Silver stocks (SIL) acted rather weak this year, on a neutral to bearish silver (SILVER) price. Will this trend to continue in 2019 or will things get better for silver stocks? Read our viewpoint in our silver stocks forecast for 2019.

Needless to say, our silver stocks forecast for 2019 will be largely determined by our silver price forecast for 2019.

[Ed. note: This silver stocks forecast 2019 was originally published on October 3d, last year. Readers can verify this by checking the dates on the charts. Throughout 2019 we will continuously update this silver stocks forecast, every 6 to 8 weeks approximately. The new updates will appear at the bottom of this silver stocks forecast. It allows our followers to track the evolution of the silver stocks market as well as our silver stocks forecast. With every major update in 2019 we will also update the publish date. Last update of this silver stocks forecast: February 17th, 2019.]

Silver price forecast 2019

In our recent silver price forecast we conclude the following:

Our silver price baseline forecast is $17 to $21.50. We prefer to work with a range, not a specific price point. That’s area (4) on below chart.

However, if the bond market outflow, as explained above, will result in an inflow of capital in commodities and stocks, resulting in a sudden rise in inflation and ‘risk on’, we will see a strong breakout in silver above $21.50. In that scenario we forecast $26 for silver in 2019. The probability is just 20% though.

Moreover, as explained in Major Turning Point: End Of 40-Year Bull Market In Bonds there will be seismic shifts in markets in 2019 and beyond once 10-year Treasury Yields confirm their breakout above 3.10. This quote is one of the most important ones you will read this year as well as in 2019!

A massive level of capital, never seen before, in the order of $40 trillion, will start moving around. Obviously, not all of it, but a considerable part will move elsewhere. Can anyone imagine what will happen if this becomes a trend into the same direction. Correct: stampede.

Massive outflow out of the bond market will push capital to stocks and commodities. Consequently, capital will flow out of the US Dollar. In such a scenario we expect a sudden hit of inflation. If, and that’s a big IF, that were to happen, we see a sudden rise in commodities and inflation indicators which, combined, will push the price of silver much higher in 2019. The probability of this top happen is 20% according to us.

These are the most important quotes from our silver price forecast, which are critical for our silver stocks forecast for 2019.

Silver stocks forecast 2019: fundamentals vs. chart

We can try to do fundamental analysis, similar to this great piece silver stocks fundamentals article, but we don’t see value in it. The reason is that fundamentals of silver miners may be great, even outstanding, but as long as the price of silver is not moving, silver stocks will go nowhere, literally.

That’s why we don’t spend much time on fundamental analysis of silver miners, but prefer to focus on the silver price forecast (see highlights above) as well as the silver stocks chart (see below).

