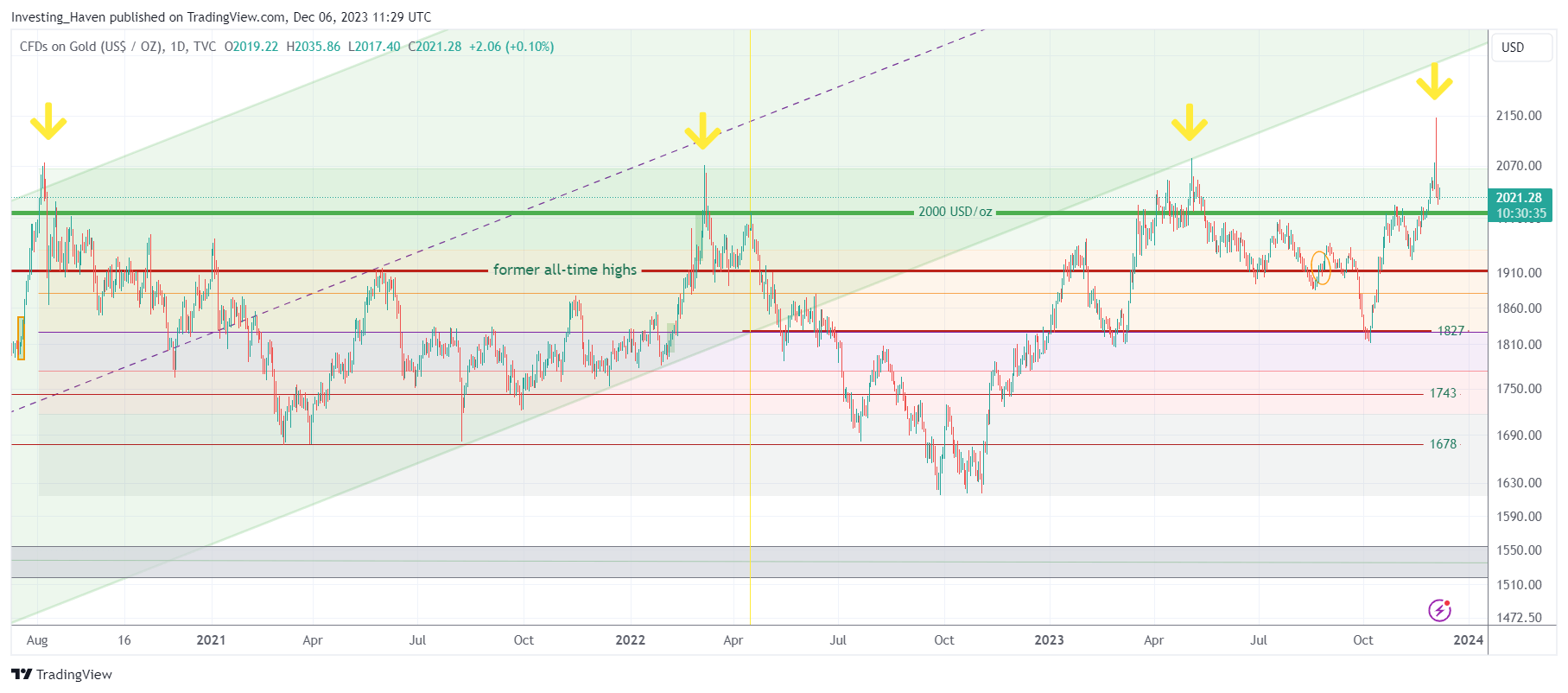

The price of gold came down after hitting new all-time highs. In doing so, it left a pretty long wick which could be indicative of a turning point. However, it is is too early to call for a gold price crash in 2024. Some investors are really afraid of a gold crash to start anytime soon. We disagree. If anything, we prefer to wait for December 11th, 2023, a key date which will help us understand whether the failed gold breakout marks the start of a gold price crash, a strong pullback or a mild pullback.

The mind of investors is really special. They get excited when prices go up, they panic when prices go down.

What we should be focusing on, instead, is structure (especially chart structures): while 99% of analysts and investors look at price, and only price, we look at price and time combined.

That’s why we conclude that it is premature to understand the impact of the large wick on the gold price chart.

