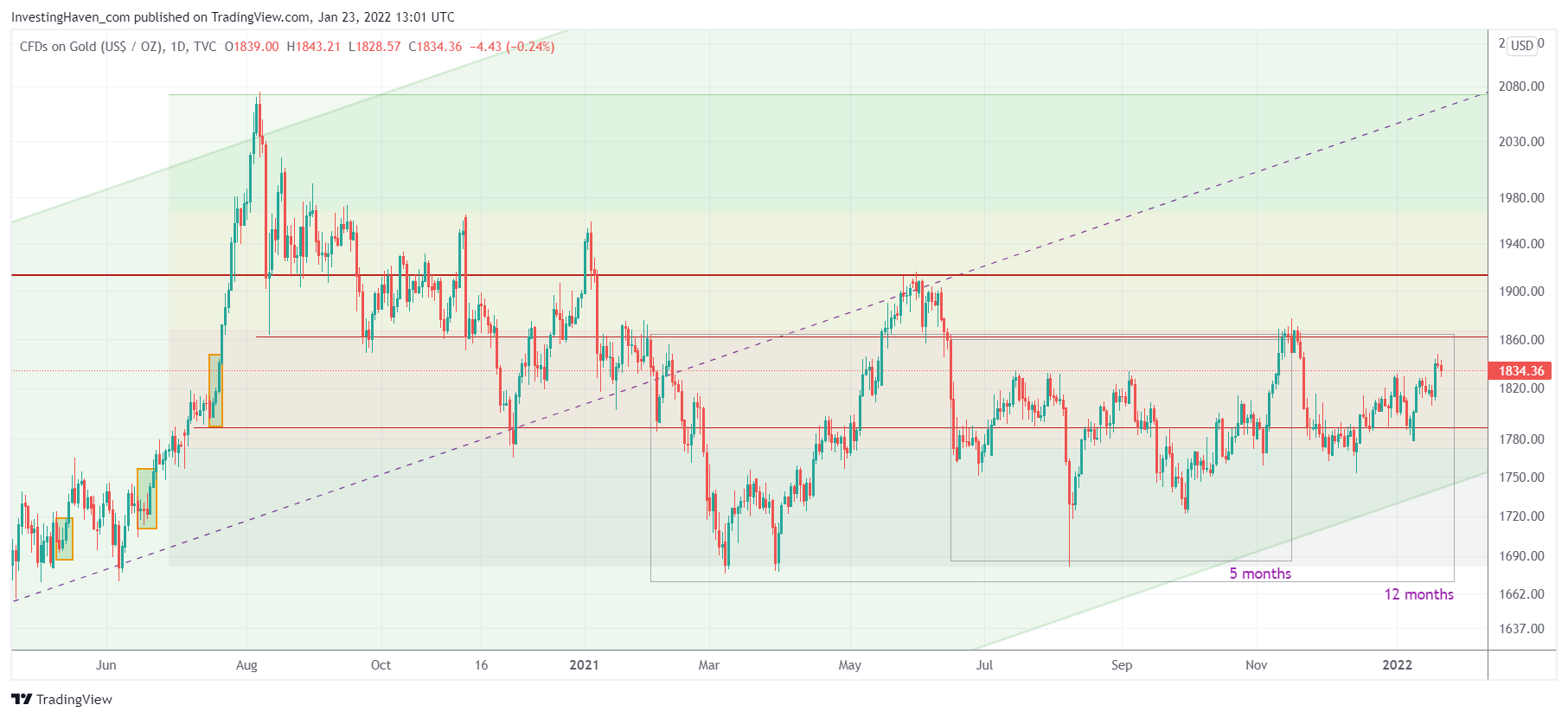

It’s funny how many investors simply had no interest in gold in 2021. We stayed factual, and the chart showed an ongoing reversal that kept on improving. Next week, gold will be completing a 12 month period below the important 1860 USD/oz level. Better watch what happens at that level, in the next few weeks and months, as it might be giving us clues about our bullish targets outlined in our gold forecast! Note that the silver setup is much more aggressive, and gives us much more aggressive bullish targets as explained in our silver forecast.

Last week was really horrible in markets. Tech stocks sold off, the Russell 2000 started an epic breakdown, most stocks went down sharply. Not so with our green battery metals, they closed the week around the same levels as their opening prices. This might change is selling pressure escalates, but it’s clear where the winners reside.

Gold and silver performed well, in relative terms. They are not ready to start a big bull run, but they are preparing a bigger move, it’s clear from the chart.

Below is the daily gold chart.