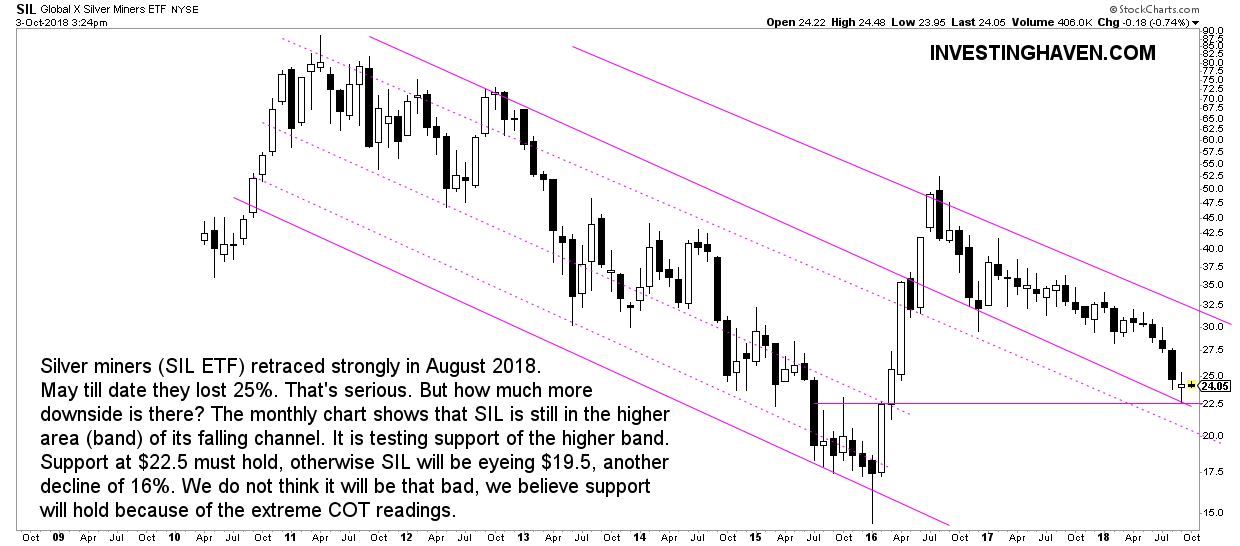

The monthly silver stocks chart reveals some very interesting insights.

First, the falling channel is still intact. No surprise, silver stocks got slashed since they peaked in the summer of 2016.

Second, peak to trough, from summer 2016 till September 2018, the decline was slightly more than 50%. This is typically a level of decline that comes to an end.

Third, since 2016 silver stocks move in the higher band of their long term falling channel. That’s a good thing.

Fourth, silver miners represented by SIL ETF tested their breakout level of April 2016. Now this is a very powerful point. We believe this is support on steroids.

