We do stick to our bullish silver forecast simply because the data points suggest that silver will turn bullish in the near future. This might start early 2023 or near the end of 2023… or somewhere in between. We expect silver to be more bullish than gold, as per both the detailed analysis in our silver and gold forecast. With that said, there is one more data point that might not be the immediate catalyst for silver’s price to move higher but more of a support data point: the supply/demand imbalance in the silver market in 2022 is shaping up to be of epic and historic proportions.

We have covered silver extensively in our recent writings:

5 Investing Tips For 2023 in which we tipped silver as the wildcard

XRP Or Silver In 2023? Why Not Both?

Silver: A Strongly Bullish Long Term Setup In Its Leading Indicator

One Silver Chart Justifies ‘Buy The Dip’ For Long Term Positions

In all those writings, we focused on intermarket dynamics as well as chart analysis. We never looked into the details of supply/demand dynamics in the silver market, simply because silver price setting is happening in the futures market (you might want to use the word ‘price manipulation’, which seems legit in this particular case, we refer to specialist Ted Butler for the specifics on how this works).

Here is one additional data point underpinning the bullish picture in the silver market: Global Silver Demand Forecast to Reach a Record High in 2022 (source: The Silver Institute).

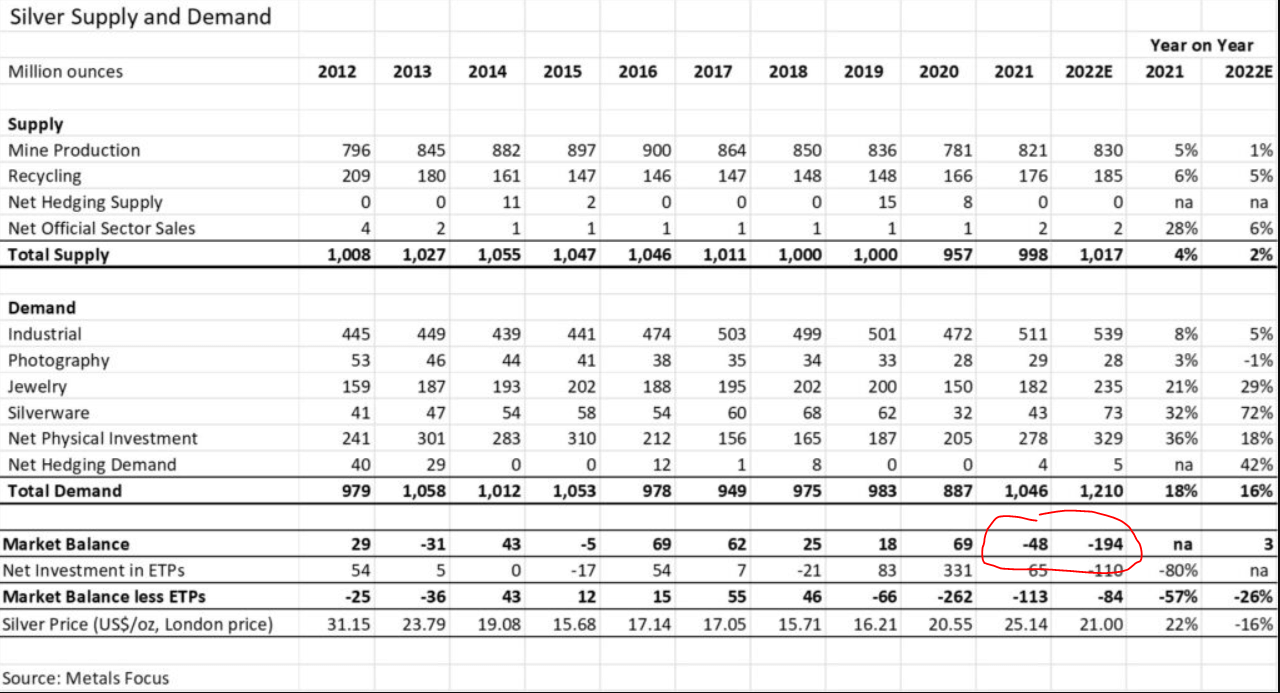

The global silver market is forecast to record a second consecutive deficit this year. At 194 Moz, this will be a multi-decade high and four times the level seen in 2021.

More specifically, the article looks at the different types of demand in the silver market. Specifically, demand for physical silver for investment purposes is forecasted to jump 18% this year:

Physical investment in 2022 is on track to jump by 18% to 329 Moz, which would also be a new record. Support has come from investor fears of high inflation, the Russia-Ukraine war, recessionary concerns, mistrust in government, and buying on price dips. The rise was boosted further by a (near-doubling) of Indian demand, a recovery from a slump last year, with investors often taking advantage of lower rupee prices.

Below is the table where, in our view, the market imbalance is the one number that sticks out, see red annotation.

This physical market imbalance (supply shortage) is historic, it’s not just a big supply shortage jump of 4x against last year.

Sooner or later, price should adjust to this reality, is what we are thinking, even though the physical silver market may not be the ultimate catalyst of the silver price. The catalyst is (unfortunately) the silver futures market, but then again the silver CoT report remains very bullish.