Are we about to witness a once-in-a-generation market turning point? The probability is very high that the answer is ‘yes’. The bond market has arrived at such a pivotal point. A small push higher in interest rates, and it would confirm that the 40-year bull market in bonds in the U.S. has ended. That’s correct, a 4-decade bull market in bonds (bear market in yields) is about to make place for a new bear market in bonds. When do we know for sure, and what does this mean to investors?

Note that, technically, it is a 37-bull market right now. But for the sake of simplicity let’s use rounded figures in this article, and continue with ’40-year bull market in bonds’.

Make no mistake, a 40-year bull market in bonds is, by far, the longest active bull market. A turning point in the 40-year bull market in bonds is not only major news, but also comes with major implications.

Let’s lay it out in plain simple terms: if this 40-year bull market in bonds in the U.S. turns into a bear market, with a U.S. bond market size of almost $40 trillion in Q1 of 2017, there will be capital seeking a new home to a level never-seen before.

40-year bull market in bonds: the news

It is a bad habit, admittedly, and every time again we come to the same conclusion: news is the lagging indicator, and smart investors do not really on news because the 1/99 Investing Principles.

As per Forbes the end of the 40-year bull market in bonds will have major implications, unsurprisingly. However, this is really one of the few articles that we like, really. It is the 1% that is worth reading and reflecting on. This is a crucial quote in there:

The failure of getting inflation to rise over the past eight years has thrown a monkey wrench into the central bank strategies of the last 60 years. The game plan was to create long-term inflation, in order to reduce the real governmental debt outstanding, and diminish the real size of that debt mountain. In other words, inflation was the silent tax on individuals. However, nothing is forever. A huge trend change could be starting now. Central bankers will cheer and encourage that trend. A cheaper dollar will be one of the goals.

Pay special attention to the last sentence, in bold (emphasis ours), as that’s for us the key theme: intermarket effects.

In other words, a massive level of capital, never seen before, in the order of $40 trillion, will start moving around. Obviously, not all of it, but a considerable part will move elsewhere. Can anyone imagine what will happen if this becomes a trend into the same direction. Correct: stampede.

Do we know at this point in time in which direction exactly markets will trend? The answer is “no”, and the key point is that new trends will become visible, so it is imperative to monitor markets very closely now, all markets, in order to understand which trend(s) will arise.

As always, there is this opposite side of the story that is there to confuse people. Here is a MarketWatch story that comes with an exotic viewpoint on the bond market, the opposite of the one mentioned above, with this quote summarizing the future of markets:

“In the long term, Gurevich expects the U.S. economy to look more like Japan’s. “We have structural issues like aging demographics, while increasing the budget deficit is deflationary. If that view is correct, then 10-year yields will eventually go into negative territory. From this perspective, the bond rally hasn’t happened yet,” he said.”

40-year bull market in bonds: the most important chart in the world

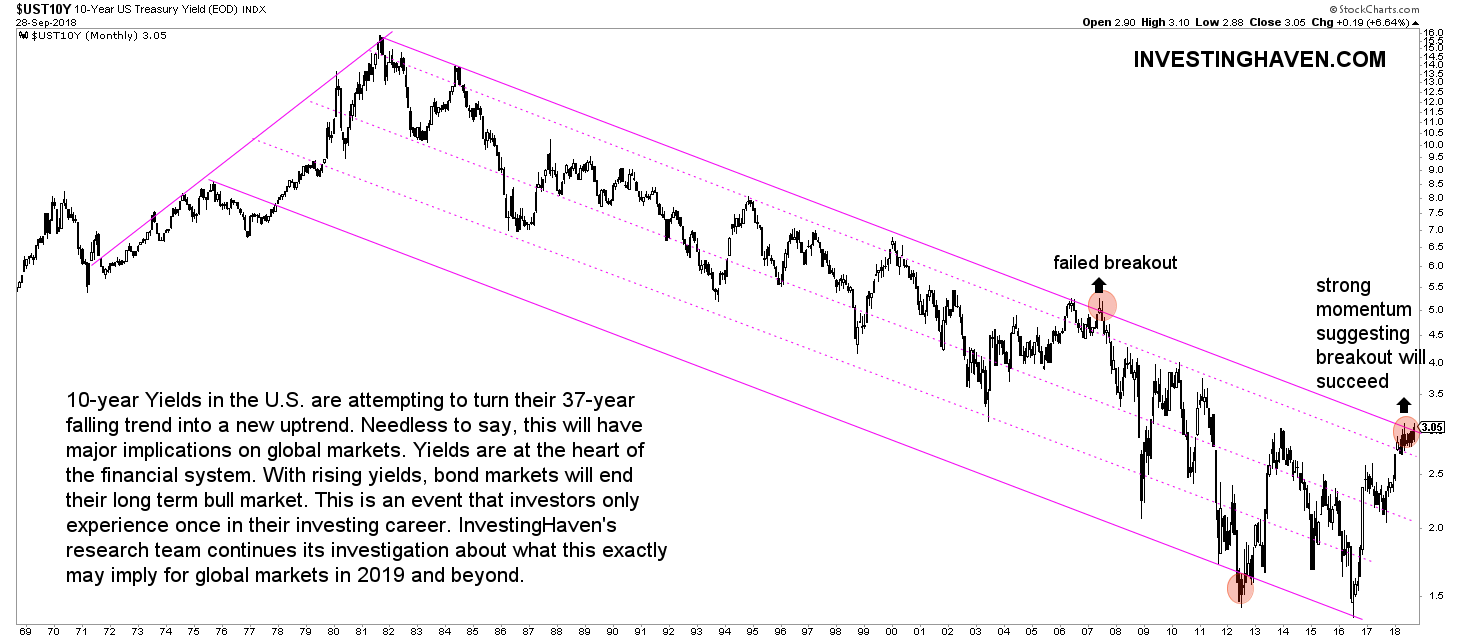

The historic chart of 10-year Yields in the U.S. visualize our point.