Combined with the silver price forecast which is mildly bullish, we believe the bottom in silver stocks is in, and our silver stocks forecast for 2019 is also mildly bullish. We expect silver stocks (SIL ETF) to rise to 32.5 points, at a minimum, and potentially even to 42.50.

If, and that’s a big IF, the bond market starts crashing, in line with our expectation, and capital does not flow massively to the USD, then we expect silver miners to be a big beneficiary, and silver stocks may be wildly bullish in 2019 and beyond. The 52.50 level will be crushed in that scenario. Again, this scenario has a 20% probability.

Silver stocks forecast 2019: silver stocks to S&P 500 ratio

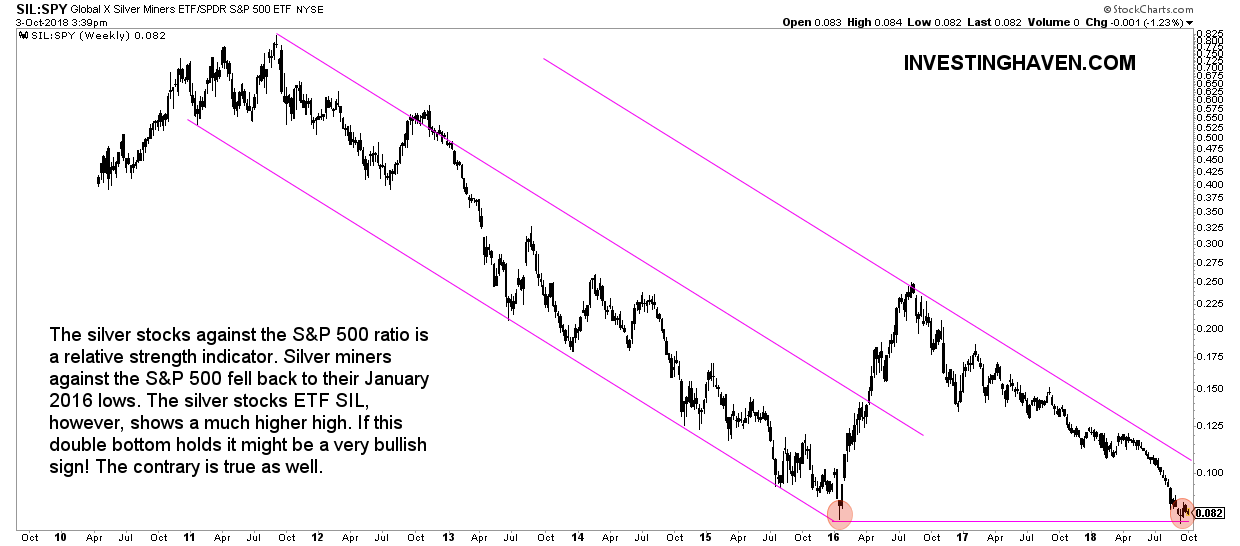

We get additional evidence from the silver stocks to S&P 500 ratio.

