It is starting to get serious out there. The number of banks that are charging money (read: negative interest rates) simply to hold your savings on a savings account is growing. And it’s getting scarily close to everyone, not only high net worth individuals. What’s the way out? One thing investors have to remember is that there is not one answer to this challenge, it has to be a mix of answers. One of the answers we see is investing in the single most powerful trend of this decade, and pick out a few very promising companies (stocks) to hold for the long term. Which trend? According to our analysis it is green battery metals that is the most promising mega trend, as explained in the Biggest Investing Opportunity Of This Decade and Super Cycle In Green Battery Metals Starts In 2021.

What are negative interest rates? More about it here (The Guardian), here (BBC) and here (Bankrate).

The purpose of this article is not to go into detail in negative interest rates. The fact that humans have to pay to their banks for holding their capital is a drama, so let’s not focus on the problem. We want to focus on solutions, and in this article we offer one solution.

Green battery metals: the mega trend

Let’s summarize our rationale for concluding that green battery metals are starting a mega trend which will last several years.

From the first of the 2 articles we mentioned in the introduction:

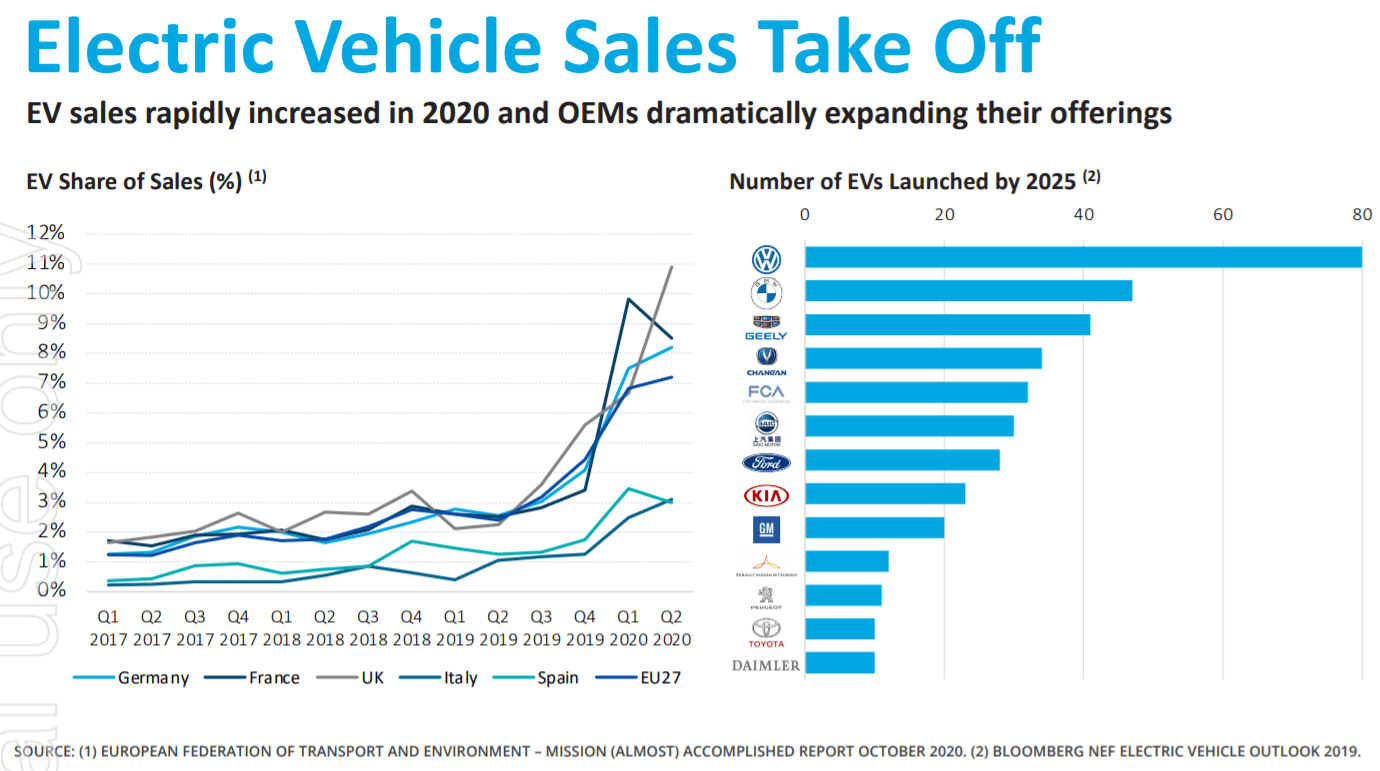

“Electric vehicle sales are only starting to take off. Major car producers are starting a new wave of mass production. It’s just the start, so we cannot look around us and observe how big this trend is. It is the start. And as we know financial markets are great in ‘sniffing’ new trends, and anticipating 6 to 9 months before trends make it into the real world.