Remember that Yields and bonds are inversely correlated: the lower the Yield, the higher the bond price. So the long term Yield chart provides the insights we need.

As seen on the chart there was an impressive bull market in bonds (bear market in Yields) that started with the peak in 1982. Back then, central planners decided to rise inflation by means of rising rates. It got out of hand.

Be that as it may what is way more important for us, today, is the effect of a turning point, the one that we see happening on the chart. Note that this momentum build-up did never take place before: all tests of resistance were short-lived.

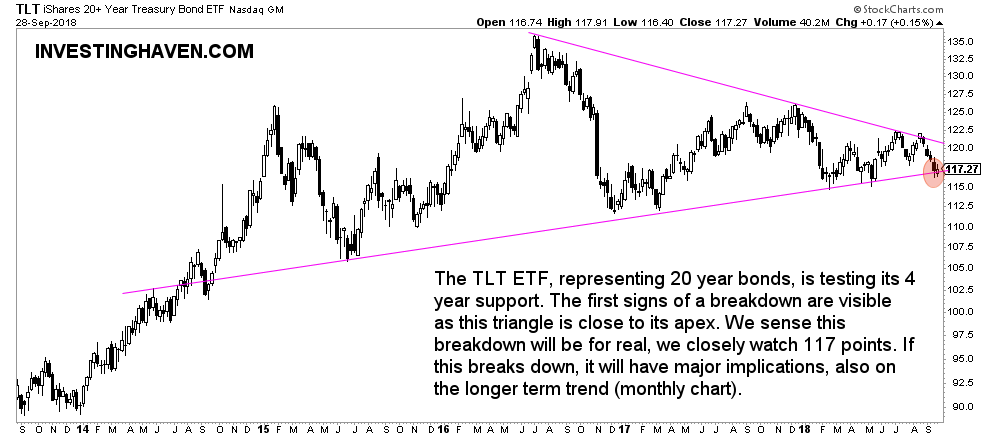

From a different perspective the TLT ETF, representing 20 yr treasury bonds, show the start of a breakdown on the weekly chart.

This is meaningful. The weekly chart represents 5 years, so a pattern that is in play for 4 years, that will get broken to the downside, is significant! We watch the 117 point level closely.

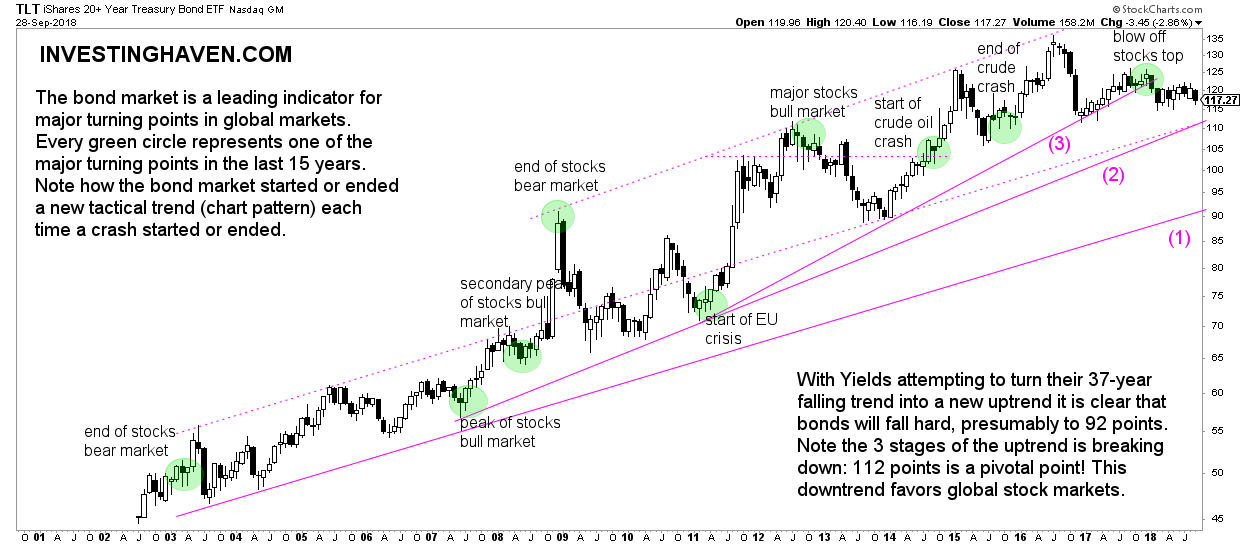

Zooming out the TLT ETF chart we see what a breakdown on the weekly (chart above) may imply in the bigger scheme of things.

The monthly TLT ETF chart has the typical 3 level bull market, a pattern which comes back over and over again. Think of the major gold bull market between 2001 and 2011, which also had 3 levels in its uptrend. Or the Bitcoin uptrend between 2015 and December 2017.

As seen, the fastest rising trendline got broken in January of this year. There is some 7% downside until trendline (2). Ultimate support will sit at 92 points.

Time will tell whether the bond market will totally crash, too hard to forecast this right now.

One thing is for sure: the exodus out of the largest asset in the world will create ripple effects, and there will be great opportunities.

Our advice is to closely watch what the U.S. dollar will do on its chart. Any weakness will be amazingly bullish for commodities and stocks. The opposite is true as well. This is a time in which chart analysis will pay off big time as charts will reveal all new trends.