Gold is doing what we expected it to do: confirm a bullish reversal. For 9 months are we pointing to the bullish setup in gold, with a series of higher lows. Last week, the gold market confirmed its bullish intent. We don’t think this setup will lead to a breakout in the next few days, we rather expect a consolidation. Gold is getting too much attention, right now, it can’t break out yet. The market will first need deviate the attention of most participants after which it can ‘suddenly’ and ‘unexpectedly’ initiate the gold breakout. Our 2022 gold forecast and silver predictions will be confirmed, mark our words!

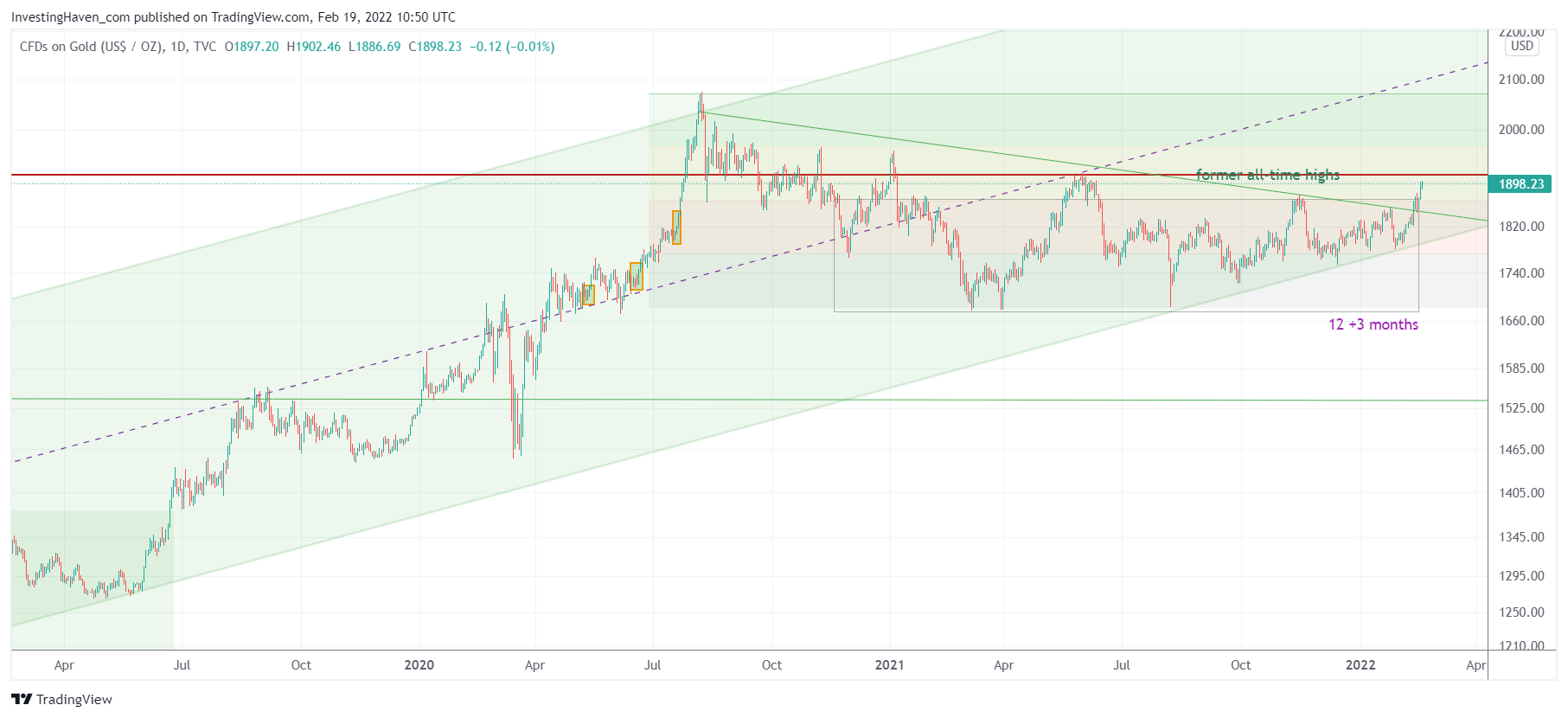

The daily gold price says it all: a bullish reversal is near completion.

There is still work to do, let’s be clear. The 2011 highs around 1915 USD/oz need to be cleared. But the confidence that we get from this bullish setup makes us think that it’s a matter of time until 1915 USD/oz is cleared.

