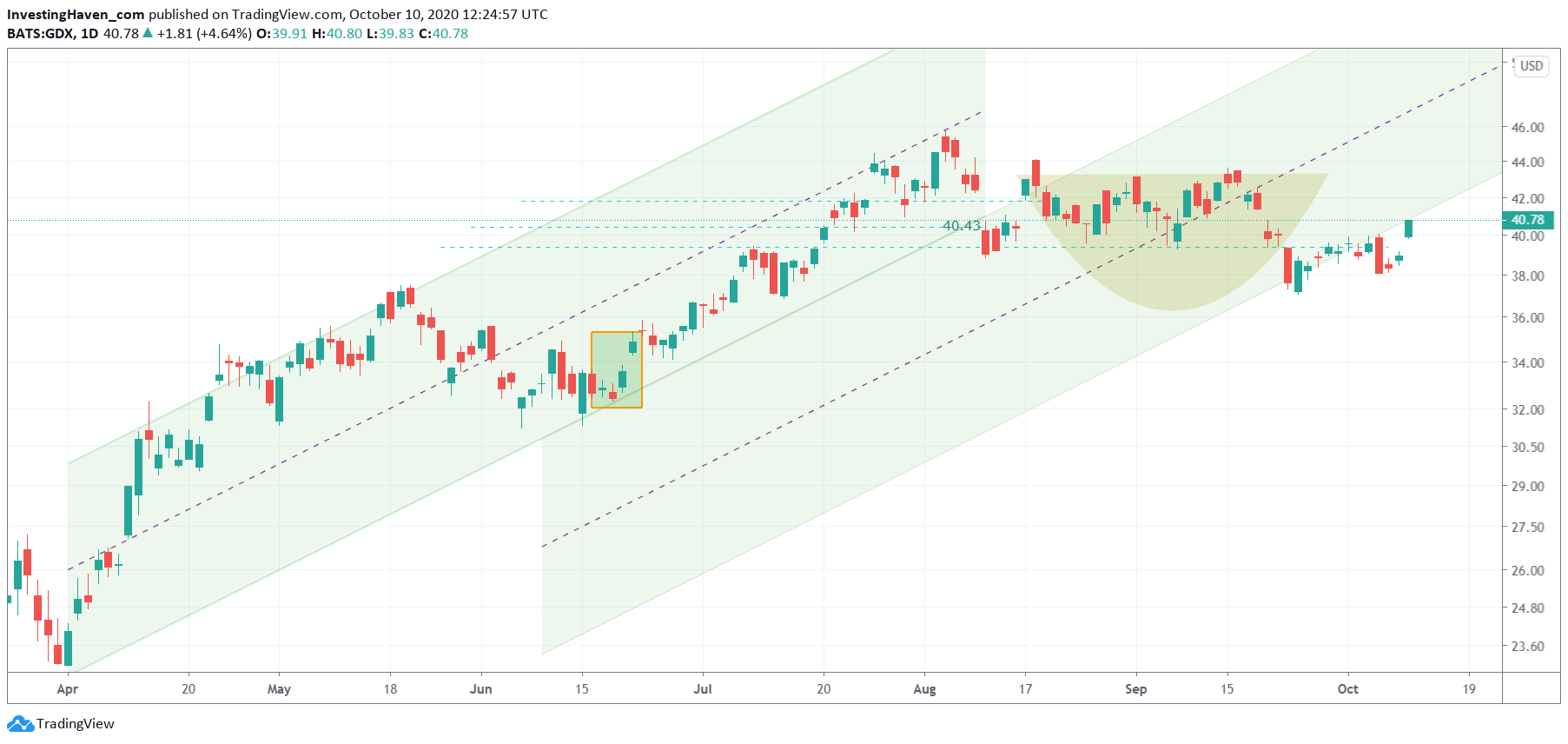

Gold and silver miners, as per GDX ETF, are trying to get back into their rising trend channel. Note how they fell below it with 2 full candles below it. But the 3d day (Friday, yesterday) they touched the channel.

This is another illustration of how extreme and unusual these markets are. This is a setup that also illustrates epic fights between bulls and bears. You do not want to stand in their way, you want to take positions once you see confirmations even if this means leaving some profits on the table.