Gold is trading around $1500. This is just 4 pct below our $1550 price target which we published a year ago in our Gold Price Forecast For 2019. Investors who are late to the party should not aim for this last 4 pct upside. At all, it will be counter productive. Where there are still opportunities is in the rest of the precious metals complex: the silver market (silver price and silver stocks) as well as some top gold stocks.

The reason we believe the upside potential in gold is limited is not only because we said so in our forecast, which was also published on MarketWatch and Barron’s with these headlines: Why gold’s a ‘bargain’ at less than $1,300 an ounce (MarketWatch) and How Gold Could Stage a 20% Rally This Year.

The real reason is because of one the leading indicators for the gold price: COTs.

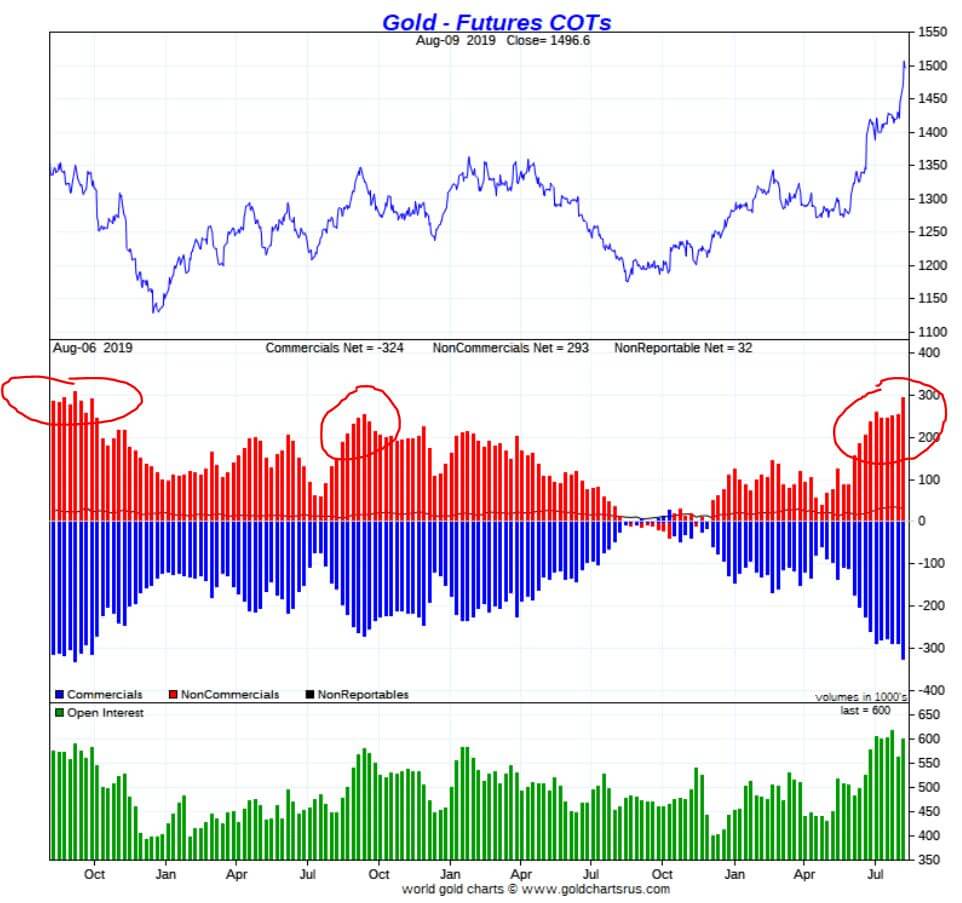

As seen on below chart, courtesy of Goldchartsrus, the gold futures market arrived at extreme readings.

Pay special attention to the extremely high levels of net long positions of non-commercials, the red bars in the center pane. Combine this with the extremely high levels of open interest on the lower pane, the green bars.

What we read in these charts is upside vs downside potential. It’s not a timing indicator, but rather an indicator for the direction and potential of price swings.

Right now, with extreme bullish levels, there isn’t much potential for further gold price increases in the short to medium term. With the next gold price sell off we want to see a fast decrease of these levels to clear the way for more upside potential.

Very important: silver has no similar extreme readings, which means there is more upside in the short term in silver. Also, with gold’s bullish energy, it triggered a bullish wave in gold and silver stocks. It is perfectly possible for gold to trade a few weeks in the current range in which gold and silver stocks continue their rise. In fact, it is the most likely path we project.

That’s why we tipped a top silver stock in this week’s special investing opportunities series. Want to receive these top notch articles as well, then just simply sign up for the free newsletter as explained below.

[Ed. note: As of this week we will provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific investing tips on a weekly basis, mid-week, free of charge. We will do this for 4 months. Subscribe to our free newsletter and get premium investing insights in 2019 for free.]