The bullish setup has 2 ‘components’. On the one hand, the long bullish reversal (18 months in the meantime) right below the secular breakout level (2011 highs). It’s as clear as it can get. On the other hand, the long term rising channel was confirmed with 3 touches, the first one was the August 8th pre-market sell-off, the last one early February this year.

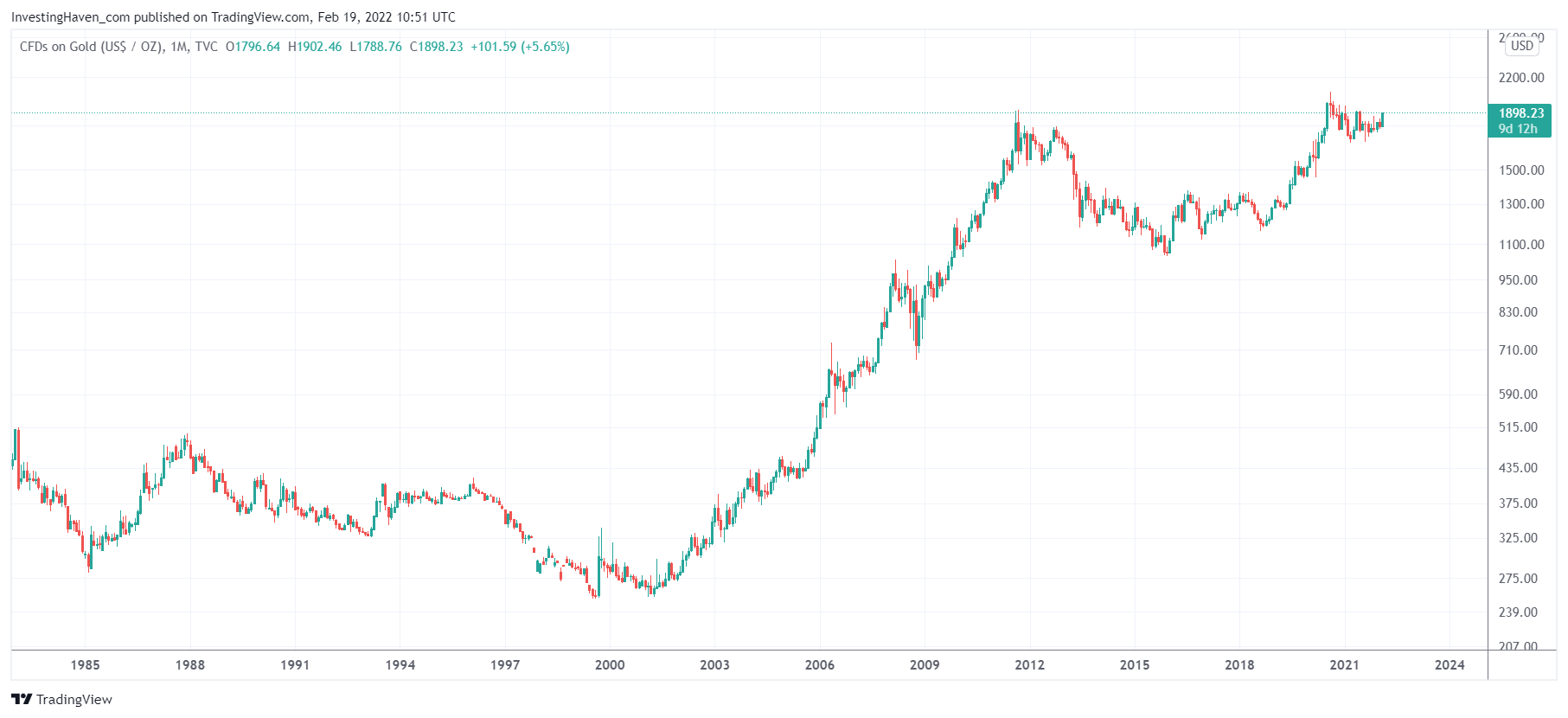

In the meantime, the monthly chart over 40 years is absolutely phenomenal and powerful, both at the same time.

Will gold break out next week?

We don’t think so, because it’s too obvious as a breakout play now. Remember this:

The market is never obvious. It is designed to fool most of the people, most of the time. Jesse Livermore

So, we expect that the market will attract the attention to something else, maybe a flash crash in stocks as explained last week in Volatility A Pressure Cooker, Is A Flash Crash Underway?

Once ‘everyone’ is focused on the other side of the market, we expect gold to take off.

Silver will follow, but will go much harder and much higher, as said repeatedly Silver: The Big, Really Big Breakout Underway?