As said many times before this is not a primary or leading indicator. Any ratio is a secondary indicator, meant to provide additional evidence.

The silver stocks to S&P 500 ratio (below) shows a different picture as the long term silver stocks chart (above). What really stands out is the test of the January 2016 lows. The recent decline bottomed exactly at the same level as the bottom 2.5 years ago.

This ratio is not going to determine any price level which is useful for our silver stocks forecast for 2019. However, it is helpful in understand how relative weakness has gone so far that it provides additional evidence that the bottom might be in.

Silver stocks forecast 2019: leading pure play silver stock

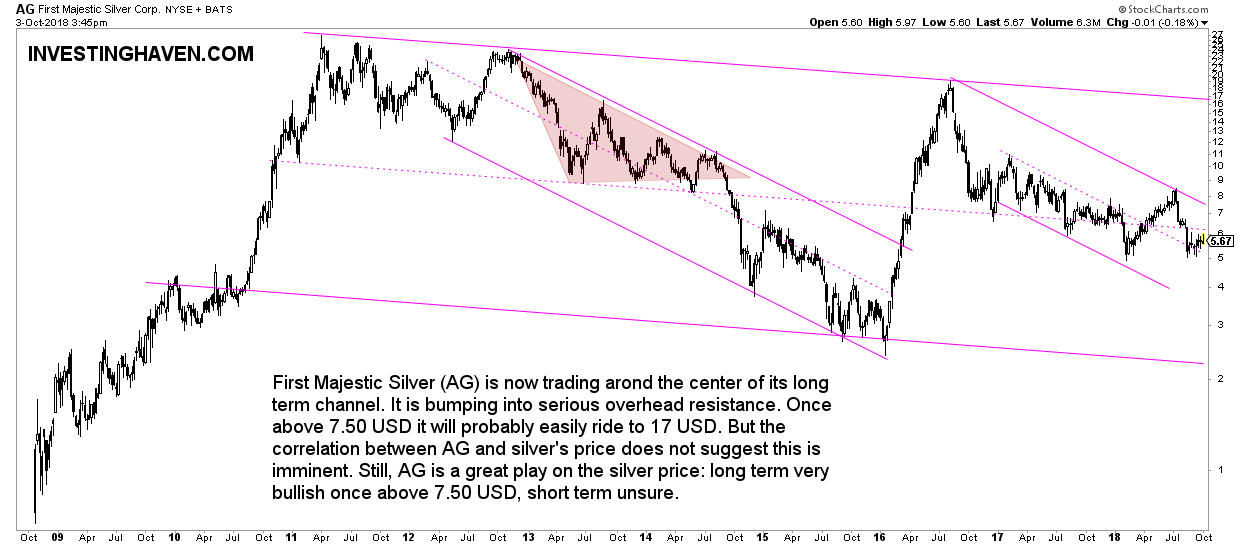

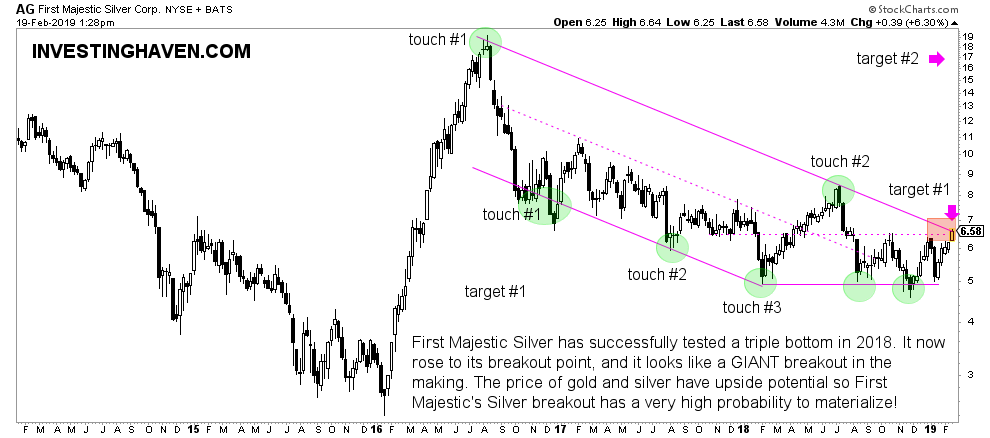

Very useful in our silver stocks forecast 2019 is to look into the largest pure play silver miner: First Majestic Silver, symbol AG. Also be sure to check out our First Majestic Silver Stock Forecast for 2019.

Three months ago we wrote this when First Majestic Silver (AG) showed exceptional strength, for sure against all other silver stocks: “Given all this, we believe that First Majestic Silver is bought on speculation. Prices can certainly go higher, but given the speculative nature the question is whether it is justified to go long at this point from a risk management perspective.” That’s close to the peak seen on below chart, in June of this year.

Since June 30th of this year, when First Majestic Silver published its earnings report, there has been no communication or news whatsoever according to the silver miner’s site. This confirms our point that silver stocks are highly reliant on the silver price.

First Majestic Silver (AG) is now trading arond the center of its long term channel. It is bumping into serious overhead resistance. Once above 7.50 USD it will probably easily ride to 17 USD. But the correlation between AG and silver’s price does not suggest this is imminent. Still, AG is a great play on the silver price: long term very bullish once above 7.50 USD, short term unsure.

** Update on January 6th, 2019 **

Silver stocks forecast 2019 underway with this breakout

Very encouraging signs are visible in the silver stock sector.

Interestingly, only Bloomberg reports on this. This article explain how strong the gold and silver stock segment has performed in recent weeks, and how this was the best December in a decade. Readers can check the Google news feed on silver stocks, nothing to see.