Green batteries for cars, planes, but also homes. Will this be the next big thing. Will this offer once-in-a-lifetime type of opportunities?

It could be. Probably it will. But specifically the commodities that are inputs into this secular renewable energy wave. Why? Simply because of the big rotation that comes with market crashes. We saw this in 2000 and 2010 so we should see it again in 2020 and beyond. It is commodities that came out of a major bear market, so some segments in the commodities space should create a secular trend in 2020 and beyond.

Moreover, we continued our thinking and concluded in the 2nd article mentioned in the intro of this article:

History shows that bull runs in these metals don’t happen concurrently. They rise one by one. As an investor the trick is to be go overweight, per strategic metal, as each bull run unfolds. It’s ok to keep a one or two smaller allocations for the long term, but we want to have a larger allocation in each bull run. That’s exactly the strategy we will apply in this strategic metals super cycle, particularly in our Momentum Investing strategy and portfolio.

So… buy BATT ETF, right? The battery metals ETF is going to offer an easy solution?

Not really, because BATT ETF offers a mix of miners and producers. Think EV producers like NIO, but also electronics producers like Samsung.

What’s wrong with that?

A lot, because producers have to heavily invest in upgrading their production facilities. There is no ‘native green battery metals’ company out there other than Tesla and maybe one or two other exceptions.

We believe investors have to focus on the inputs, the producers and explorers (higher risk) of the real stuff: strategic metals.