The reversal which we have been tracking for many, many months is now crystal clear: it’ a bullish reversal!

There is a series of higher lows, the structure of the chart (also the candles) is getting smoother. This bullish pattern is being printed right below ATH which were printed in 2011.

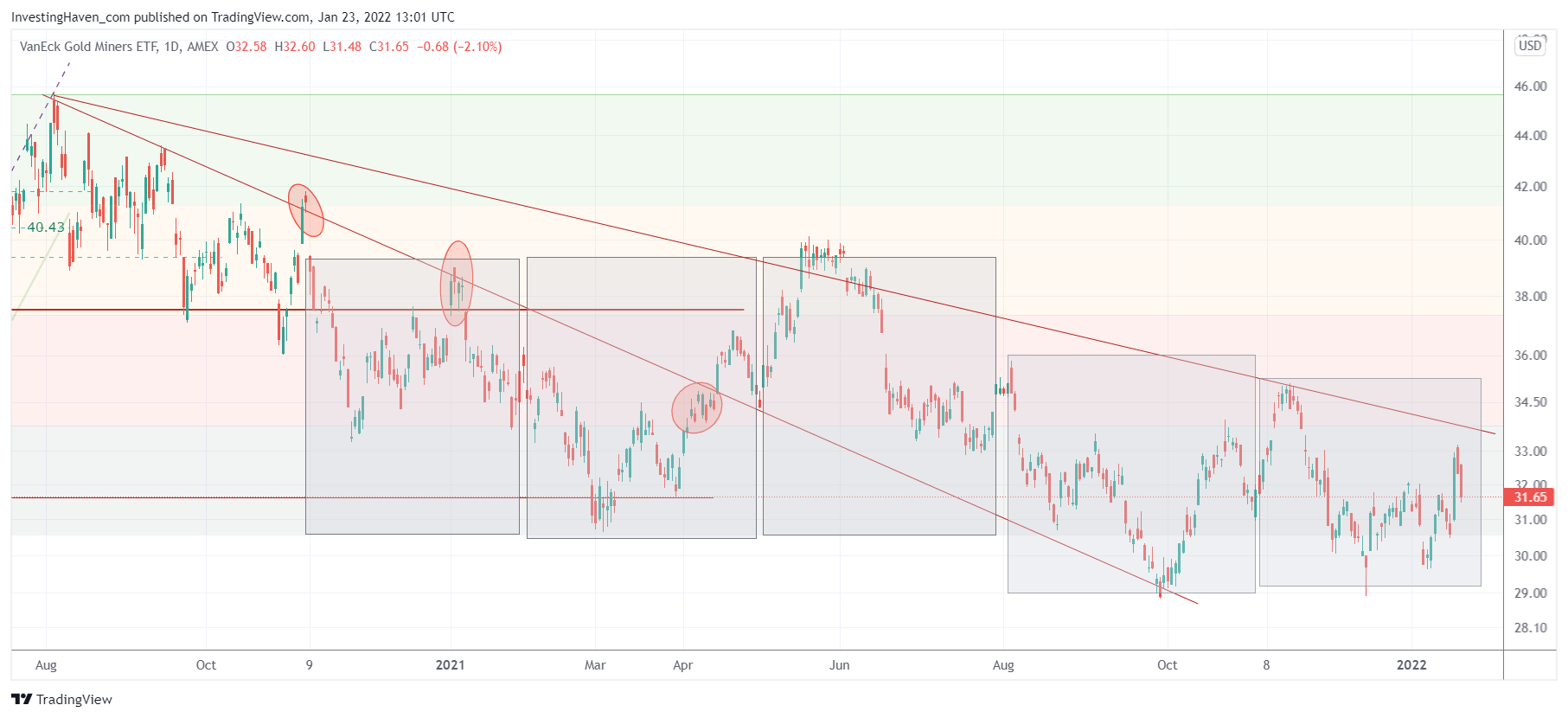

The question is whether investors should buy bullion (e.g., physical or GLD ETF) or gold miners.

The GDX ETF chart shown below is certainly NOT as strong as the gold chart shown above. It is clear, at this very point in time, that bullion has a stronger profile.

One way to think of it is to park some capital in the slow moving GLD ETF. A portion can go in the more aggressive SLV ETF.

Another way to think of it is to look for the very best miners. Only the best, the strongest, which requires to find the top 3 of all gold miners out there.

In our Momentum Investing portfolio we will start guiding members to profit from the bullish gold and silver reversals in 2022. We will try to pick two, max three miners.