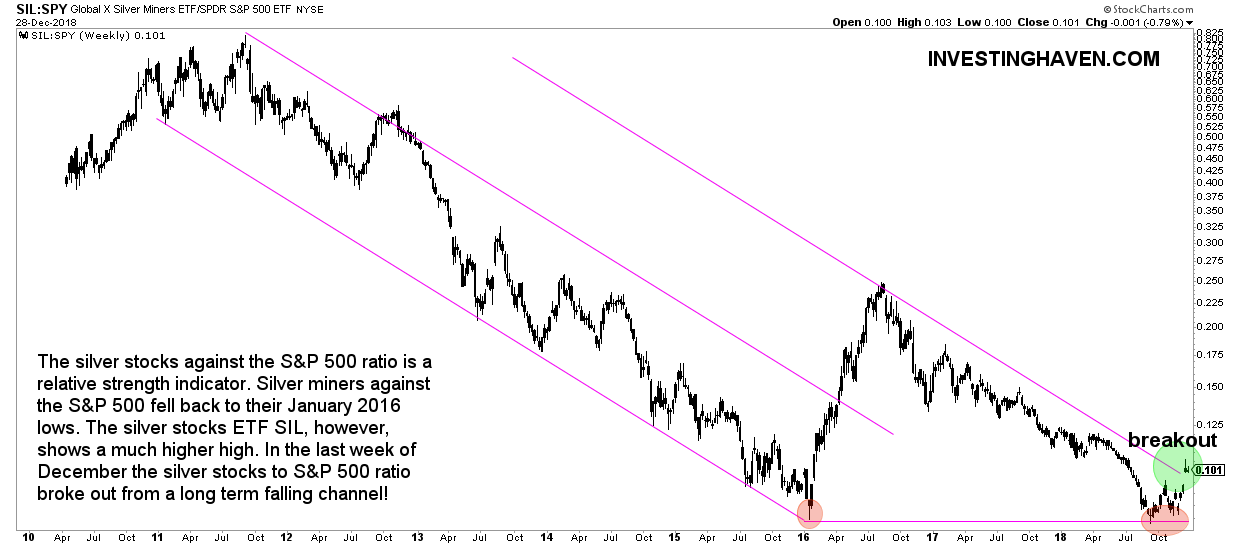

One of the indicators discussed in this silver stocks forecast, in the original part of the article, was the silver stocks to S&P 500 ratio.

What really stands out is this giant double bottom in which the January 2016 lows were re-tested in October-November-December of this year, essentially Q4 of this year. The recent decline bottomed exactly at the same level as the bottom 2.5 years ago.

But this is not the key argument for the silver sector. The precious metals space is deeply undervalued is the right take-away from this chart. And, on top of this, with a falling set of broad stock market indexes it makes sense that money flows into deeply undervalued sectors. That’s the right way to read the next chart.

** Update on February 17th, 2019 **

Silver stocks forecast 2019 almost confirmed, giant breakout in the making

We see extremely encouraging signs in the silver sector. Especially silver stocks will be beneficiaries if this bullish price action continues for just a little longer.

First, the price of silver continues to look increasingly bullish.

As said in today’s silver price forecast article update (look for the hyperlink at the top of the current article) there is a breakout on the weekly silver price chart timeframe. This is of course incredibly bullish.

The monthly silver price shows the beginnings of a new and future rising channel. It suggests the silver price to rise at a minimum to $20-21 and best case to the $28-29 range.

When it comes to silver miners we have the monthly timeframe embedded below.

The silver miners are testing a breakout point as well. This is a crucial time period as any push higher from here will be in breakout territory.

We cannot stress enough the importance of this type of event! It has incredibly bullish implications on the short to medium term.

Silver miners are known to rise very fast and aggressive as of the moment they become bullish. They can easily rise 2-fold to 3-fold in ‘no time’.

If and when this breakout in silver stocks takes place we may expect silver stocks to double in a matter of 2 to 3 months.

As we look for silver stocks news, interestingly, there is nothing, absolutely nothing to see on any major financial media! It’s beyond us, how silent this bull market is about to evolve.

We checked major sites like Investopedia on silver stocks news, nothing to see. Google News has absolutely nothing to tell about silver stocks. Obviously it’s not Google, it is financial media that do not consider this sector ‘hot’ enough to talk about it as advertising would not sell (it only sells once it gets mainstream attention which is when prices have risen too high). Even NewsNow has in its silver section no sign whatsoever of coming excitement and breakout signs in its silver section.

This is incredible!

An even more interesting chart is the one we featured above already twice. It comes handy to track its evolution.

This is the silver stocks to S&P 500 ratio, a gauge for relative strength of silver stocks against broad markets.

- Back in October, as seen above, the key topic was whether the market would prevent a breakdown or not.

- In January of 2019 it was about the start of a breakout, so that’s a much more bullish setup.

- In Feb of 2019 it is all about the confirmation of a breakout.

What we are looking at now is to get a confirmation of our bullish silver stocks forecast. We will know for sure that this breakout is for real if we have 3 weekly closes above 0.12x.

Last but not least First Majestic Silver, our favorite silver miner. This one is also showing a giant breakout in the making. In fact, today, Feb 17th, it is trading right at the breakout point.

Any push higher from here, which seems almost inevitable with giant breakout setups all over the place in the precious metals space, is going to send this stock 2 to 3 multiples higher in 2019.

Did we say that we feel comfortable our bullish silver stocks forecast will play out in 2019?