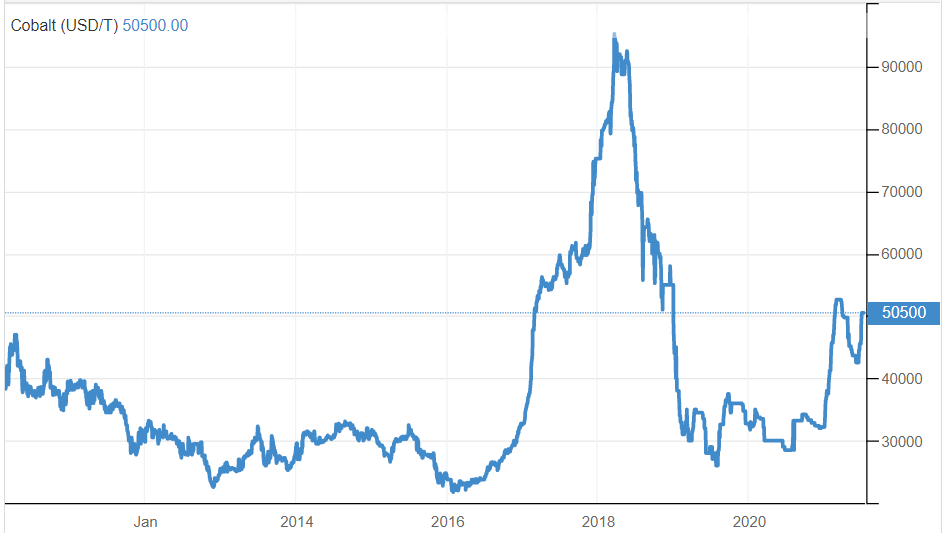

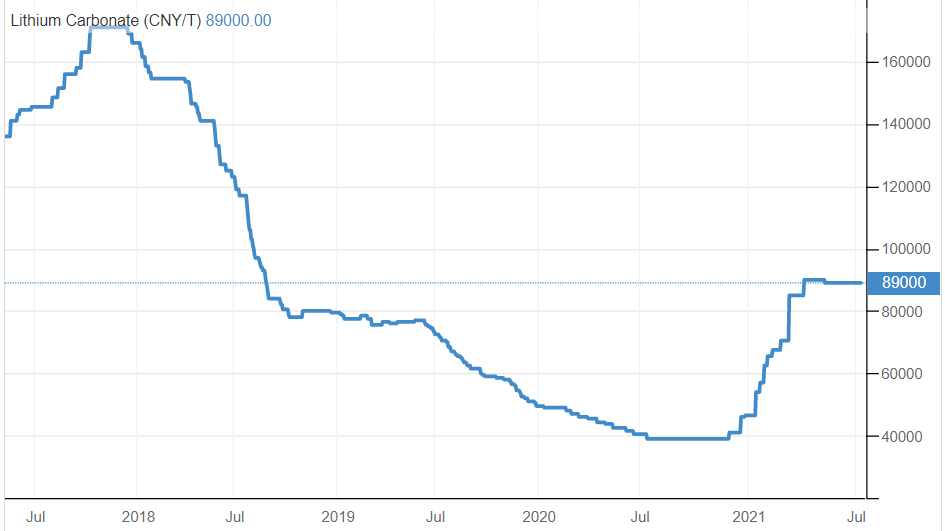

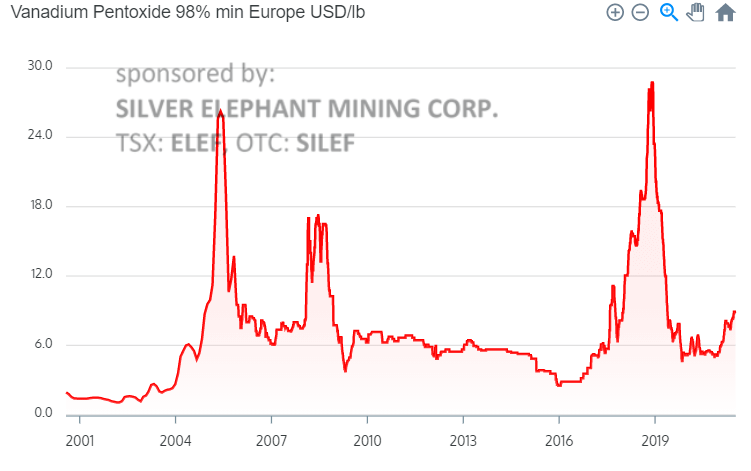

Think rare earths, think vanadium, think lithium and cobalt.

Our point becomes clear when checking the long term chart of some of these metals.

Cobalt in a secular uptrend, presumably about to double.

Lithium in a secular uptrend, presumably moving to previous all-time highs.

Vanadium, breaking out after a 2 year consolidation. Presumably about to triple, if not quadruple.

What do you think producers and explorers of these metals will do? Indeed, they will go ballistic.

How to pick future winners? And how to know you are not over-invested?

The second question is the easiest one: use your common sense! Never over-invest in one sector, unless you really (really) know what you are doing (i.e., have done this successfully at least 5 times). Only invest a portion of your investable assets, diversify between producers and explorers, only make a decision after doing your due diligence, don’t go all-in (take partial allocations over time).

On the first question “How to pick future winners” we covered several stocks especially in Sydney in our Momentum Investing premium service. Will all of them succeed? Presumably, but there is a risk. On the flipside we believe we will hit multi-baggers with our selection of stocks provided we wait long enough. Maybe, just maybe, investing in some green battery metals stocks for the very long term (accepting they may go down and avoiding to trade them) might be a solid answer to the negative interest rates drama.