Dollar weakness is boosting precious-metals ETFs like GLD, SLV, and PPLT, creating strong momentum and investor inflows.

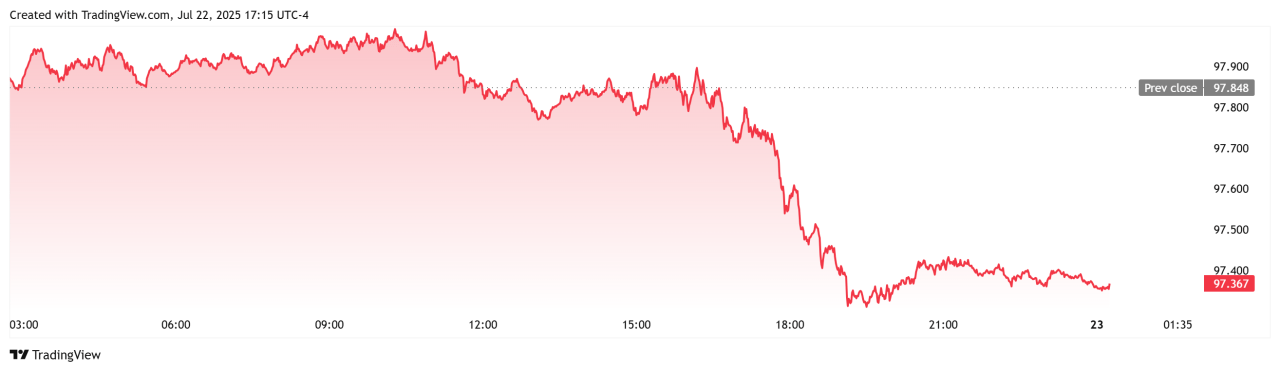

In recent weeks, the U.S. dollar has softened significantly, with the DXY index hovering near 97.4, its lowest in over a year, as it struggles to reclaim its 50‑day moving average.

This sustained dollar weakness has brightened the spotlight on precious‑metals ETFs that typically thrive when the greenback falters. For investors, that means fresh ETF inflows and compelling entry points.

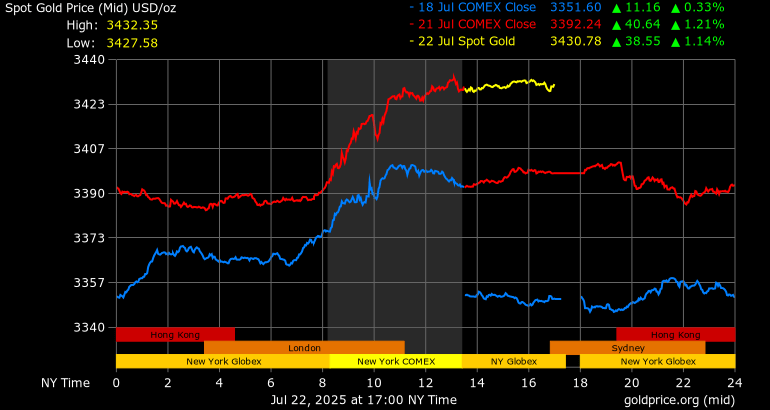

Weekly Gold Price Analysis

Our public blog posts typically share high level insights that are not actionable. For actionable insights, we recommend considering our detailed gold & silver price analysis. It is a premium service, covering leading indicators of the gold price and silver price. Premium service: Gold & silver price analysis >>

Dollar Drag and ETF Boom

A sliding dollar boosts demand for dollar‑priced metals, making bullion and related ETFs more attractive.

Barron’s research shows that during recent dollar dips in February and May, VanEck Junior Gold Miners ETF surged about 34% and 15%, while abrdn Physical Platinum ETF jumped 45%, and iShares Silver Trust (SLV) returned 5% – 12%.

Simultaneously, spot gold reached $3,389.98/oz, its strongest since mid-June, on the back of weaker dollar and Treasury yields.

Top Precious‑Metal ETFs to Watch

Gold‑centric funds are riding the trend. SPDR Gold Shares (GLD) is up roughly 27% year-to-date, fueled by a record $38 billion in ETF inflows during H1.

In silver, SLV has gained about 27% this year, with silver trading above $37 – $39/oz, its highest in over 13 years. Meanwhile, platinum-focused PPLT (abrdn) has rallied nearly 50%, supported by rising platinum prices and tight supply.

Finally, the junior miners ETF gives high leverage to gold moves, ideal for aggressive investors.

Why the Dollar is Slumping — and What It Means

Multiple factors are dragging the dollar down: deepening U.S. fiscal deficits, trade tensions (especially looming tariffs), and expectations of Fed rate cuts or delays, all favoring precious‑metal gains.

As long as the dollar remains pressured and Treasury yields stay low, metal ETFs should continue to outperform, especially those offering direct or leveraged exposure.

Conclusion

Dollar weakness has set the stage for precious‑metals ETFs to shine. Key funds to watch include GLD, SLV, PPLT, and VanEck Junior Gold Miners. If you are investing, ensure to track DXY levels (97 – 100), Fed messaging, and Treasury yields for future ETF momentum cues.

Our most recent alerts – instantly accessible here

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)

- The Two Only Silver Charts That Matter In 2025 (July 6)

- Quarterly Gold & Silver Charts Are In, Here’s the Big Picture (June 29)

- Gold & Silver – The Big Picture Charts That Matter (June 21)

- Gold & Silver Shine but Not Simultaneously… The Market Loves To Confuse Investors (June 15)

- Silver On Its Way To 50 USD/oz (June 8)

Read them all here