Gold price crash?

Note that we talk about a gold price crash we really mean a drop of at least 30%, pushing gold back to its 2022 lows. With a gold price crash we mean a drop similar to the one in the period April to September of 2022.

We want to emphasize this because when we listen to investors they tend to exaggerate, too often.

Terminology is often important, and using the wrong terminology can be dangerous, mentally.

That’s why we want to ‘warn’ not to think in terms of a gold price crash, it’s not going to happen in the short term.

What might happen, though, is a mini-crash in the price of gold once a much higher target is reached. That’s because of two reasons:

- Gold was trying to break out from a triple top. Moreover, it has a long consolidation, almost 3.5-years long. Both chart characteristics do not justify a gold price crash to occur in the near term.

- The market’s volatility is low. Leading indicators are supportive of higher gold prices. If we compare this situation with early 2022, when volatility levels were much higher, also in leading indicators, there is no ground for a gold price crash as we head into 2024.

With that said, let’s look at a more nuanced question: is the gold going to pull back mildly or strongly as opposed to asking the question whether a gold price crash is underway?

Gold price bullish or bearish?

One day does not make a market. On the other hand, we have to be mindful of a potential turning point.

In our gold forecast 2024 we mentioned that leading indicators suggest a bullish start of the year, with 2,200 to 2,400 USD/oz approximately as a reasonable price target.

One could argue that 2,200 was almost hit on Monday, Dec 4th, 2023 (intraday top in pre-market trading was approx. 2040 USD/oz).

Not too fast, is what we would argue, leading indicators do not suggest that this is the end of the gold bull run.

Moreover, on the question whether gold will print new highs in 2024, we recommended to watch the gold futures market. Admittedly, it is getting a crowded trade in there. So, some cooling makes sense, especially the way it happened (pre-market trading).

Mid to long term, the gold price is bullish, especially going into 2024. This dominant trend would not justify a gold price in 2024, certainly not in the short to medium term.

Gold price crash, gold price pullback or none?

That said, what does the spot gold price chart tell us?

First of all, the that was printed on Monday, December 4th, 2023, is a rather long wick. That’s obviously not a great sign, it means that there has been tremendous selling pressure when gold moved above 2070 USD/oz.

Next to this, when comparing this failed breakout attempt with the wicks that were printed in recent years when gold moved to 2070 USD/oz (three occurrences) we observe that tis current situation is very different for two reasons:

- Gold has been rising from much lower levels in the previous tests of all-time highs (most from the area 1600-1690 USD/oz). In the last occurrence, gold started its rally at 1830 USD/oz.

- The gold price went very fast down following the failed breakout attempt, mostly within a period of 3 to 5 days.

That’s why we conclude that ‘this time may be different’ in case gold remains above 2000 USD/oz by Monday, December 12th, 2023 (end of day). That’s when this week’s breakout rejection should turn out to be a mild and temporary rejection.

On the other hand, if gold moves fast lower, by Dec 12th, 2023, it might mean the start of a stronger pullback, one that will lead to readings below 2000 USD/oz.

Gold volatile?

The fact that gold would be volatile was to be expected.

In our latest gold & silver price analysis, shared with premium members of our SPX, Gold & Silver Price Analysis premium service, we wrote Is The Big Silver Run Of 2011 About To Repeat Itself? in which we concluded:

A quadruple top breakout is in the making, anything can happen here, don’t initiate new positions (it’s too late, we were screaming from the roof to enter gold & silver in the first week of October, even in the public space with this post published on Oct 8th Gold’s Leading Indicator Among The Most Bullish Readings In The Last 10 Years). It’s a HOLD for now, it will get interesting and volatile, it’s pointless to stand in the way of the largest traders now.

This quote says it all: “It will get interesting and volatile, it’s pointless to stand in the way of the largest traders”

We also said:

We prefer to watch the gold market, going forward, not actively participate, as volatility will pick up.

So, increased volatility was to be expected. The best time to enter was 8 weeks ago, when we said so. Now we wait, especially if there will be a rotation out of gold into silver. Now THAT would make tons of sense, in our view, as Silver Will Soon Start A Rally To 50 USD and it might happen with profits realized on the price of gold (by the largest traders who are moving this market).